Please use a PC Browser to access Register-Tadawul

Could New Leadership and Infrastructure Plans Signal a Strategic Shift for CMS Energy (CMS)?

CMS Energy Corporation CMS | 69.84 | +0.14% |

- In September 2025, Consumers Energy appointed Shannon Thomas as senior vice president and chief people officer, following regulatory approvals and infrastructure investment announcements, including plans to update 135 miles of natural gas pipelines.

- Thomas’s track record of strengthening workforce strategies at major industrial companies highlights Consumers Energy’s commitment to operational excellence and long-term reliability for its customers.

- We'll examine how recent regulatory approvals and leadership changes may reinforce CMS Energy’s investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CMS Energy Investment Narrative Recap

For shareholders, believing in CMS Energy means trusting the company's ability to convert grid modernization and clean energy investments into stable returns while navigating regulatory processes in Michigan. The recent leadership shift and pipeline upgrade announcements strengthen the company’s operational reliability, but do not materially impact the biggest short-term catalyst, near-term regulatory tariff approvals, or the main risk of cost recovery constraints if regulatory support weakens.

The September 2025 announcement of plans to update 135 miles of natural gas pipelines stands out, supporting CMS Energy’s focus on infrastructure resilience as regulatory decisions approach. Timely completion of these upgrades could aid cost recovery discussions, reinforcing investor optimism around ongoing rate cases and potential top-line growth tied to increased system reliability.

However, if regulatory momentum slows, the company’s ability to recover substantial costs in a timely manner may come under closer scrutiny, a consideration every investor should...

CMS Energy is forecast to reach $9.2 billion in revenue and $1.4 billion in earnings by 2028. This outlook assumes 4.6% annual revenue growth and a $0.4 billion increase in earnings from the current $1.0 billion.

Uncover how CMS Energy's forecasts yield a $76.54 fair value, a 7% upside to its current price.

Exploring Other Perspectives

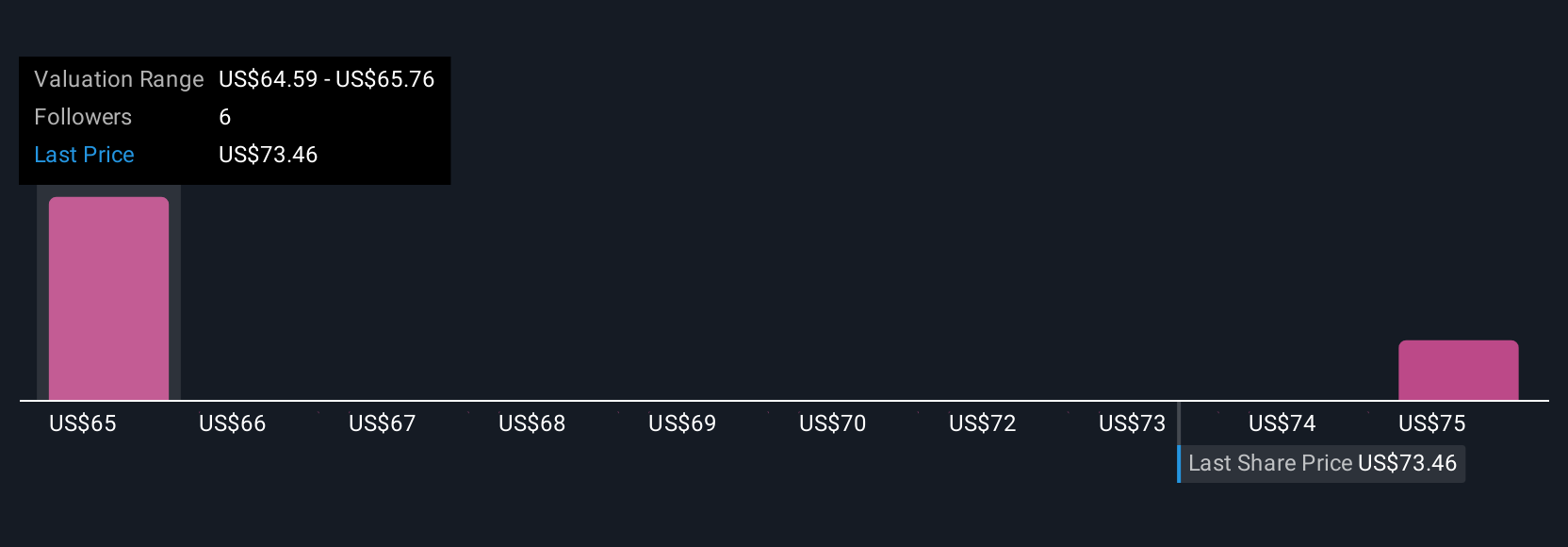

Simply Wall St Community fair value estimates for CMS Energy range from US$64.21 to US$76.54, with two distinct perspectives. Investors should recognize that regulatory lag or weakened policy support could affect future earnings, prompting an even broader range of opinions around the company’s outlook.

Explore 2 other fair value estimates on CMS Energy - why the stock might be worth as much as 7% more than the current price!

Build Your Own CMS Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CMS Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CMS Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CMS Energy's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.