Please use a PC Browser to access Register-Tadawul

Could CCCX's Quantum Push Signal a New Competitive Edge or Just Incremental Innovation?

Churchill Capital Corp X Class A CCCX | 14.91 | +1.57% |

- Infleqtion has announced a collaboration with Silicon Light Machines to incorporate novel MEMS Displacement Phase Modulator technology into Infleqtion's neutral atom quantum computing systems, aiming to boost performance and scalability.

- This partnership arrives as Infleqtion is set to go public via a merger with Churchill Capital Corp X, underscoring momentum and interest in cutting-edge quantum computing advancements.

- We'll explore how the integration of new photonics technology could influence Churchill Capital Corp X's investment narrative going forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Churchill Capital Corp X's Investment Narrative?

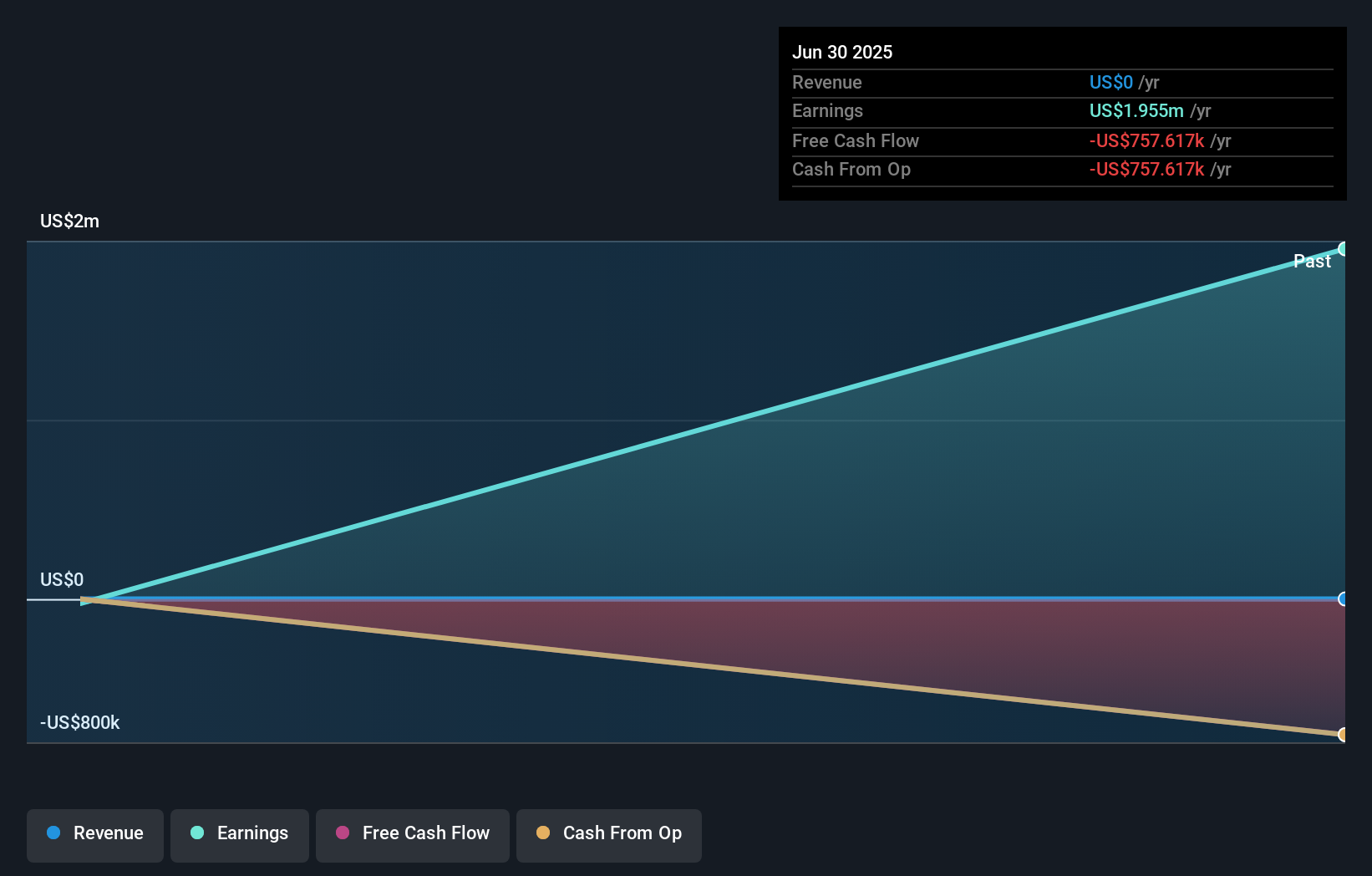

The investment case for Churchill Capital Corp X has always revolved around its big bet on quantum computing through the upcoming Infleqtion merger, but recent news may be relevant for those tracking its short-term catalysts and risks. With Infleqtion’s new collaboration to integrate Silicon Light Machines’ photonics technology, the market has responded quickly, treating this as an affirmation of Infleqtion’s potential to lead in scalable quantum hardware, as seen in a strong price rally. This momentum could help support the merger narrative and may further boost stakeholder confidence ahead of the 2026 shareholder vote. However, much of the company’s future still hinges on closing this deal, addressing regulatory approvals, and ultimately delivering on the commercial promise of quantum technology. Meanwhile, Churchill’s financials remain at an early stage with zero revenue and negative equity, meaning execution risks and timeline uncertainties remain front and center for prospective shareholders.

But despite rising optimism, the regulatory and deal approval process could present fresh hurdles for investors. In light of our recent valuation report, it seems possible that Churchill Capital Corp X is trading beyond its estimated value.Exploring Other Perspectives

Build Your Own Churchill Capital Corp X Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Churchill Capital Corp X research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Churchill Capital Corp X research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Churchill Capital Corp X's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.