Please use a PC Browser to access Register-Tadawul

Could Rigetti's (RGTI) NVIDIA Partnership Reveal Its True Edge in the Quantum-AI Race?

Rigetti Computing, Inc. RGTI | 17.71 | +18.26% |

- On October 28, Rigetti Computing announced its support for NVIDIA's NVQLink, a new open platform integrating AI supercomputing with quantum computers, and showcased this collaboration at the NVIDIA GTC event in Washington, D.C.

- This partnership highlights growing industry momentum toward hybrid quantum-classical systems and positions Rigetti at the forefront of real-time, accelerated computing integration.

- We'll explore how Rigetti's role in enabling AI-quantum integration with NVIDIA may shape the company's investment case going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Rigetti Computing's Investment Narrative?

For Rigetti Computing, the core story is all about whether quantum technology can transition from early adoption to actual commercial utility, and just how much of this shift is already priced into the shares. The recent NVIDIA NVQLink partnership certainly puts Rigetti’s technology in the spotlight, underscoring industry demand for integrating quantum and classical computing. However, the immediate impact on near-term catalysts appears modest. Analysts had already become more cautious, highlighting concerns about delays in U.S. government funding and questioning if current valuations can be justified by meaningful revenue growth in the foreseeable future. While the NVIDIA news could ultimately strengthen Rigetti’s longer-term case and ecosystem relevance, recent price swings and significant insider selling indicate the market may be grappling with high expectations that could remain unmet if major contracts or meaningful sales do not materialize soon.

Yet with government funding delays and continued losses, short-term risks should not be overlooked.

Exploring Other Perspectives

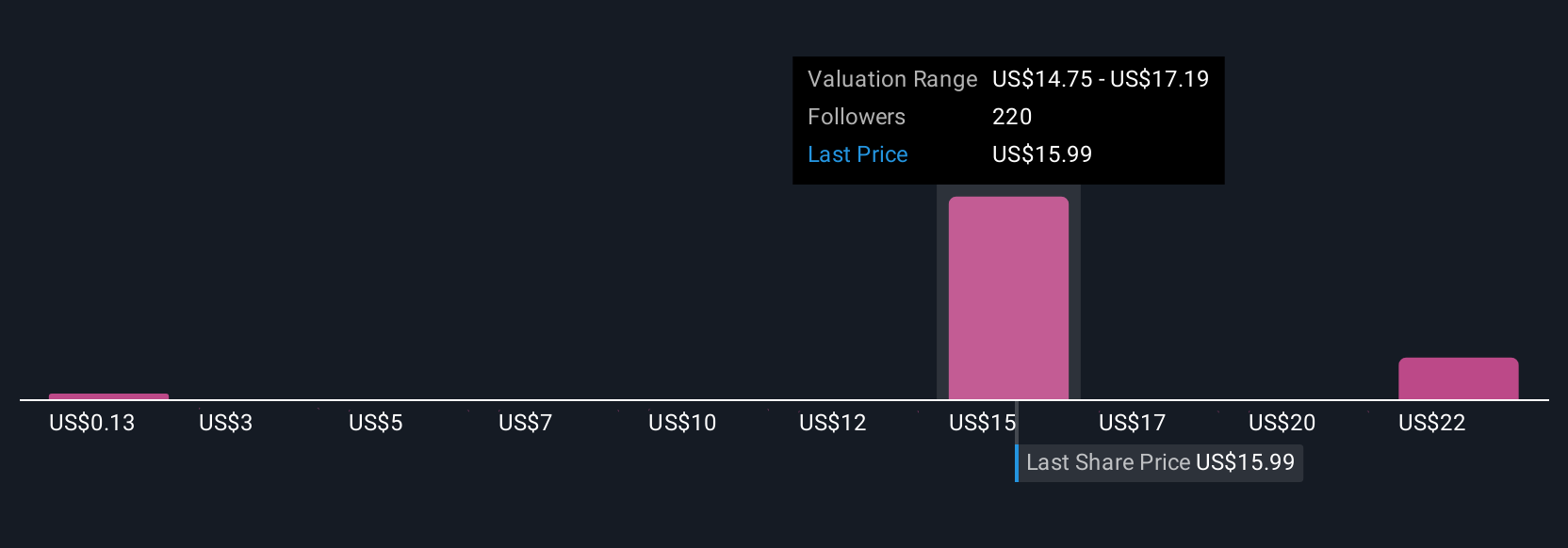

Explore 49 other fair value estimates on Rigetti Computing - why the stock might be worth as much as $33.50!

Build Your Own Rigetti Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigetti Computing research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Rigetti Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigetti Computing's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.