Please use a PC Browser to access Register-Tadawul

Could Analyst Optimism on Airbnb's Hotel Push Signal a Shift in Its Margin Story (ABNB)?

Airbnb, Inc. ABNB | 128.39 | +0.30% |

- In recent days, Mizuho Securities initiated coverage on Airbnb, highlighting the company's high operational efficiency and positive business model outlook as it expands into the hotel market. This coverage underscores increased analyst confidence in Airbnb despite ongoing discussions about valuation concerns and margin pressures.

- We'll explore how the reaffirmation of Airbnb's operational strengths and market expansion by Mizuho Securities influences the company's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Airbnb Investment Narrative Recap

To own Airbnb shares, you need to believe the company's strong operational model and ongoing expansion into the hotel sector can offset margin pressures and regulatory hurdles. Mizuho Securities’ new coverage does give a modest confidence boost, but valuation debate and potential slowing in mature markets remain live issues, so in my view, the most important short-term catalyst is continued traction in new segments, while the biggest risk is regulatory pushback in core geographies. The recent analyst attention, while positive, does not significantly shift these fundamental concerns.

Among recent developments, the introduction of Airbnb’s $6 billion share buyback program this August aligns with the focus on operational efficiency and capital returns. This initiative is highly relevant, as it signals management’s confidence in the company’s long-term cash generation and is often viewed as a supportive factor when weighing near-term catalysts such as expansion moves or analyst upgrades.

However, despite recent endorsements, investors should also be aware of the risk that intensifying regulatory scrutiny in key cities could force hosts off the platform and...

Airbnb's narrative projects $15.4 billion revenue and $3.7 billion earnings by 2028. This requires 10.0% yearly revenue growth and a $1.1 billion earnings increase from $2.6 billion today.

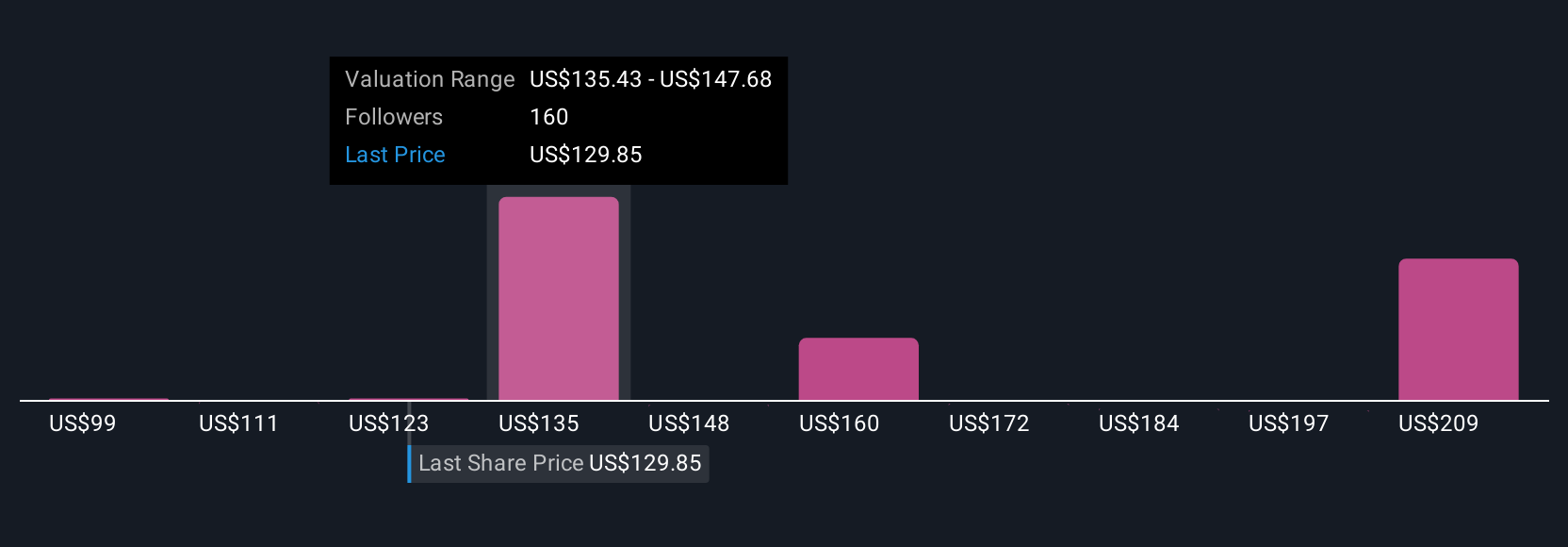

Uncover how Airbnb's forecasts yield a $138.12 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Compared to consensus, the most optimistic analysts project Airbnb could reach US$16.5 billion in revenue with US$4.3 billion earnings by 2028, assuming international growth and new segments outpace expectations. This is a much more bullish scenario, reminding you that opinions on Airbnb’s outlook can vary widely, especially as recent news and analyst upgrades may alter these forecasts soon.

Explore 33 other fair value estimates on Airbnb - why the stock might be worth as much as 73% more than the current price!

Build Your Own Airbnb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbnb research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Airbnb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbnb's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.