Please use a PC Browser to access Register-Tadawul

Could DiDi Global’s (DIDI.Y) New Partnerships Shift Its Competitive Edge in Mobility and Travel?

- DiDi Global has introduced an upgraded membership system featuring cross-sector benefits in partnership with leading brands such as Hilton and HAIDILAO, while also collaborating with UNEX EV to roll out battery-swapping electric vehicles in Mexico for the ride-hailing and car rental markets.

- These moves signal DiDi's focus on both elevating customer experience and aligning its growth strategy with global trends in sustainable transportation and travel.

- We'll explore how expanding the membership program with high-profile partners could influence DiDi's broader investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

What Is DiDi Global's Investment Narrative?

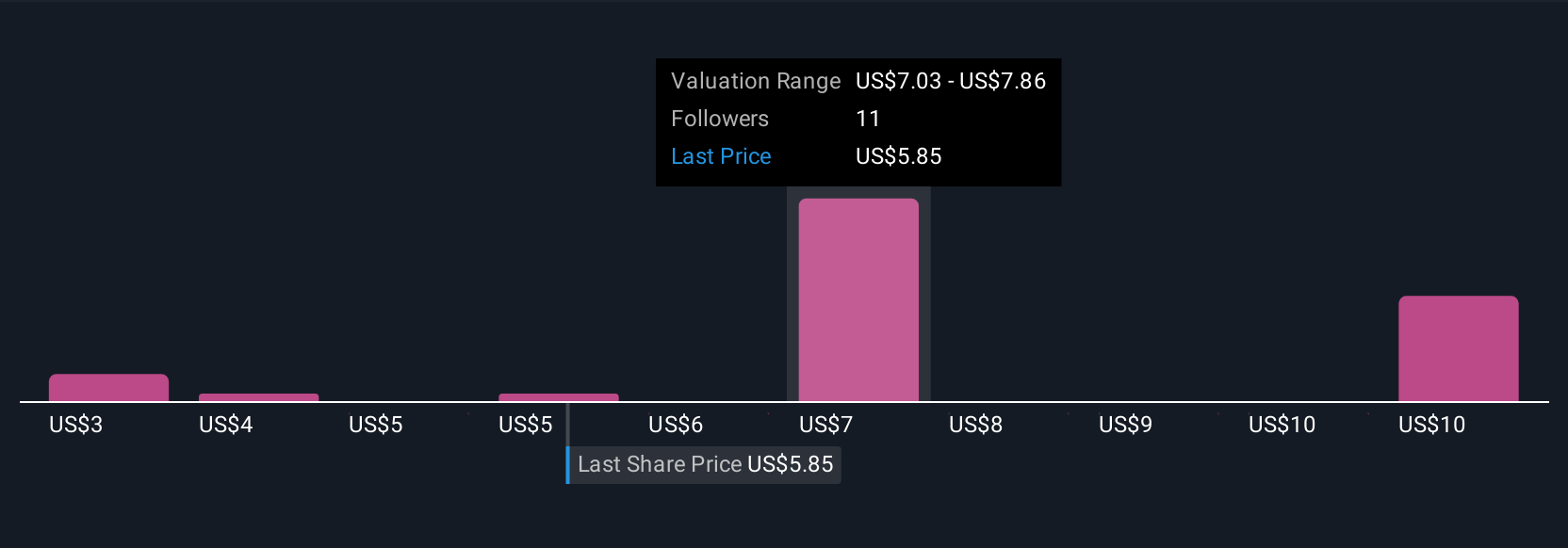

For anyone considering DiDi Global, the big picture rests heavily on whether you believe the company can reposition itself as more than just a ride-hailing platform. The latest news on extending membership benefits beyond transport and venturing into EV-enabled operations in Mexico could complement some of the existing short-term catalysts, mainly, DiDi’s improving profitability and user engagement. These moves may help broaden DiDi’s ecosystem, potentially supporting higher recurring revenue yet are unlikely to move the needle significantly in the near term given the company’s current size and global competition. The more immediate risks, like high valuation levels (a P/E ratio above peers and fair value), lingering regulatory concerns, and questions around achieving sustainable margins, still feel the most relevant. This recent news does suggest a shift to higher-value partnerships and green mobility, but it’s too early to say if these shifts fundamentally alter the risk profile.

However, persistent concerns about valuation could matter more than ever for investors.

Exploring Other Perspectives

Explore 5 other fair value estimates on DiDi Global - why the stock might be worth as much as 92% more than the current price!

Build Your Own DiDi Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DiDi Global research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DiDi Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DiDi Global's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.