Please use a PC Browser to access Register-Tadawul

Could Jurisdiction Challenges Shape Roku (ROKU)'s Long-Term Global Licensing Strategy?

Roku, Inc. Class A ROKU | 88.52 88.97 | +3.11% +0.51% Pre |

- In July 2025, the US District Court for the District of Massachusetts dismissed Roku's effort to have a global FRAND royalty rate set for the HEVC Advance Patent Pool, determining it lacked jurisdiction over an international patent portfolio spanning 117 countries.

- This outcome underscores the territorial nature of patent law and emphasizes that US courts do not serve as venues for setting worldwide licensing terms, spotlighting the importance of jurisdiction in complex global patent disputes.

- With the court dismissal highlighting ongoing legal realities for Roku, we'll now assess how this development could influence the company's investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Roku Investment Narrative Recap

Shareholders in Roku generally need to believe in the company's ability to drive platform revenue and advertising growth, especially through home screen integration and expanding third-party partnerships. The recent US court dismissal of Roku’s request to set a global FRAND royalty rate does not appear likely to have a material impact on Roku's most pressing near-term catalyst, which is its upcoming Q2 2025 earnings, nor does it alter the highest risk, which remains competitive and pricing pressures in the device market.

Among recent company announcements, the collaboration with Amazon Ads stands out: this partnership could fuel additional ad demand and improve monetization potential, a key short-term catalyst for Roku. While not directly related to the legal news, expanding major ad partnerships continues to shape the platform’s revenue growth outlook.

By contrast, investors should be mindful that competitive discounting and excess inventory in devices could bring pricing challenges that …

Roku's projections point to $5.8 billion in revenue and $301.5 million in earnings by 2028. This outlook calls for an 11.1% annual revenue growth rate and a $407.5 million increase in earnings from the current loss of $106.0 million.

Uncover how Roku's forecasts yield a $91.75 fair value, in line with its current price.

Exploring Other Perspectives

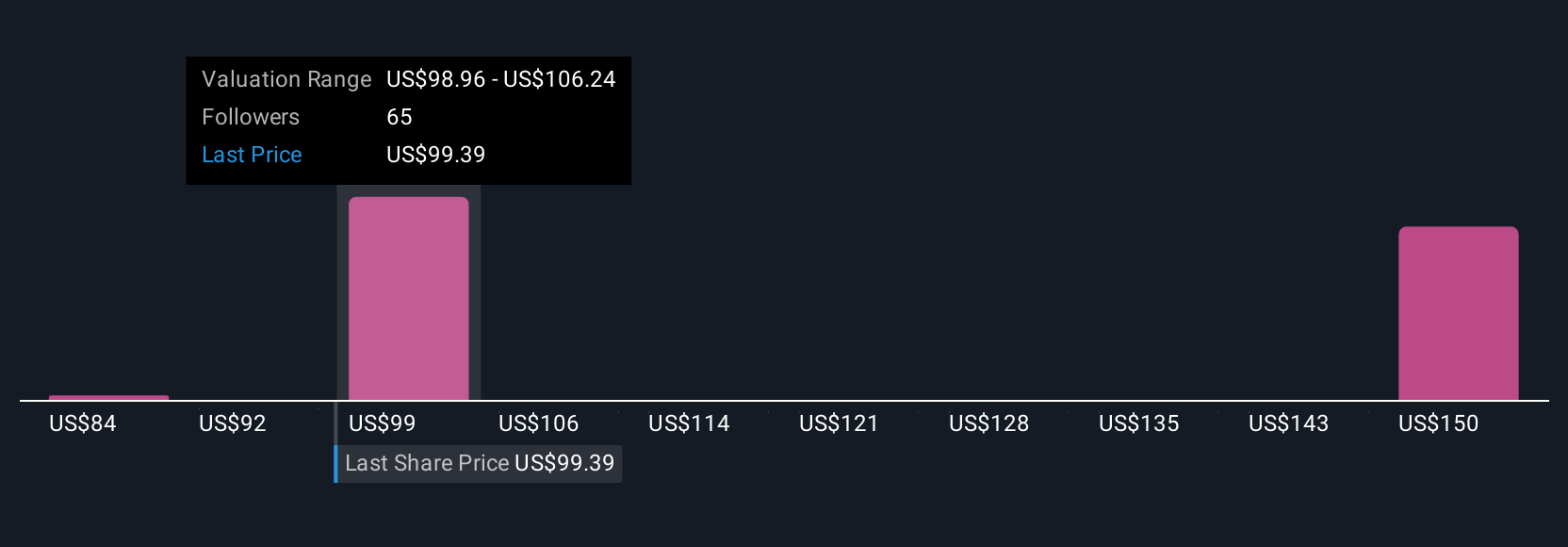

Nine Simply Wall St Community fair value estimates for Roku range from US$84.75 to US$174.90 per share. While opinions vary broadly, the company’s exposure to device market pricing pressures remains a central point that could affect future revenue and margin performance.

Explore 9 other fair value estimates on Roku - why the stock might be worth as much as 90% more than the current price!

Build Your Own Roku Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roku research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Roku research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roku's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.