Please use a PC Browser to access Register-Tadawul

CrowdStrike (CRWD) Is Up 8.8% After Surge in Contract Renewals Driven by AI and Platform Integration

CrowdStrike CRWD | 504.78 | -2.49% |

- Recently, CrowdStrike reported that customers on its Falcon Flex platform are renewing contracts at significantly higher values, following the removal of SIEM migration barriers through the ONUM acquisition and strengthened by new AI-powered innovations such as Charlotte.

- Integration with Saviynt and advances in AI-driven cybersecurity highlight CrowdStrike's expanding platform capabilities, aiming to provide real-time risk-based security and operational efficiency for enterprise customers.

- We'll examine how CrowdStrike's ability to drive rapid customer contract growth through its platform strategy could reshape its investment outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CrowdStrike Holdings Investment Narrative Recap

To own CrowdStrike, you need to believe its innovation-led platform strategy and expanding AI capabilities can propel sustained customer and revenue growth in the competitive cybersecurity market. While recent news around contract renewals and partner ecosystem enhancements reinforces the momentum behind key customer and product catalysts, it does not materially alter the biggest short-term risk, whether new product launches and acquisitions will consistently deliver anticipated growth and margin benefits, or introduce execution volatility.

Among recent developments, the launch of Falcon Data Protection stands out for its relevance as enterprises grapple with AI-driven threat sophistication. This product directly addresses rising compliance, cloud security, and data protection demands, which is at the heart of CrowdStrike’s effort to deepen customer lock-in and support contract value expansion, aligning closely with the catalysts supporting its growth outlook.

Yet, it’s worth noting that if CrowdStrike fails to maintain high customer retention or struggles with Falcon Flex execution, investors should be aware that ...

CrowdStrike Holdings' outlook projects $7.9 billion in revenue and $691.1 million in earnings by 2028. This is based on analysts forecasting a 22.1% annual revenue growth rate and an $988.1 million increase in earnings from the current level of -$297.0 million.

Uncover how CrowdStrike Holdings' forecasts yield a $498.91 fair value, a 5% downside to its current price.

Exploring Other Perspectives

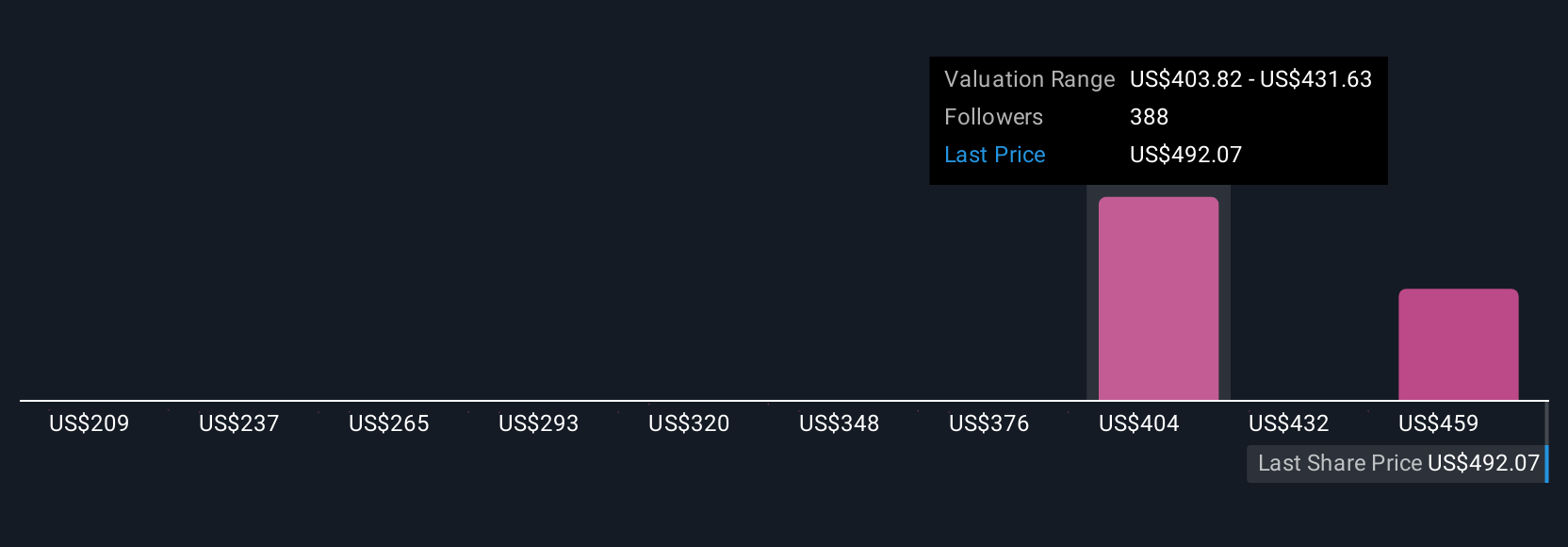

Simply Wall St Community members provided 29 fair value estimates for CrowdStrike, spanning US$277 to US$600, highlighting wide-ranging views. In light of ongoing platform innovation, readers should explore several alternative viewpoints on growth prospects and potential risks.

Explore 29 other fair value estimates on CrowdStrike Holdings - why the stock might be worth 47% less than the current price!

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.