Please use a PC Browser to access Register-Tadawul

Could NuScale Power’s (SMR) Unique Licensing Edge Outweigh Its Absence in Atlantic Tech Funding?

NuScale Power SMR | 18.34 | -13.57% |

- In recent days, NuScale Power gained attention after the United States and United Kingdom agreed to advance nuclear, AI, and quantum technologies with a combined US$350 billion commitment, though most nuclear funding was directed to private firms and NuScale was not explicitly included as a beneficiary.

- Despite not receiving direct investment, NuScale's position as the only company with an approved modular nuclear reactor design, and the fast-tracked licensing under the Atlantic Partnership for Advanced Nuclear Energy, drew investor optimism given the rapid growth expectations for small modular reactors.

- We'll examine how the accelerated US and UK regulatory support for SMR deployment could reshape NuScale Power's investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

NuScale Power Investment Narrative Recap

To see value in NuScale Power today, shareholders must believe that rapidly accelerating demand for clean, scalable power, especially for data centers and AI, will translate into meaningful contracts and revenue, supported by NuScale’s unique regulatory position. The recent US-UK nuclear and technology alliance temporarily lifted sentiment, but with no direct investment for NuScale, the most important short-term catalyst remains contract wins, while the biggest risk is the lack of customer agreements and resulting revenue uncertainty. The news has not materially altered these near-term drivers or risks.

Among recent announcements, NuScale’s support for ENTRA1 Energy’s agreement with the Tennessee Valley Authority stands out as potentially transformative, given its ambition to deploy up to 6 gigawatts of SMR capacity across a broad US region. This partnership, if progressed into concrete contracts, could address near-term revenue and project execution catalysts investors are watching. Yet, unlike government alliances, actual project delivery is what will ultimately...

NuScale Power's outlook envisions $402.3 million in revenue and $42.2 million in earnings by 2028. This is based on an assumed 121.5% annual revenue growth rate and a $178.8 million increase in earnings from the current level of -$136.6 million.

Uncover how NuScale Power's forecasts yield a $41.69 fair value, a 7% downside to its current price.

Exploring Other Perspectives

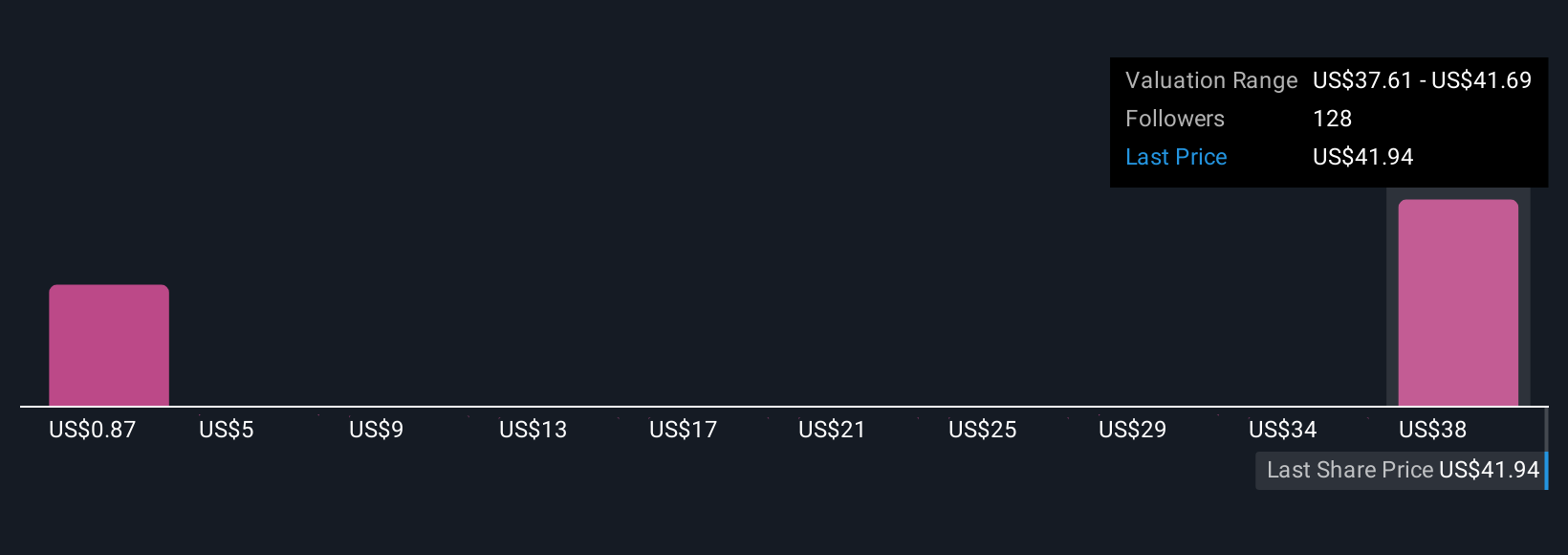

Simply Wall St Community members shared 13 fair value estimates for NuScale, spanning from US$0.87 to US$41.69. While opinions diverge on valuation, many remain focused on contract progress and the company’s ability to secure revenues under the ongoing SMR deployment push.

Explore 13 other fair value estimates on NuScale Power - why the stock might be worth less than half the current price!

Build Your Own NuScale Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NuScale Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NuScale Power's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.