Please use a PC Browser to access Register-Tadawul

Could New H-1B Fee Lawsuits Test H&R Block’s (HRB) Approach to Workforce Flexibility?

H&R Block, Inc. HRB | 43.31 | +1.38% |

- Earlier this week, the U.S. Chamber of Commerce filed multiple lawsuits against the Trump administration's new US$100,000 fee on new H-1B visa petitions, arguing it is unlawful and could have significant consequences for U.S. employers seeking skilled foreign workers.

- This legal challenge has drawn considerable attention from technology sector leaders and business groups who warn that the fee could disadvantage U.S. companies in accessing global talent, particularly impacting smaller businesses and innovation.

- We'll assess how the legal uncertainty around the new H-1B visa fee may influence H&R Block's investment outlook and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

H&R Block Investment Narrative Recap

To be a shareholder in H&R Block, you need to believe in the ongoing demand for professional tax solutions as tax code complexity grows, with the company aiming to capture value through digital innovation and a strong retail presence. The new US$100,000 H-1B visa fee lawsuit draws focus on policy uncertainty for sectors relying on skilled foreign labor; however, for H&R Block, this development does not materially affect the main short-term catalyst, its digital platform growth, or alter its core risk of losing share to lower-cost digital tax providers.

Among recent announcements, H&R Block's collaboration with OpenAI to enhance its digital tax solutions stands out, directly tying into its most promising catalyst: the drive toward digital services. While the visa policy debate affects many industries’ access to talent, H&R Block’s growth story continues to hinge on accelerating adoption and improvements in its own tech-enabled offerings, supporting higher client conversion and premium service uptake.

In contrast, investors should be especially aware of how intensifying competition from digital-only platforms could ...

H&R Block's outlook anticipates $4.1 billion in revenue and $653.0 million in earnings by 2028. This is based on a 3.0% annual revenue growth rate and reflects a $46.3 million increase in earnings from the current $606.7 million.

Uncover how H&R Block's forecasts yield a $55.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

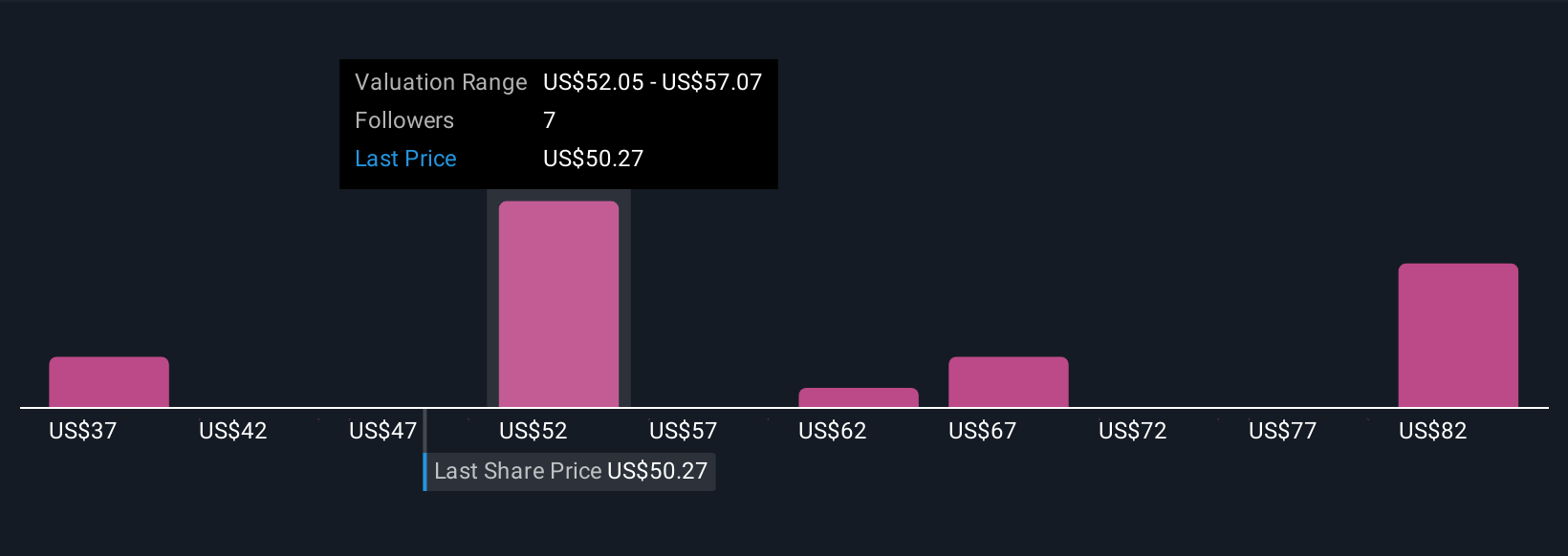

Seven members of the Simply Wall St Community have arrived at fair value estimates ranging from US$37 to US$89.77, giving wide latitude for interpretation. While future digital expansion remains a key catalyst, you may want to consider how differing expectations for tech-driven competition could shift prospects for H&R Block’s business model.

Explore 7 other fair value estimates on H&R Block - why the stock might be worth as much as 71% more than the current price!

Build Your Own H&R Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H&R Block research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free H&R Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H&R Block's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.