Please use a PC Browser to access Register-Tadawul

Customers Bancorp (CUBI): Evaluating Valuation After $150 Million Follow-On Equity Offering

Customers Bancorp, Inc. CUBI | 74.38 | +1.20% |

Customers Bancorp (CUBI) just made headlines by completing a $150 million follow-on equity offering, only hours after filing a shelf registration. For investors, this kind of move matters because a rapid influx of fresh common stock can alter supply dynamics, influence capital strength, and often signal management’s mindset about future needs or opportunities. Whether you already own shares or are watching from the sidelines, it is only natural to wonder what comes next when a company raises this much cash in one shot.

Looking at the bigger picture, Customers Bancorp’s stock has performed strongly, up more than 40% in the past year and posting even larger gains over the past three years. Momentum really picked up in recent months, with a jump of 35% over the past quarter. Beyond the equity raise, the company’s financials also show meaningful annual increases in both revenue and net income, potentially reinforcing the narrative that operational trends are supporting share performance here.

The key question now is whether today’s valuation accurately reflects the company’s growth prospects, or if this equity raise might open up a fresh buying window for careful investors. Is the market fully pricing in what comes next for Customers Bancorp?

Most Popular Narrative: 12.2% Undervalued

The most widely followed narrative considers Customers Bancorp undervalued by double digits. According to this viewpoint, strong digital banking momentum and projected financial growth justify a premium compared to the current market price.

"The rapid digitization of commercial banking and payments is driving institutional clients to seek tech-focused, 24/7 banking solutions. Customers Bancorp capitalizes on this trend through its proprietary cubiX platform. With payments volume of $1.5 trillion in 2024 and accelerating growth, ongoing regulatory clarity around digital assets and stablecoins positions Customers as the leading provider. This supports significant potential for deposit and fee income growth."

Want to discover the secret formula behind this undervalued label? The analysts’ narrative leans on ambitious targets for digital transformation, blue-sky fintech expansion, and a future profit structure that could outpace traditional banks. Curious about which bold projections make this price target possible, or what surprising performance metrics underpin the model? The story behind this number may change the way you view where value really lies in next-gen banking.

Result: Fair Value of $77.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant exposure to digital asset deposits and evolving regulatory scrutiny could quickly change the outlook and challenge the bank’s projected growth path.

Find out about the key risks to this Customers Bancorp narrative.Another View: Market Ratios Paint a Different Picture

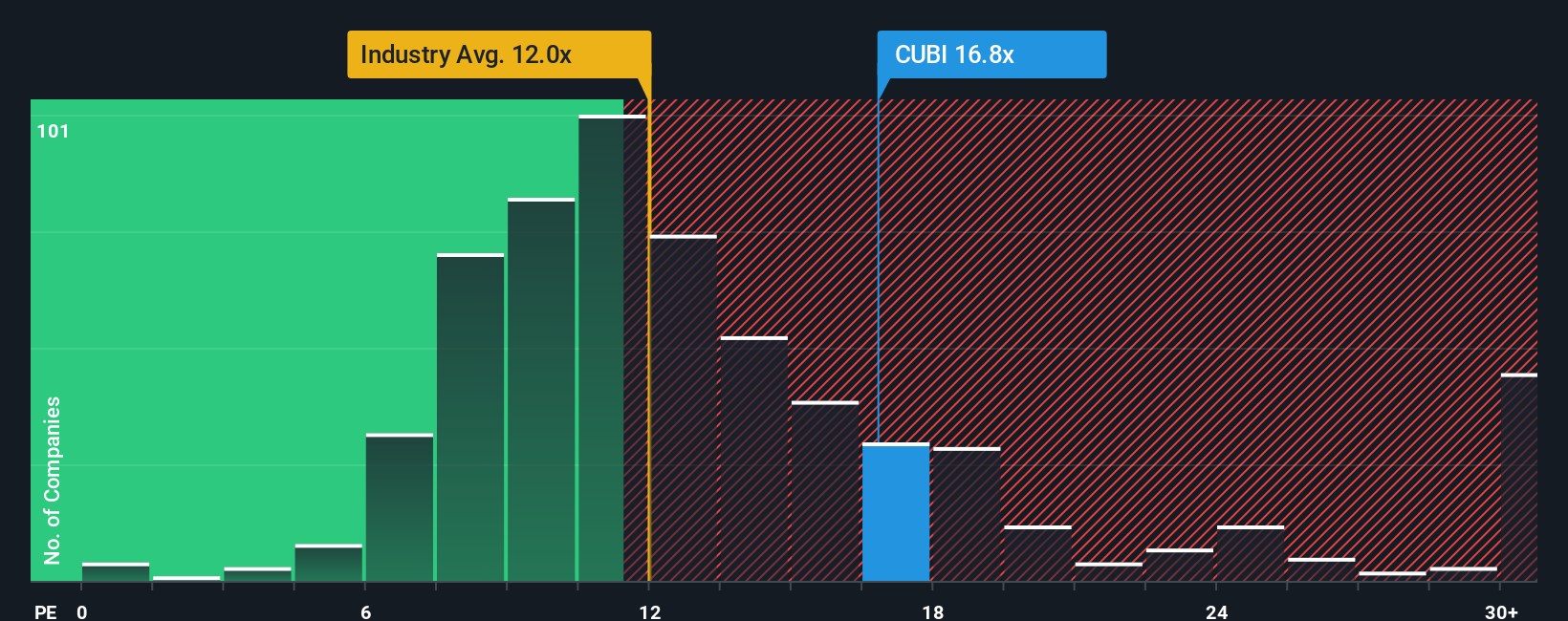

While analyst models see upside, a look at the company's price-to-earnings ratio compared to other US banks tells a more cautious story. By this measure, Customers Bancorp actually looks expensive right now. Which method will matter most in the end?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Customers Bancorp Narrative

If you see things differently or want to dig into the numbers on your own terms, creating your own perspective is quick and simple. Do it your way.

A great starting point for your Customers Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your portfolio strategy and stay ahead of the market by acting on these unique stock opportunities. Don’t let great possibilities pass you by.

- Capture the potential of overlooked companies with explosive growth ambitions by starting your search among penny stocks with strong financials.

- Power up your investments with trailblazers in medical innovation using healthcare AI stocks and spot companies shaping the future of healthcare.

- Strengthen your income stream as you connect with businesses offering impressive yields. Use dividend stocks with yields > 3% for a smarter approach to steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.