Please use a PC Browser to access Register-Tadawul

Could Lumentum's (LITE) New Debt Raise Signal a Shift in Long-Term Capital Allocation Strategy?

Lumentum Holdings, Inc. LITE | 324.35 | -12.83% |

- Earlier this week, Lumentum Holdings Inc. completed a US$1.1 billion convertible senior note offering due March 15, 2032, featuring a 0.375% fixed coupon and unsecured senior status under Rule 144A.

- This capital raise could enhance Lumentum's financial flexibility and fund future growth or investment opportunities as the company addresses expanding optical and photonic markets.

- We'll examine how this sizable convertible note issuance may influence Lumentum's investment narrative and capital allocation approach.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Lumentum Holdings Investment Narrative Recap

To be a shareholder in Lumentum Holdings, you need to believe that surging global demand for optical and photonic components, propelled by AI, cloud computing, and hyperscale data centers, will drive sustainable revenue and earnings growth, even amid intense competition and margin pressures. The recent US$1.1 billion convertible note offering supports the company’s ability to fund expansion and innovation, but it is not expected to materially change the major short-term catalyst: Lumentum’s ability to scale cloud module production to meet hyperscaler demand, nor does it lessen the primary risk of customer concentration.

Of the recent announcements, the August 2025 update highlighting Lumentum’s major U.S. semiconductor facility capacity expansion stands out. This move to increase domestic manufacturing is highly relevant to the current growth catalyst, aligning with the need to overcome capacity limitations and strengthen supply chain resilience as cloud and AI demand accelerate.

But while the company is ramping up capacity, investors should be aware that heavy reliance on just a few major cloud customers could still...

Lumentum Holdings is projected to reach $3.1 billion in revenue and $389.1 million in earnings by 2028. This outlook assumes annual revenue growth of 23.4% and an earnings increase of $363.2 million from current earnings of $25.9 million.

Uncover how Lumentum Holdings' forecasts yield a $138.26 fair value, a 7% downside to its current price.

Exploring Other Perspectives

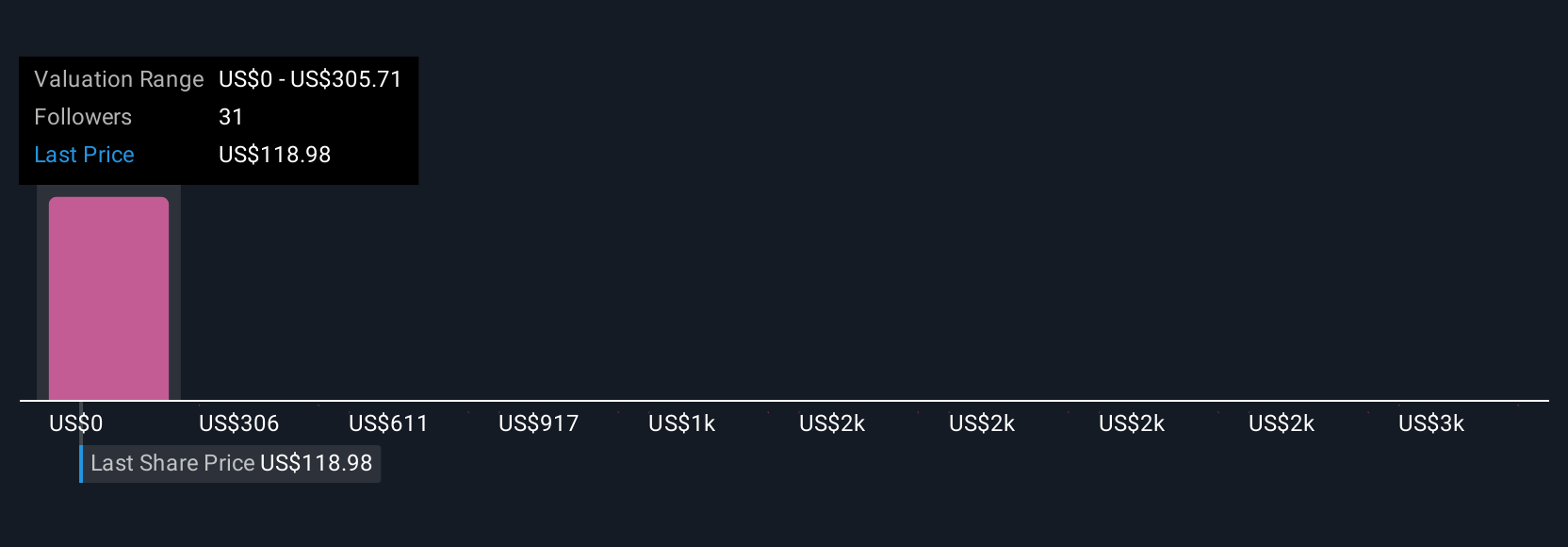

Nine private investors in the Simply Wall St Community estimate Lumentum’s fair value between US$305,706 and US$3,057,060. Amid this wide range, keep in mind that the company’s capacity expansion remains core to meeting surging AI and cloud demand, prompting different outlooks on future returns. Explore a range of alternative viewpoints.

Explore 9 other fair value estimates on Lumentum Holdings - why the stock might be a potential multi-bagger!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.