Please use a PC Browser to access Register-Tadawul

Could Rezolve AI's (RZLV) Autonomous Commerce Push Reshape Its Long-Term Competitive Edge?

Rezolve AI Ltd Ordinary Shares RZLV | 2.15 | -3.59% |

- Rezolve AI recently announced its framework for the "Age of Agentic Commerce," unveiling a vision where autonomous AI agents search, negotiate, and transact on behalf of users in real time, and disclosed its acquisition of Latin American digital-asset payments provider Smartpay to deepen its capabilities in borderless, instant settlement.

- This marks a significant move towards integrating enterprise AI-driven commerce with decentralized payments infrastructure, positioning Rezolve AI at the intersection of traditional and digital-asset economies.

- We'll examine how Rezolve AI's push into autonomous transaction technology may shape its overall investment narrative and long-term positioning.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Rezolve AI's Investment Narrative?

For anyone considering Rezolve AI, the big picture centers on the company’s ambition to pioneer the era of autonomous digital commerce, where artificial intelligence doesn’t just recommend products but autonomously executes transactions, optimizes deal terms, and settles payments across borders. The recent unveiling of the “Age of Agentic Commerce” framework, combined with the Smartpay acquisition, may accelerate Rezolve’s existing push into real-time AI-powered commerce and decentralized payments, a shift that could strengthen its appeal to investors focused on high-growth, disruptive tech. These moves could amplify short-term expectations around expansion and revenue growth, but also potentially add to execution risk, particularly as Rezolve remains unprofitable and has seen its losses widen even while scaling sales. Despite substantial capital raises and notable partnerships, a volatile share price and persistent negative equity remain key risks that could weigh on near-term sentiment. The scale of recent product announcements and integrations means the risk profile and main catalysts for Rezolve could shift if adoption lags or if the path to profitability remains elusive.

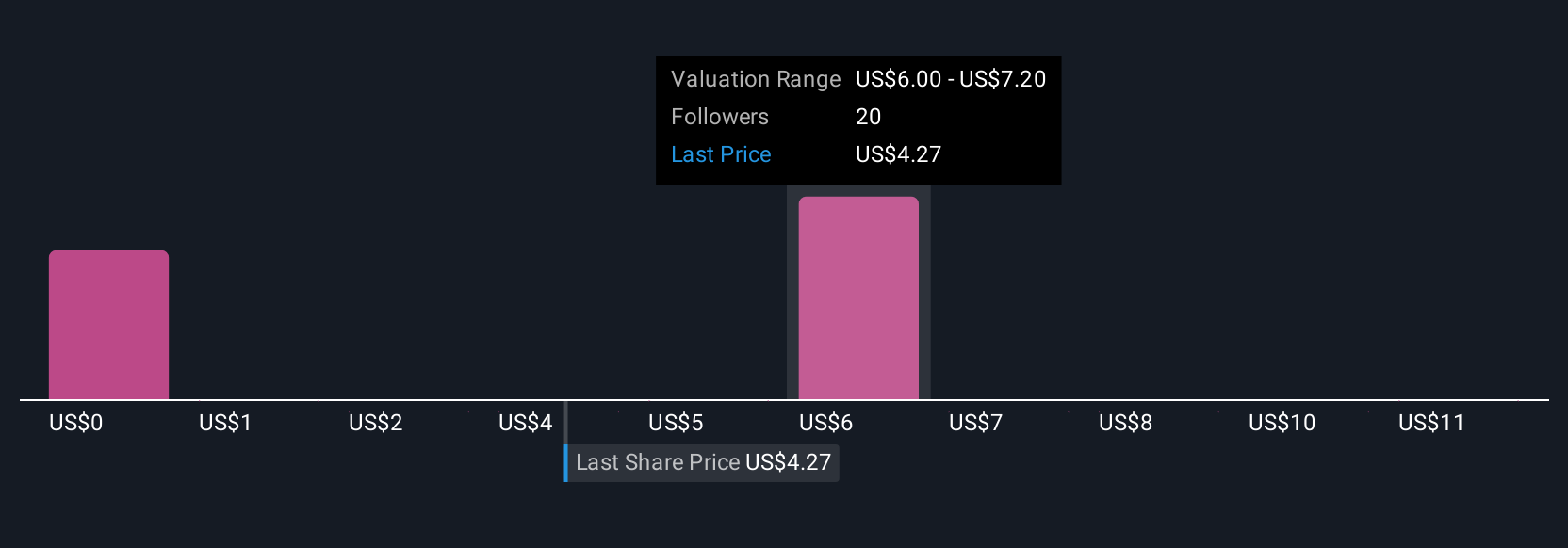

But with all this innovation, execution risk should not be overlooked. Despite retreating, Rezolve AI's shares might still be trading 30% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 12 other fair value estimates on Rezolve AI - why the stock might be worth less than half the current price!

Build Your Own Rezolve AI Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rezolve AI research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Rezolve AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rezolve AI's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.