Please use a PC Browser to access Register-Tadawul

Crinetics Pharmaceuticals (CRNX): Assessing Valuation After a 36% Three-Month Share Price Rebound

CRINETICS PHARMACEUTICALS, INC. CRNX | 46.55 46.55 | -1.77% 0.00% Pre |

Crinetics Pharmaceuticals (CRNX) has been quietly grinding higher, with the stock up around 11% over the past month and more than 36% in the past 3 months, drawing fresh attention from biotech investors.

That recent 11.5% 1 month share price return caps a sharp 36.2% 3 month share price rebound for Crinetics, even though the year to date share price return remains slightly negative and the 1 year total shareholder return is still in the red. Momentum appears to be rebuilding as investors warm to its growth story.

If this kind of renewed optimism in biotech has your attention, it could be a good time to explore other healthcare stocks that might be setting up for their next leg higher.

With shares still down over the past year but trading well below consensus price targets, investors now face a key question: Is Crinetics undervalued with more upside ahead, or is the market already pricing in its future growth?

Price-to-Book of 4.3x: Is It Justified?

On a price-to-book basis, Crinetics trades at 4.3 times book value versus the US pharmaceuticals average of 2.5 times, despite a last close of $48.87 and a still negative one year return.

The price-to-book ratio compares the company’s market value to the accounting value of its net assets, a common yardstick for asset light, R and D driven biopharma names where earnings are not yet meaningful.

For Crinetics, paying a premium multiple suggests investors may already be factoring in substantial future success from its late stage pipeline, even though the company remains loss making and does not yet generate meaningful revenue.

Compared with the broader US pharmaceuticals industry, Crinetics trades at a materially richer price-to-book multiple, pointing to a market narrative that appears more optimistic than the sector average about its long term growth and commercialization prospects.

Result: Price-to-Book of 4.3x

However, risks remain, including potential clinical setbacks in late stage trials and ongoing cash burn from loss making operations that could pressure sentiment.

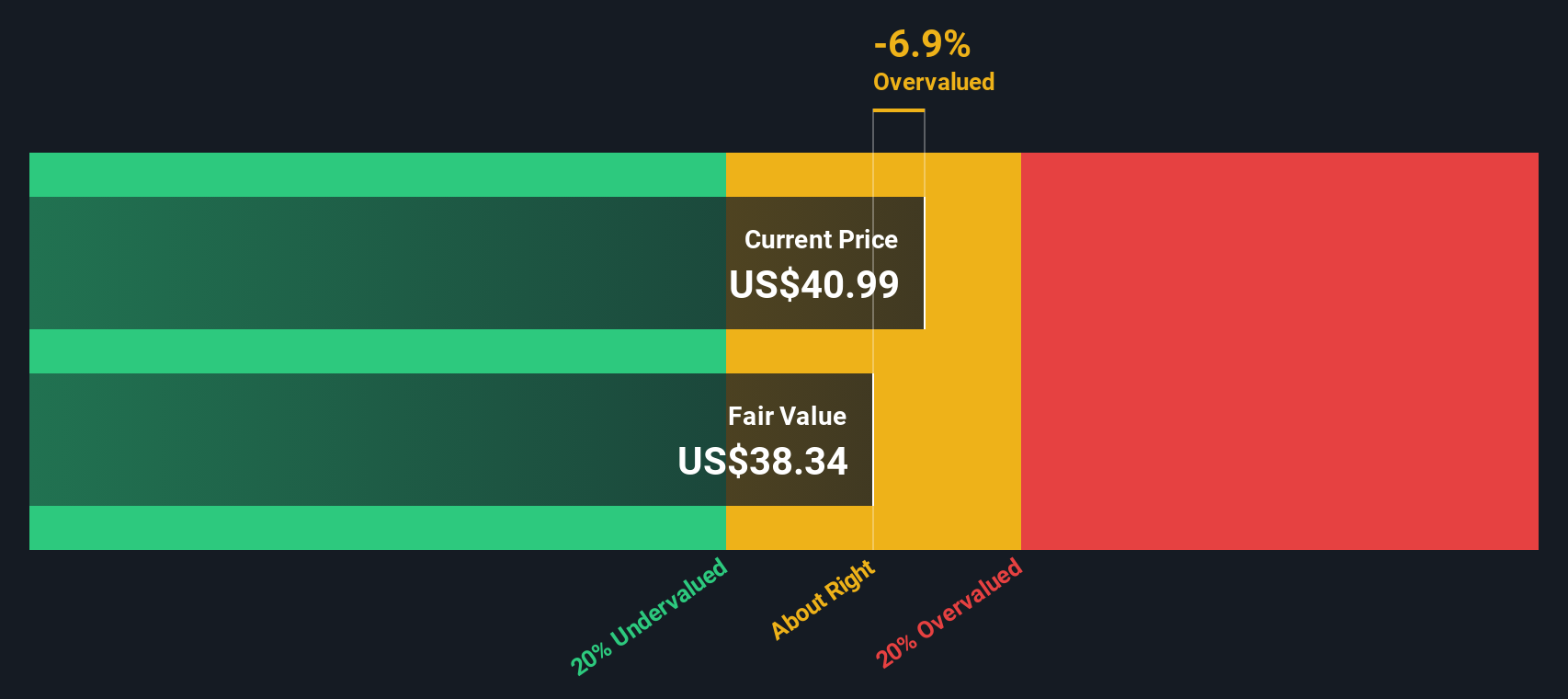

Another View Using Our DCF Model

While the 4.3 times price to book ratio suggests Crinetics is priced at a premium, our DCF model points the other way and indicates the shares may be trading at a steep discount to estimated fair value. If that gap closes, which story will end up being right?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Crinetics Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Crinetics Pharmaceuticals Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Crinetics Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single opportunity. Use the Simply Wall Street Screener to uncover fresh, data driven stock ideas that could sharpen your portfolio edge.

- Capture potential mispricings by targeting companies that look cheap on fundamentals with these 908 undervalued stocks based on cash flows and position yourself ahead of a possible re rating.

- Ride powerful growth trends by scanning for innovators in automation and machine learning via these 24 AI penny stocks before their earnings stories reach the mainstream.

- Strengthen your income stream by hunting for reliable payouts using these 10 dividend stocks with yields > 3% and avoid leaving attractive yields on the table.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.