Please use a PC Browser to access Register-Tadawul

Could Premier’s (PINC) Expanded Focus on Compliance Deepen Its Advantages in Group Purchasing?

Premier Inc. Class A PINC | 28.26 | Delist |

- AIS Healthcare recently announced it was awarded a group purchasing agreement with Premier Inc. for 503A intrathecal compounded medications, effective July 1, 2025, granting Premier members access to special pricing and enhanced service terms.

- This agreement stands out by offering Premier member hospitals not only preferred pricing but also site audit evaluations and ongoing quality reporting to help with compliance policies.

- We’ll examine how the addition of compliance-focused value to member hospitals could influence Premier’s overall investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Premier Investment Narrative Recap

For investors considering Premier, the core belief centers on the company's ability to leverage its scale, technology, and supply chain partnerships to drive efficiency for healthcare providers. The recent AIS Healthcare group purchasing agreement may not fundamentally shift the short-term catalysts or biggest risks, as revenue pressure from lower administrative fees and Performance Services remains the main challenge in the upcoming quarters.

Among recent announcements, Premier’s ongoing share repurchase activity stands out as most relevant to the current investment story. Despite headwinds in revenue and net margin, the company has completed a significant number of share buybacks this year, signaling a commitment to shareholder returns, even as supply chain segment results and contract renegotiations continue to shape near-term performance.

In contrast, investors should be aware of emerging risks related to administrative fee revenue volatility and the potential effect on...

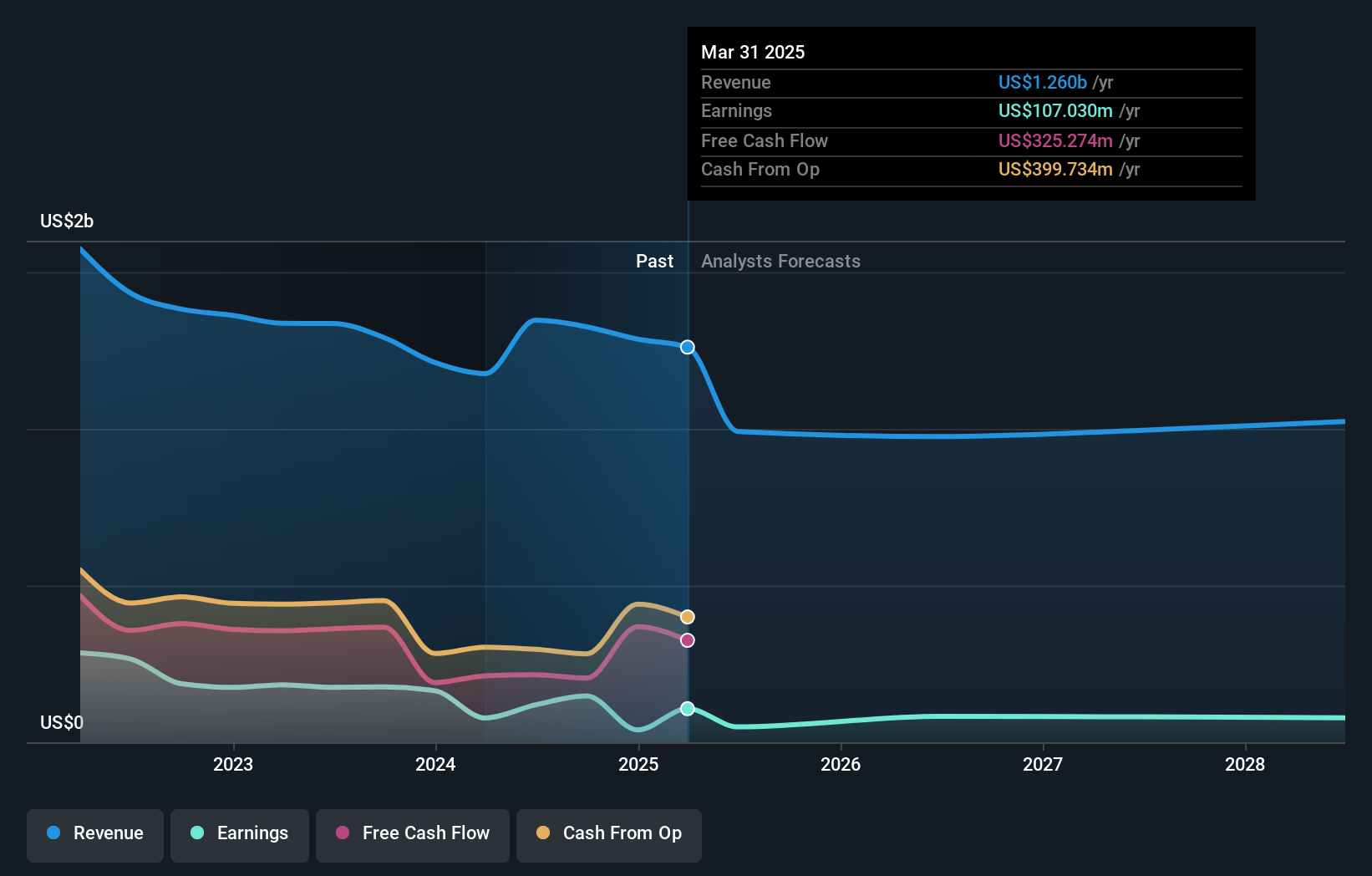

Premier's outlook projects $1.0 billion in revenue and $78.9 million in earnings by 2028. This requires a 6.9% annual revenue decline and a $28.1 million earnings decrease from current earnings of $107.0 million.

Uncover how Premier's forecasts yield a $22.33 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$22.33 to US$88.48, reflecting two very different outlooks. Your peers are weighing ongoing pressure on supply chain services against long-term digital transformation opportunities that could shift Premier’s performance trajectory, see how your viewpoint compares.

Explore 2 other fair value estimates on Premier - why the stock might be worth just $22.33!

Build Your Own Premier Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Premier research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Premier research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Premier's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.