Please use a PC Browser to access Register-Tadawul

Darden Restaurants (NYSE:DRI) Announces US$1.40 Dividend and Expands Delivery with Uber

Darden Restaurants, Inc. DRI | 189.53 | +2.16% |

Darden Restaurants (NYSE:DRI) saw a share price increase of 4% over the past week, aligning with several company developments. The declaration of a quarterly dividend of $1.40 per share signals strong cash flow, which can be appealing to income-focused investors. The company's earnings announcement reported a rise in sales and net income compared to the previous year. However, revenues slightly underperformed expectations, yet same-restaurant sales reflected steady consumer spending according to CEO Rick Cardenas. Further expansion plans, including 50 to 55 new restaurant openings, and a pilot program with Uber for on-demand delivery also highlight growth prospects. These updates likely supported the stock's performance amid a broader market increase of 2%. The optimism around Darden's ability to maintain strong consumer engagement, despite some broader economic uncertainties, may have contributed to the favorable investor sentiment reflected in the stock's recent movement.

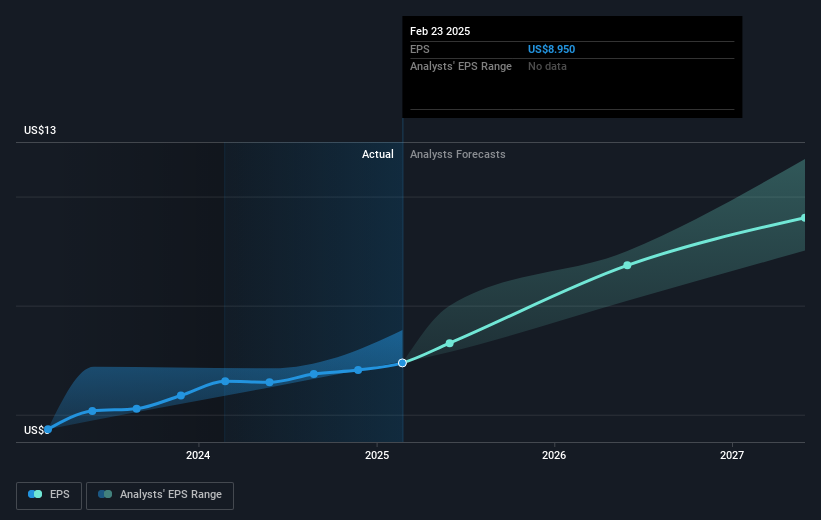

Over the past five years, Darden Restaurants (NYSE:DRI) has delivered a total shareholder return of 256.87%, reflecting both share price appreciation and dividends. This impressive performance outpaces the recent annual return of the US Hospitality industry by a significant margin. The company's earnings have shown robust growth, averaging 26.6% per year over this period, which can be attributed partly to various strategic actions. For instance, Darden's ongoing expansion plans, including the opening of 50 to 55 new restaurants in fiscal year 2025, have likely played a role in attracting long-term investor interest.

Moreover, Darden's strategic partnership with Uber for on-demand delivery services through Cheddar's Scratch Kitchen could further enhance consumer accessibility and engagement. Despite revenue growth forecasts being somewhat subdued compared to broader market expectations, Darden's sound financial health is evidenced by trading below its estimated fair value and having a strong Return on Equity, albeit skewed by high debt levels. These elements collectively underscore the company's ability to drive shareholder value over the extended period.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.