Please use a PC Browser to access Register-Tadawul

Could PRAX's Focus on Delivery Innovation Signal a Shift in CNS Therapy Ambitions?

PRAXIS PRECISION MEDICINES, INC. PRAX | 268.80 268.80 | +0.57% 0.00% Pre |

- ReCode Therapeutics recently announced a research collaboration with Praxis Precision Medicines to develop lipid nanoparticle formulations that enhance delivery of antisense oligonucleotides to underexposed regions of the brain.

- This partnership aims to combine expertise in genetic medicines and delivery technology, potentially advancing treatment options for central nervous system disorders involving neuronal excitation-inhibition imbalance.

- We'll explore how this collaboration could reshape Praxis Precision Medicines' investment narrative by expanding its reach in CNS genetic therapy innovation.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Praxis Precision Medicines' Investment Narrative?

Praxis Precision Medicines is positioned as a clinical-stage innovator in central nervous system (CNS) genetic therapies, but investors must weigh a difficult balance of promise and risk. The newly announced collaboration with ReCode Therapeutics brings a fresh dimension by targeting more effective brain delivery of antisense oligonucleotide drugs. This partnership could expand Praxis’s technical capabilities and align with its mission to address neuronal excitation-inhibition imbalances. However, the company remains unprofitable with significant net losses growing year-over-year and is not expected to change this trajectory in the near term based on previous analysis. Recent capital raises and positive clinical advances, such as the progress in the RADIANT and POWER1 studies, remain primary short-term catalysts for sentiment. While the ReCode collaboration could eventually strengthen the pipeline, its immediate impact on financials or near-term catalysts may be limited unless future milestones deliver additional data or partnership revenue. For now, risk remains centered on sustained operating losses, clinical trial outcomes, and ongoing shareholder dilution, especially in light of the ambitious revenue growth expectations. Yet, as with many growth-stage biotechs, persistent losses are a key risk that future news may not quickly resolve.

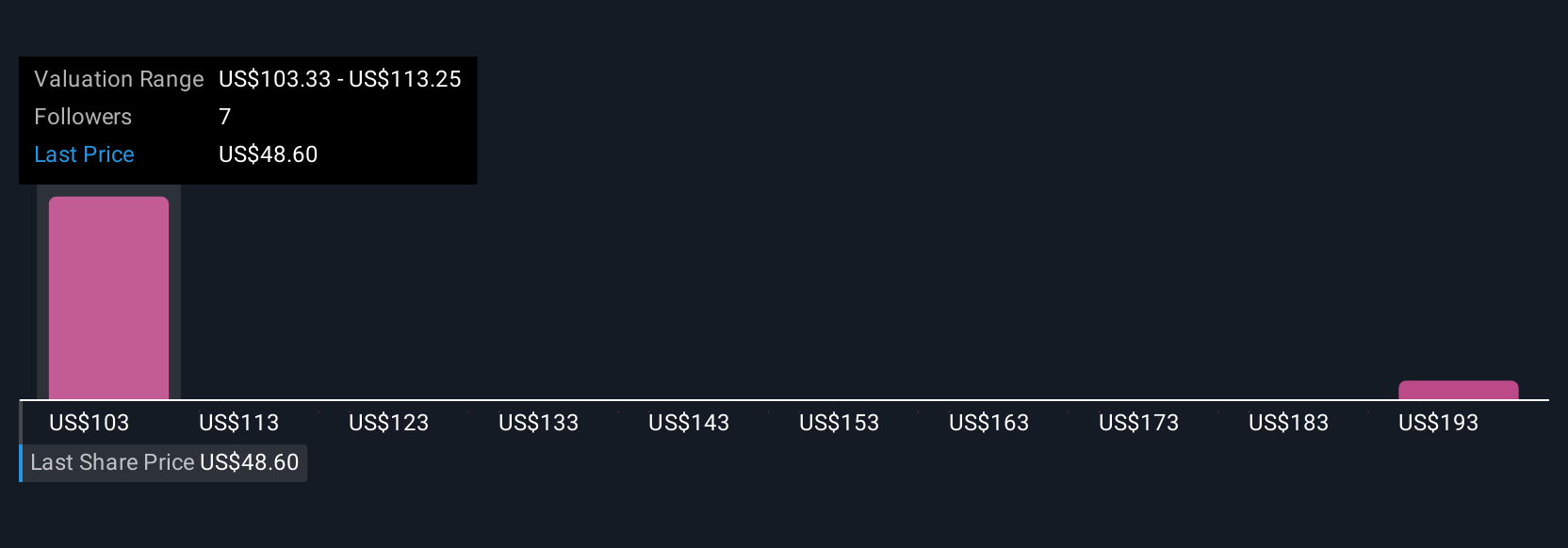

Our comprehensive valuation report raises the possibility that Praxis Precision Medicines is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 2 other fair value estimates on Praxis Precision Medicines - why the stock might be worth just $100.00!

Build Your Own Praxis Precision Medicines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Praxis Precision Medicines research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Praxis Precision Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Praxis Precision Medicines' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.