Please use a PC Browser to access Register-Tadawul

Cummins (NYSE:CMI) Unveils X10 Engine For Optimal Performance And Efficiency In Medium And Heavy-Duty Vehicles

Cummins Inc. CMI | 513.61 | -0.20% |

Cummins (NYSE:CMI) recently announced the launch of its X10 engine, marking a significant advancement in its product lineup. The engine introduction, poised to enhance performance and efficiency, coincides with a period where the company's stock experienced a 4% increase over the last month. This performance stands out against a backdrop of a declining market trend, with major indexes such as the Nasdaq and S&P 500 experiencing respective 5% and 3% drops in February. Additionally, changes in Cummins's executive team, including the promotion of Bonnie Fetch and Shon Wright, could be shaping investor perceptions positively. The broader market saw some relief from inflation showing signs of cooling, adding a layer of optimism. Cummins's strategic partnership developments and solid earnings reports may also be contributing to the stock's resilience amidst generally turbulent market conditions.

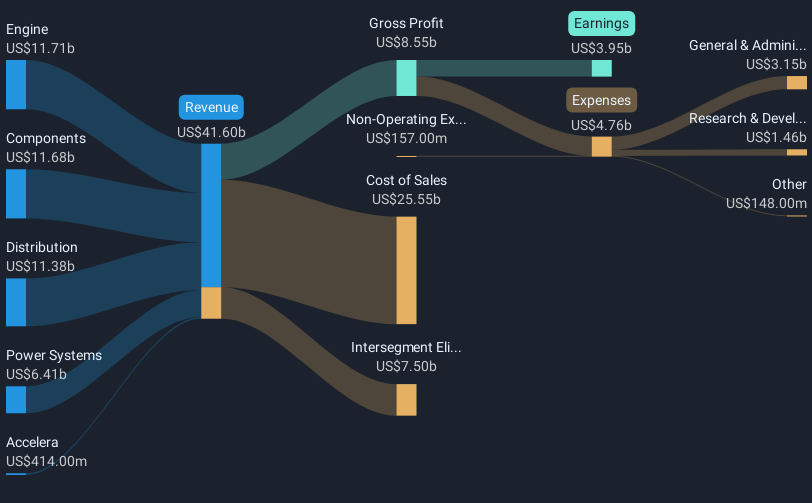

Cummins Inc.'s shares have delivered a substantial total return of 178% over the past five years, reflecting strong performance relative to the US Machinery industry and broader market. Key factors within this period include the impressive launch of innovative engines such as the X10 and the 6.7-liter Turbo Diesel, which may have bolstered market sentiment. Financially, the company showcased substantial improvement with the full-year 2024 net income reaching US$3.95 billion, a significant recovery from a previous loss, alongside steady dividend payouts.

Significant enhancements in executive management, including the promotions of Bonnie Fetch and Shon Wright, highlighted Cummins's focus on strong leadership. Furthermore, the collaboration with partners like DG Innovate underlined its commitment to advancing zero-emissions technology. Despite facing challenges such as a class-action lawsuit over emissions compliance, Cummins's commitment to innovation and efficiency continued to strengthen investor confidence and bolster long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.