Please use a PC Browser to access Register-Tadawul

Dave (DAVE) Valuation After CashAI v5.5 Rollout and Fintech Sector Momentum

Famous Dave's of America, Inc. DAVE | 198.93 | +4.14% |

If you’ve been tracking Dave (DAVE) lately, you know the last few weeks have been unusually lively for fintech stocks. First, rocket-level interest in Klarna’s IPO lit up the sector, with demand off the charts and everyone talking about what’s next in digital finance. Meanwhile, Robinhood’s entry into the S&P 500 brought even more legitimacy and investor buzz. Layer in Dave’s own big move with the rollout of CashAI v5.5, their latest AI-driven, real-time underwriting engine, and it’s no surprise the stock caught a double tailwind.

Against this backdrop, Dave’s shares have surged more than 11% recently and climbed an incredible 566% year-to-date, outpacing most digital finance peers by a mile. The rollout of CashAI v5.5 isn’t just a tech upgrade; it’s already showing better risk ranking and lower loss rates, hinting at meaningful performance improvements. All of this sector enthusiasm and in-house innovation has boosted not only Dave’s profile but also short- and long-term momentum, giving investors plenty to consider as the end of the year approaches.

With so many positive catalysts now on the table, the key question is whether Dave’s future growth is fully reflected in the current price or if this is one of those rare opportunities that only come around every few years.

Most Popular Narrative: 15.6% Undervalued

According to the most popular narrative, Dave’s shares are trading at a meaningful discount to the consensus fair value, with analysts pointing to fundamental growth drivers as the catalyst for upside.

Strategic fee and technology enhancements, alongside rising member growth, drive revenue and margin expansion through higher customer value and improved credit performance. Partnerships and cost-efficient infrastructure shifts increase financial flexibility, lower operational costs, and support sustained demand from the gig economy segment.

Curious how analysts justify this bullish target? Discover what sets Dave apart as future earnings and profit margins take center stage. One crucial financial assumption underpins the entire fair value estimate. Can you guess which key growth metric analysts are betting on? Uncover the narrative’s boldest projections and what might fuel the next rally.

Result: Fair Value of $271.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, expanded regulation of fee-based models or intensifying competition from larger fintechs could challenge Dave’s revenue growth and continued margin expansion.

Find out about the key risks to this Dave narrative.Another View: Market Context Shifts the Picture

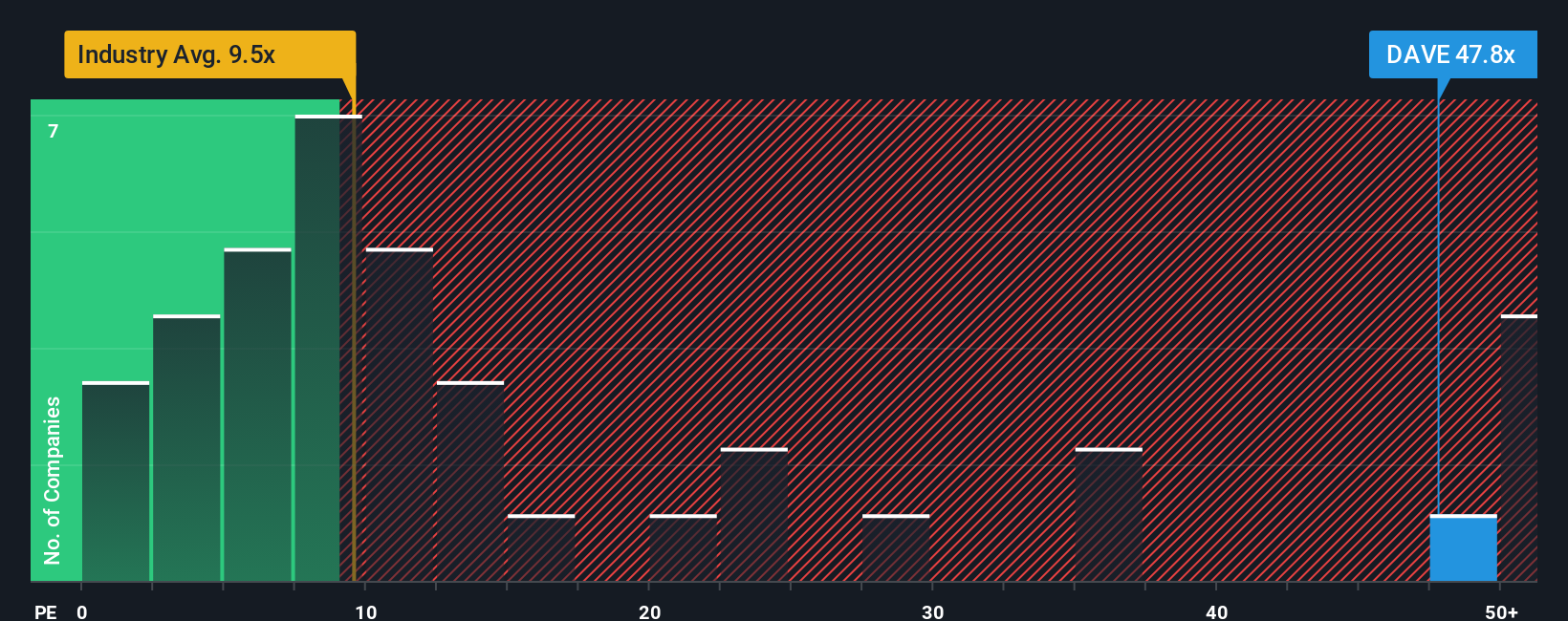

Despite the bullish outlook based on future growth, a look at the current earnings-based valuation paints a different story. Compared to the broader US Consumer Finance sector, Dave looks pricey right now. Could recent optimism be running ahead of reality?

Build Your Own Dave Narrative

If you see things differently or want to dig into the details yourself, you can build your own take on Dave’s outlook in just a few minutes. Do it your way.

A great starting point for your Dave research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Don’t let great opportunities pass you by. Take charge of your next move and uncover stocks with breakout potential using these handpicked market screens below.

- Scan for high-upside bargains and spot undervalued shares for tomorrow’s leaders by checking out undervalued stocks based on cash flows.

- Boost your search for companies leveraging artificial intelligence breakthroughs with AI penny stocks backed by bold innovation and growth.

- Tap into reliable potential by sourcing income-focused picks yielding strong returns through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.