Please use a PC Browser to access Register-Tadawul

Could Michigan’s Regulatory Shift Reshape DTE Energy’s (DTE) Clean Energy Ambitions?

DTE Energy Company DTE | 134.30 | -0.39% |

- In July 2025, DTE Energy Company reported mixed second-quarter results, with revenue rising to US$3.42 billion while net income fell to US$229 million, and reaffirmed its 2025 operating EPS guidance.

- Concurrently, Michigan’s governor replaced a clean energy advocate on the state’s regulatory commission with an industry ally, raising questions about utility influence on state energy policy.

- We'll examine how this regulatory shift, favoring major utilities, may influence DTE Energy's investment narrative and outlook on clean energy transitions.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

DTE Energy Investment Narrative Recap

To be a DTE Energy shareholder, you need to believe that the company’s massive investments in renewables and grid modernization will drive stable, long-term growth, supported by Michigan’s historically constructive regulatory environment and surging electricity demand from data centers. The recent shift on the state commission brings regulatory risk into sharper focus but is unlikely to alter the short-term catalyst tied to data center load growth and capital recovery; however, closer attention to policy trends is warranted.

Among recent events, the reaffirmation of 2025 operating EPS guidance to US$7.09–US$7.23 stands out, as it signals confidence amid ongoing policy and regulatory change. This steadiness offers some reassurance that management is actively monitoring both execution and potential headwinds tied to the evolving regulatory climate, while focusing on delivering the earnings growth expected from its capital plan.

However, against continued optimism for near-term growth, investors should not overlook the risk that future rate case pushback may...

DTE Energy's outlook anticipates $15.0 billion in revenue and $1.8 billion in earnings by 2028. This reflects a 1.8% annual revenue growth rate and a $0.4 billion increase in earnings from the current $1.4 billion level.

Uncover how DTE Energy's forecasts yield a $145.43 fair value, a 4% upside to its current price.

Exploring Other Perspectives

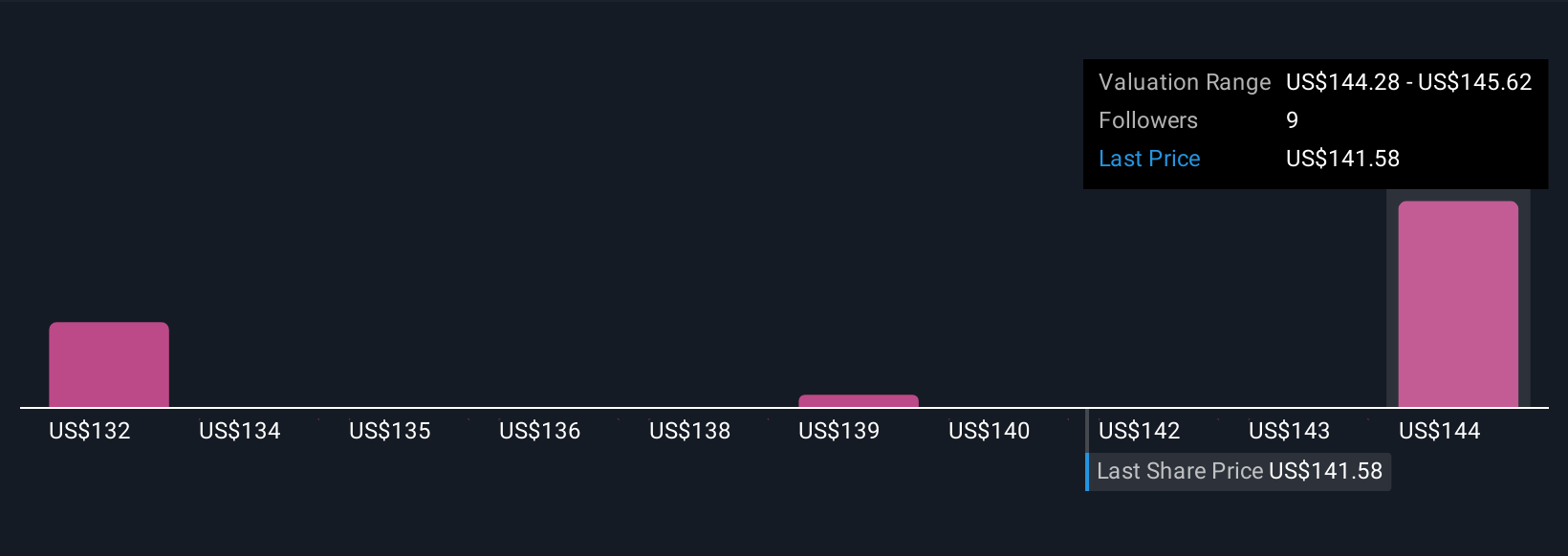

Private investors in the Simply Wall St Community provided three fair value estimates for DTE, ranging from US$131.93 to US$145.43 per share. These differing views reflect uncertainty about regulatory outcomes and the company's ability to recover costs as Michigan energy policy evolves.

Explore 3 other fair value estimates on DTE Energy - why the stock might be worth 6% less than the current price!

Build Your Own DTE Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DTE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DTE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DTE Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.