Please use a PC Browser to access Register-Tadawul

Could LifeStance Health Group's New Board Appointment Shift Its Brand and Growth Trajectory for LFST?

LIFESTANCE HEALTH GROUP, INC. LFST | 6.88 | -0.58% |

- LifeStance Health Group recently appointed Sarah Personette, a seasoned customer experience and media executive, to its board of directors, while William Miller stepped down after five years of service.

- Personette’s addition brings extensive operational and marketing experience from high-profile technology and media organizations, potentially enhancing LifeStance’s customer engagement and brand visibility as it pursues growth in mental health care.

- We'll examine how Personette’s appointment and leadership background may influence LifeStance’s investment narrative and growth prospects going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

LifeStance Health Group Investment Narrative Recap

To be a shareholder in LifeStance Health Group, you need confidence that rising demand for mental health care and strong clinical recruitment will outweigh risks from reimbursement pressure and intensifying competition. The recent appointment of Sarah Personette to the board may help strengthen LifeStance’s customer engagement and brand profile but is not likely to materially affect the most immediate catalyst, technology investment to improve clinician productivity, or the main near-term challenge of payer rate negotiations.

Among LifeStance's recent developments, the appointment of Vaughn Paunovich as Chief Technology Officer stands out in context; while Personette’s arrival enhances board experience, Paunovich’s hiring addresses the operational need to bolster digital platforms, a factor closely tied to boosting revenue leverage and staying competitive. As LifeStance invests in digital innovation to support future growth, investors should also consider...

LifeStance Health Group's outlook anticipates $2.0 billion in revenue and $111.6 million in earnings by 2028. Achieving these targets would require 14.6% annual revenue growth and a $127.8 million increase in earnings from current earnings of -$16.2 million.

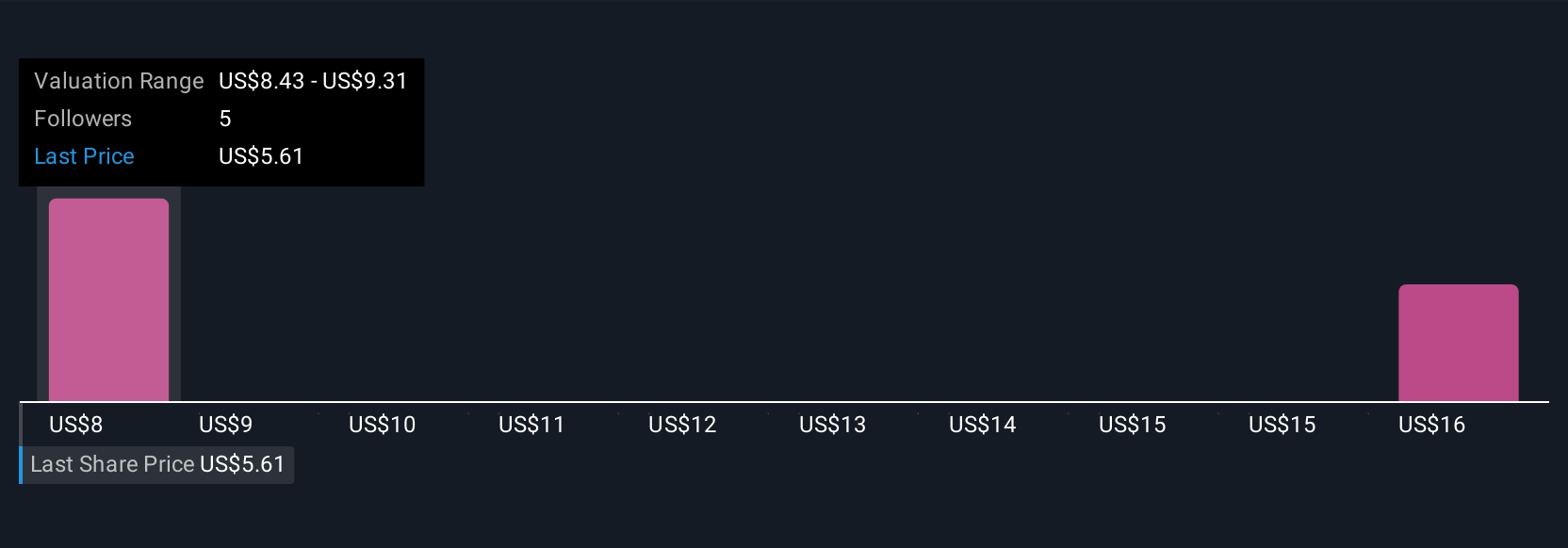

Uncover how LifeStance Health Group's forecasts yield a $8.43 fair value, a 52% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate LifeStance’s fair value from US$8.43 to US$17.21 across three analyses. While new board expertise may support brand visibility, persistent reimbursement headwinds could still shape the company’s future performance.

Explore 3 other fair value estimates on LifeStance Health Group - why the stock might be worth over 3x more than the current price!

Build Your Own LifeStance Health Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LifeStance Health Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free LifeStance Health Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LifeStance Health Group's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.