Please use a PC Browser to access Register-Tadawul

Day One Biopharmaceuticals (DAWN) Is Up 11.7% After Strong OJEMDA 2025 Sales And 2026 Outlook - Has The Bull Case Changed?

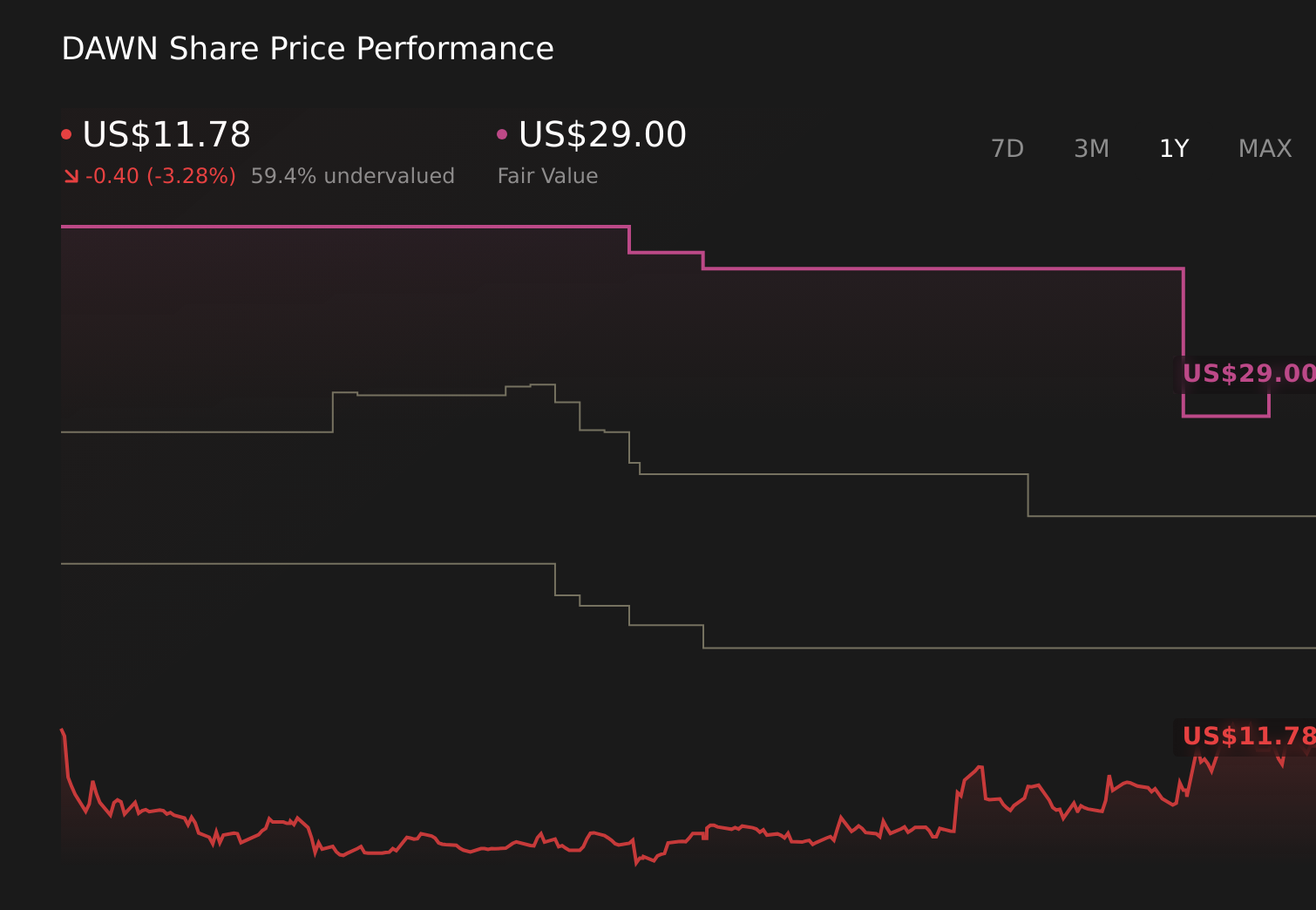

Day One Biopharmaceuticals, Inc. DAWN | 11.78 | -2.40% |

- In January 2026, Day One Biopharmaceuticals reported preliminary unaudited 2025 net product revenue of about US$155.4 million for OJEMDA, with fourth-quarter sales of roughly US$52.8 million supported by rising prescription volumes.

- An interesting angle is that management is guiding 2026 U.S. OJEMDA revenue to a US$225 million–US$250 million range, reinforcing its importance as the company’s primary growth engine while it advances new oncology assets acquired with Mersana.

- With OJEMDA’s 2025 revenue performance now clearer, we’ll examine how this updated outlook may reshape Day One’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Day One Biopharmaceuticals Investment Narrative Recap

To own Day One Biopharmaceuticals, you need to believe OJEMDA can sustain meaningful prescription demand while the company builds a broader oncology portfolio. The latest 2025 revenue update and 2026 guidance underline OJEMDA’s role as the key near term catalyst, but they do not remove the central risk that the business still leans heavily on a single drug in a relatively narrow indication.

The most closely linked development is management’s 2026 OJEMDA U.S. net product revenue guidance of US$225 million to US$250 million, which now anchors expectations ahead of clinical milestones like FIREFLY 2 enrollment and data from newer assets such as Emi Le and DAY301. These commercial targets frame how much room there may be for future contributions from the recently expanded pipeline to matter.

Yet, despite the stronger OJEMDA trajectory, investors should still be aware of how concentrated Day One’s revenue remains and what happens if...

Day One Biopharmaceuticals' narrative projects $371.5 million revenue and $40.5 million earnings by 2028. This requires 25.6% yearly revenue growth and a $135.5 million earnings increase from -$95.0 million today.

Uncover how Day One Biopharmaceuticals' forecasts yield a $22.25 fair value, a 107% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Day One span roughly US$22 to US$97 per share, underscoring how far apart individual views can be. Against that backdrop, OJEMDA’s updated 2026 revenue guidance and continued dependence on a single product give you important context for thinking about how those expectations might be tested over time.

Explore 3 other fair value estimates on Day One Biopharmaceuticals - why the stock might be worth over 9x more than the current price!

Build Your Own Day One Biopharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Day One Biopharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Day One Biopharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Day One Biopharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.