Please use a PC Browser to access Register-Tadawul

Custom Truck One Source (CTOS): Assessing Fair Value After Recent Share Price Surge

Custom Truck One Source Inc CTOS | 6.13 | -3.16% |

Custom Truck One Source (CTOS) has caught investor attention as its stock moves higher this month. The rise builds on strong gains over the past year. The company’s recent momentum has some taking a closer look at its performance and prospects.

Shares of Custom Truck One Source have shown real strength lately, with a 1-month share price return of nearly 14% and a total shareholder return over the past year of 89%. This momentum has been fueled by steady revenue gains and improving profitability, which indicates that investors are viewing the company’s outlook with increasing optimism.

If Custom Truck’s performance has you thinking about what else could be on the rise, it is a good moment to branch out and explore fast growing stocks with high insider ownership.

But with such impressive gains already on the board, the central question now is whether Custom Truck One Source is still undervalued or if recent momentum means the market has already priced in future growth.

Most Popular Narrative: 14.9% Undervalued

Custom Truck One Source’s most-followed valuation perspective sets its fair value at $7.50 per share, which is nearly 15% above the last close of $6.38. This highlights that the narrative’s assumptions differ from current market sentiment and reflect a belief in further upside.

“Sustained and growing demand from electricity grid modernization and maintenance, fueled by increasing electricity usage and multi-year utility infrastructure upgrades, is driving recurring rental revenue and supporting long-term top-line growth. Legislative tailwinds, such as the federal bonus depreciation provision, are incentivizing capital spending by smaller and mid-sized customers. This is expected to accelerate equipment purchases and bolster TES segment revenues and margins.”

Curious how this bullish fair value is justified? The financial modeling is built around aggressive profit swing forecasts and revenue expansion tied to a changing industrial landscape. If you want to uncover the bold assumptions powering this nearly double-digit premium, the complete story awaits.

Result: Fair Value of $7.50 (UNDERVALUED)

However, persistent gross margin pressures and high leverage levels remain potential headwinds that could challenge the bullish outlook for Custom Truck One Source.

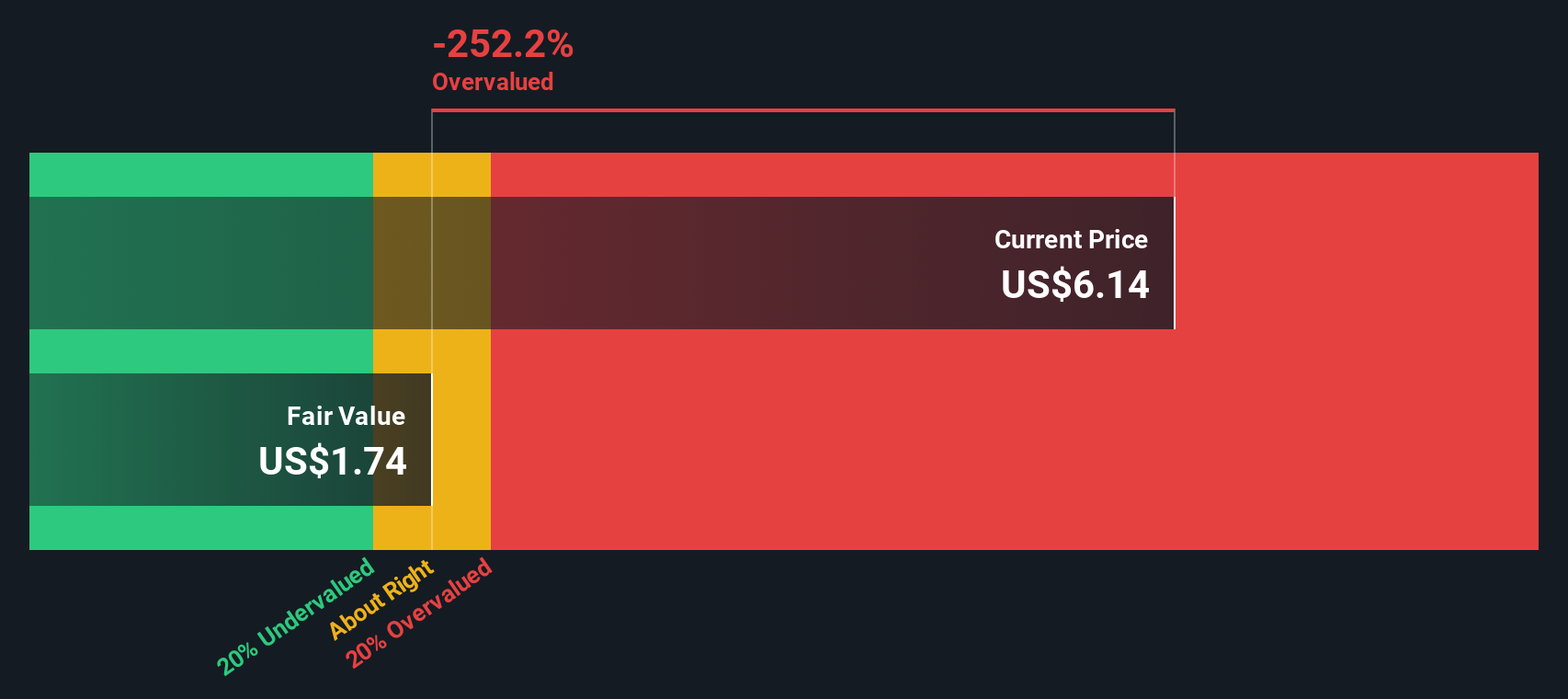

Another View: What Does the DCF Model Say?

While many investors are bullish based on multiples, our DCF model offers a more restrained perspective. It estimates Custom Truck One Source’s fair value at $5.38 per share, which is below the current price. This suggests the future cash flow outlook could be less optimistic than recent market assumptions. Will the market side with momentum or fundamentals?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Custom Truck One Source for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Custom Truck One Source Narrative

If you would rather trust your own research or have a different perspective on Custom Truck One Source, you can build your narrative from the ground up in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Custom Truck One Source.

Looking for more investment ideas?

Every day brings new opportunities in the market, and you owe it to yourself to check out fresh stocks poised for growth and innovation. Don’t let unique opportunities pass you by when the right insight could set your next winning move in motion.

- Capture reliable returns by jumping into these 18 dividend stocks with yields > 3%, a selection of companies with strong yields that reward you for holding steady.

- Fuel your portfolio’s future by exploring these 24 AI penny stocks, featuring opportunities with the potential to transform industries through artificial intelligence and automation breakthroughs.

- Uncover tech potential with these 26 quantum computing stocks, a space where leading-edge quantum computing businesses are reshaping how tomorrow’s problems get solved.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.