Please use a PC Browser to access Register-Tadawul

Could UiPath's (PATH) Latest AI Recognition Reveal Its True Edge in Software Testing Innovation?

UiPath, Inc. PATH | 17.42 | -3.38% |

- Earlier this month, UiPath was recognized as a Leader in the Gartner® Magic Quadrant™ for AI-Augmented Software Testing Tools, following the launch of new AI-powered testing products such as Test Cloud and Autopilot™ for Testers.

- This recognition highlights the company's efforts to integrate agent-based AI solutions into software quality assurance, enabling automated, adaptive testing throughout the software development lifecycle.

- We'll examine how UiPath's leadership in AI-augmented testing is shaping its broader investment narrative and growth prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

UiPath Investment Narrative Recap

To be a UiPath shareholder, you need to believe in the growing adoption of AI-driven automation and the company’s ongoing product innovation, especially in agent-based AI for testing and quality assurance. Recognition as a Leader by Gartner increases industry credibility but may not immediately resolve the biggest short-term risk: the delayed impact of these innovations on fiscal 2026 revenue given uncertain customer budgets and ongoing macroeconomic headwinds.

Among recent announcements, the September 30 expansion of UiPath’s agentic automation platform directly supports the new AI testing tools highlighted in Gartner’s report. This move reinforces one of the company’s main growth catalysts, broadening its product ecosystem for deeper customer engagement and potential ARR growth, which remains at the center of UiPath’s investment case.

However, investors should be aware that, despite impressive technological advancements, near-term financial results could still be limited by...

UiPath's outlook anticipates $1.9 billion in revenue and $243.6 million in earnings by 2028. Achieving this would require annual revenue growth of 8.6% and an earnings increase of $311.1 million from current earnings of -$67.5 million.

Uncover how UiPath's forecasts yield a $13.44 fair value, a 13% downside to its current price.

Exploring Other Perspectives

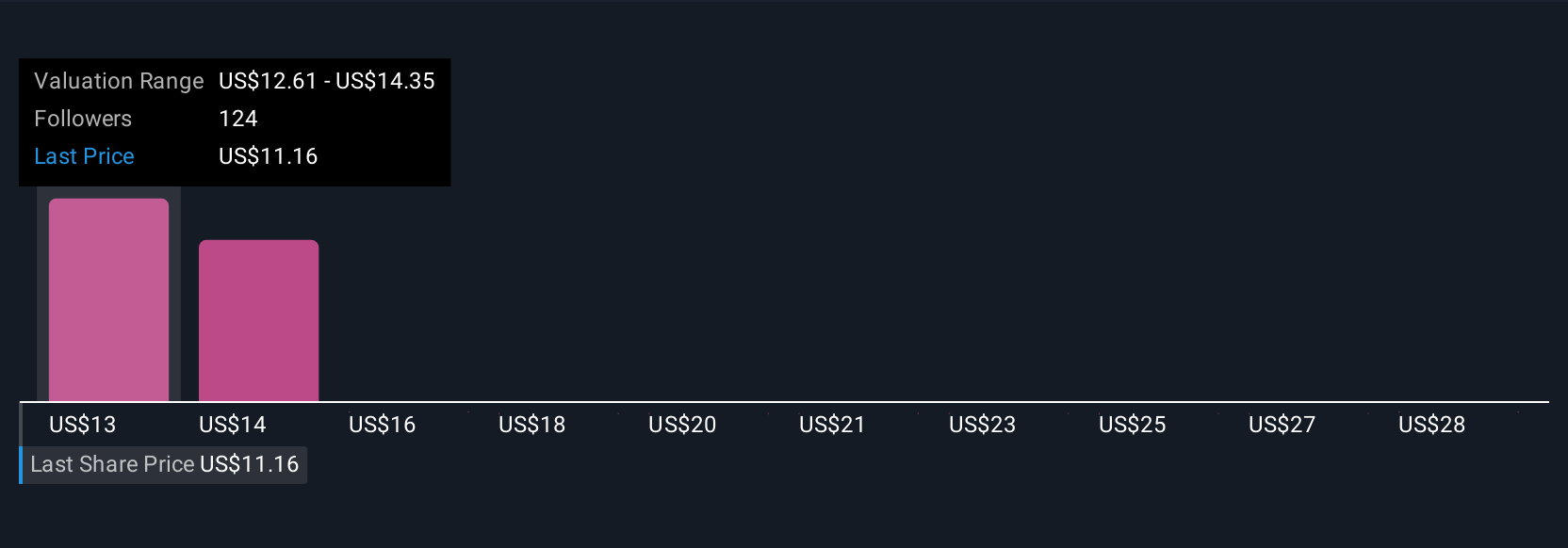

Fourteen fair value estimates from the Simply Wall St Community range from US$12.61 to US$30.32 per share. While some expect agentic AI products will accelerate growth, market participants should consider the risk that new innovations may not significantly boost short-term revenue and earnings, inviting you to explore a broad mix of opinions on UiPath’s potential.

Explore 14 other fair value estimates on UiPath - why the stock might be worth as much as 96% more than the current price!

Build Your Own UiPath Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free UiPath research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UiPath's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.