Please use a PC Browser to access Register-Tadawul

Datavault AI (NasdaqCM:DVLT) Valuation in Focus Following Aerospace, Quantum, and IBM Partnership Announcements

Datavault AI Inc. Ordinary Shares DVLT | 1.38 | -4.17% |

Datavault AI (NasdaqCM:DVLT) has moved quickly to expand its presence in aerospace and digital identity, announcing a collaboration with Korea Aerospace University that combines digital credentialing and advanced quantum supercomputing research. This move comes in addition to strengthened partnerships with IBM and a recent strategic investment from Scilex.

Recent months have been pivotal for Datavault AI, as the wave of deals and partnerships—from its IBM tie-up to the strategic investment from Scilex and now the Korea Aerospace University collaboration—have triggered renewed interest in the stock. The company’s 3.7% share price return over the past month points to building momentum, even as the one-year total shareholder return sits just below break-even. Long-term holders are still waiting for a true turnaround, but current moves suggest Datavault AI is finally gaining traction in high-growth sectors where investor enthusiasm can translate into meaningful upside.

If Datavault’s aerospace push has you wondering what else is moving, consider exploring emerging names in the sector with our See the full list for free.

But with this influx of capital and a string of high-profile alliances, investors may wonder whether Datavault AI is a bargain at current levels or if the price already reflects its future growth potential.

Most Popular Narrative: 49% Undervalued

Datavault AI’s most popular narrative sets its fair value far above the latest closing price of $1.53. This striking valuation gap is attributed to expectations of rapid earnings growth and the transformative impact of new technology alliances.

The company’s deepened alliance with IBM, including Platinum Partner status and integration of Watsonx.ai, provides Datavault with scalable AI capabilities and best-in-class cybersecurity. This supports enterprise-grade adoption and efficient scaling, which could drive higher net margins by improving operational leverage and reducing per-unit delivery costs.

Want to see which aggressive growth assumptions and profit margin improvements support this target? The narrative relies on ambitious forecasts and a potential step forward in market leadership that competitors may envy. Click through to uncover the significant drivers fueling this notable valuation.

Result: Fair Value of $3 (UNDERVALUED)

However, uncertainties remain, especially if Datavault's aggressive acquisitions strain its operations or if key revenue from major licensing deals does not materialize.

Another View: Revenue Multiple Raises a Red Flag

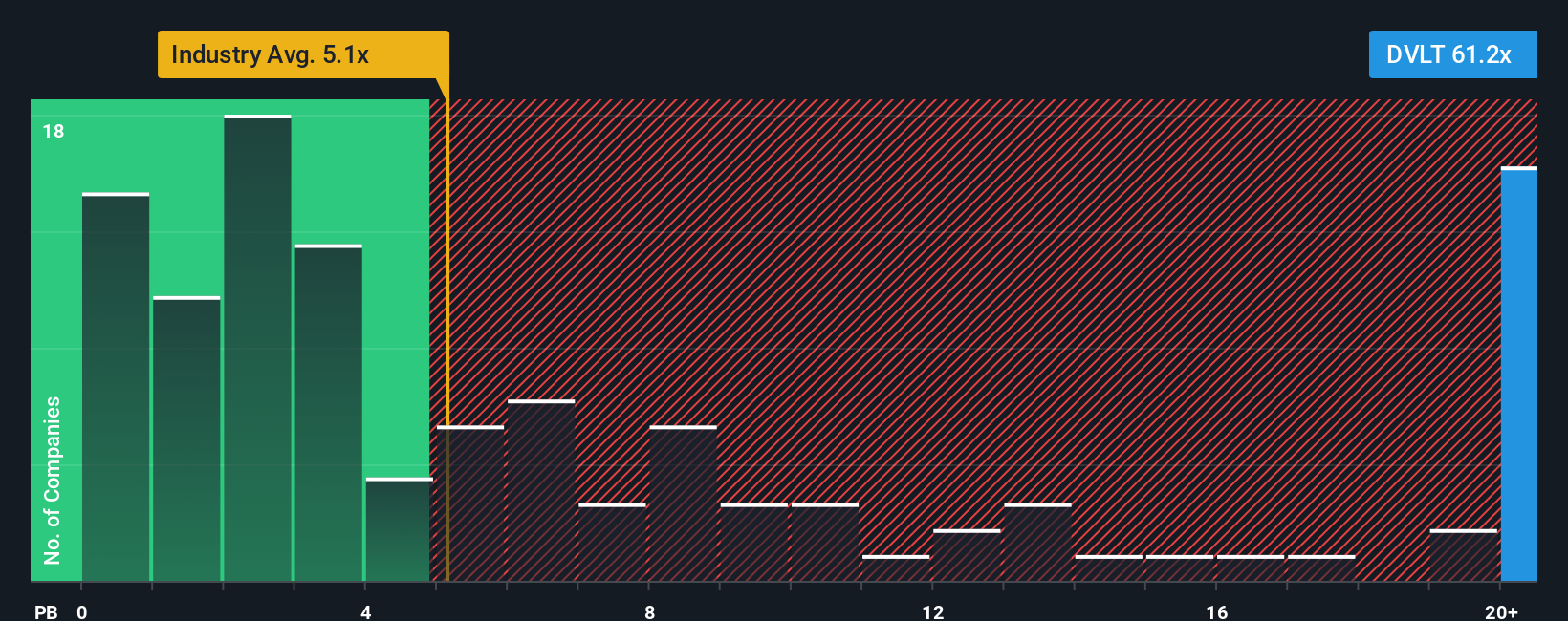

While the fair value narrative signals Datavault AI is undervalued, looking at its price-to-sales multiple tells a much different story. At 40.2 times sales, the stock is dramatically more expensive than the industry average of 4.8 and its peers at 5.6. Even compared to a fair ratio of 16.6, it looks steep. This suggests heightened valuation risk if rapid growth expectations are not met. Is optimism about future growth enough to justify such a lofty price tag?

Build Your Own Datavault AI Narrative

If you think the story could unfold differently or prefer hands-on analysis, you can craft your own view in just a few minutes with Do it your way

A great starting point for your Datavault AI research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Time to accelerate your investing journey. Expand your watchlist with standout themes beyond Datavault AI. See what you could be missing with these exciting opportunities:

- Supercharge your search for reliable income streams by checking out these 19 dividend stocks with yields > 3% offering attractive yields above 3%, ideal for investors seeking steady returns.

- Capture the upside in emerging artificial intelligence by targeting these 24 AI penny stocks at the frontier of automation and digital innovation.

- Spot tomorrow’s market leaders early when you review these 3563 penny stocks with strong financials positioned for breakout performance with robust financials backing their growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.