Please use a PC Browser to access Register-Tadawul

Could Stagwell's (STGW) News Monetization Push Reinforce Its Competitive Edge in Media Innovation?

Stagwell, Inc. Class A STGW | 4.63 | -2.32% |

- Stagwell (NASDAQ: STGW) hosted its inaugural Future of News NewsFronts event in New York on October 16, 2025, convening nearly 30 publisher partners and industry leaders to focus on innovation, productization, and monetization within the news media sector.

- The event positioned Stagwell prominently as a thought leader in the evolving media landscape, with CEO Mark Penn underscoring the essential role of a thriving free press for informed societies and effective marketing.

- We'll explore how Stagwell's emphasis on news monetization and innovation could influence its investment narrative and future growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Stagwell Investment Narrative Recap

To be a shareholder in Stagwell, you need to believe in the ongoing shift toward digital marketing, proprietary platform expansion, and the company's focus on innovation within the complex, rapidly evolving media environment. The recent Future of News NewsFronts event reinforces Stagwell’s ambitions as an industry leader but is not expected to materially shift the most prominent near-term catalyst, successful integration and growth of its digital and martech offerings, or offset the largest risk, which remains revenue concentration among a handful of tech giants. Among Stagwell’s recent updates, the appointment of Slavi Samardzija as Chief Data and Platforms Officer in September stands out, as this role ties directly into advancing the company’s data and platform strategies, a key area given the emphasis on tech-driven growth and operational efficiency discussed at the NewsFronts event. With the next earnings release around the corner, investors will likely be watching closely to see whether digital innovation can drive margin expansion and improve operating results. Yet, in contrast to upbeat innovation headlines, one risk that investors should not overlook is the revenue volatility that can arise if a major tech client were to...

Stagwell's narrative projects $3.4 billion in revenue and $363.8 million in earnings by 2028. This requires 6.4% yearly revenue growth and an earnings increase of about $365.5 million from current earnings of $-1.7 million.

Uncover how Stagwell's forecasts yield a $8.19 fair value, a 56% upside to its current price.

Exploring Other Perspectives

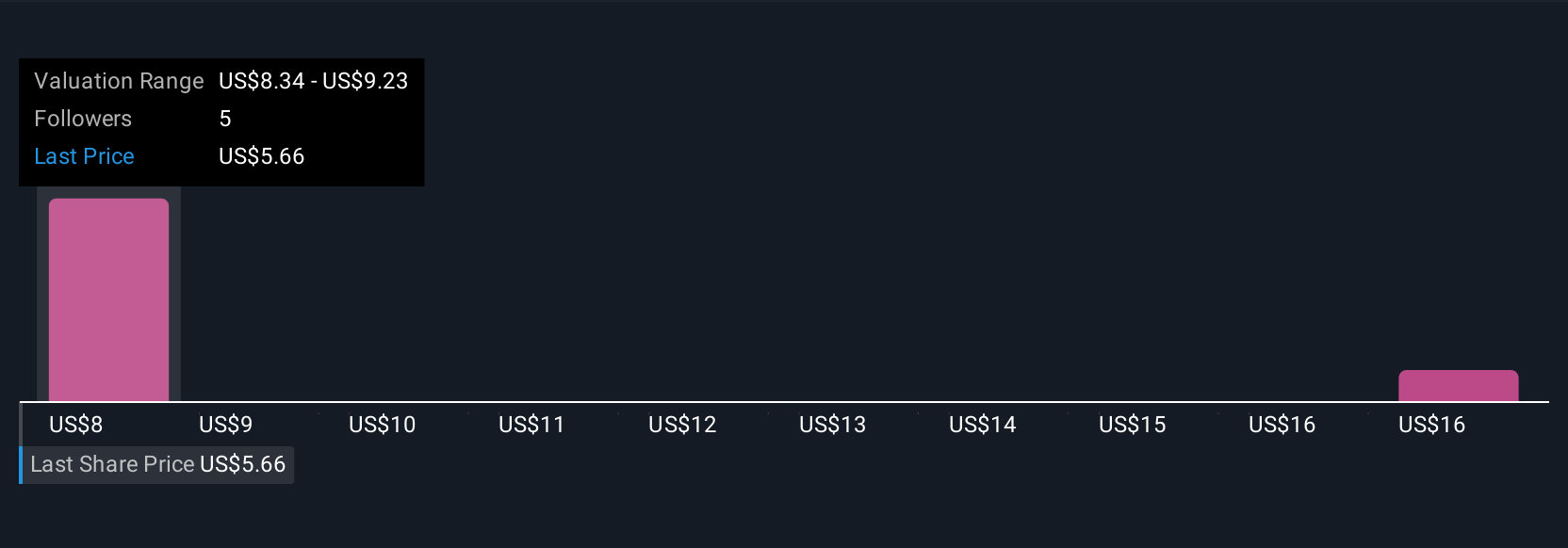

Simply Wall St Community members have posted two fair value estimates for Stagwell, ranging widely from US$8.19 to US$17.43 per share. While digital transformation remains a key catalyst, concentration among a few large clients could have broader implications for future results, consider how your own outlook compares.

Explore 2 other fair value estimates on Stagwell - why the stock might be worth just $8.19!

Build Your Own Stagwell Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stagwell research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Stagwell research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stagwell's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.