Please use a PC Browser to access Register-Tadawul

Dave (DAVE) Is Up 13.9% After Shifting to Flat Fees and Signaling Stronger 2025 Profitability - Has The Bull Case Changed?

Dave, Inc. Class A DAVE | 176.51 | -0.97% |

- Earlier this year, Dave Inc. implemented a flat $5 fee and overhauled its business model, which catalyzed increased profitability per loan and reinforced its position as a scalable and robust fintech platform while maintaining low delinquency rates.

- Recent management guidance points to significant EBITDA growth for 2025, signaling investor optimism about sustained profitability and the company’s ability to adapt amid regulatory scrutiny.

- We'll now examine how Dave Inc.'s successful transition to a transparent fee structure may reinforce confidence in its growth and earnings trajectory.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dave Investment Narrative Recap

The core case for Dave Inc. hinges on its ability to drive sustainable growth and margin expansion by leveraging fee-based monetization and differentiated AI underwriting. The upcoming Q3 2025 earnings release is the most significant short-term catalyst, as it will provide a clearer view of the recent $5 fee structure’s impact on profitability and user growth. Regulatory scrutiny of small-dollar, fee-based lending remains the biggest risk; current news does not materially alter the risk-reward balance for near-term investors.

The announcement of the Q3 2025 results call on November 4 is especially relevant, arriving after a period where Dave posted strong quarterly revenue and earnings growth and introduced new AI enhancements. This event will be closely watched as a barometer of whether recent product and fee innovations are translating into improved financial and competitive performance, especially as management has signaled meaningful EBITDA growth guidance for 2025.

Yet, for investors, it is important to remember that, should regulatory headwinds intensify or fee caps emerge...

Dave's narrative projects $702.2 million revenue and $193.0 million earnings by 2028. This requires 17.5% yearly revenue growth and a $137.9 million earnings increase from $55.1 million today.

Uncover how Dave's forecasts yield a $271.86 fair value, a 13% upside to its current price.

Exploring Other Perspectives

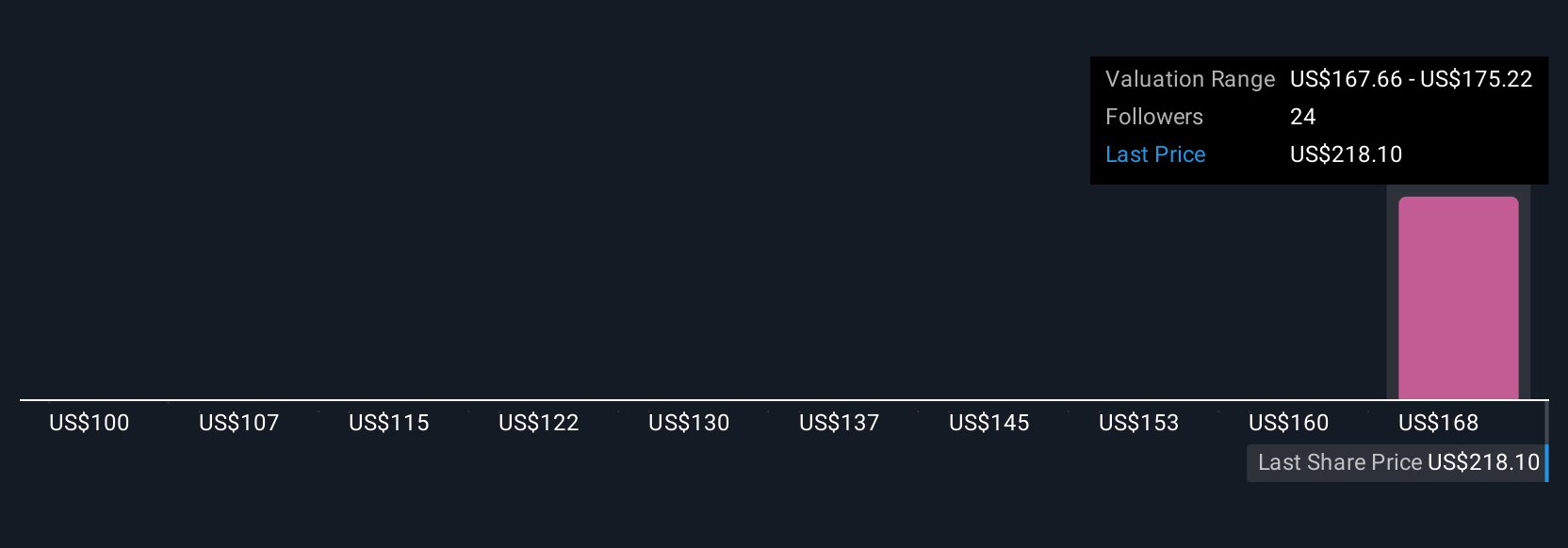

Simply Wall St Community valuations for Dave Inc. span US$99.65 to US$320 across four submissions. While strong AI-driven credit performance supports the bull case, opinions among market participants show just how much key risks and catalysts can shape expectations.

Explore 4 other fair value estimates on Dave - why the stock might be worth as much as 33% more than the current price!

Build Your Own Dave Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dave research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dave research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dave's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.