Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Al Mawarid Manpower Co.: The Daily Gain Is 10.0%, Solid Financials and High Dividends Attract Investors to This Saudi Recruitment Firm

ALMAWARID 1833.SA | 135.00 | +0.15% |

SPPC 4270.SA | 8.45 | -0.24% |

SRMG 4210.SA | 146.00 | -1.15% |

RASAN 8313.SA | 120.70 | -0.90% |

MESC 2370.SA | 23.20 | 0.00% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

At the close of 15/04/2025, the Tadawul All Shares Index rose by 0.17%, closing at 11616.81 points; the Parallel Market Capped Index rose by 0.08%, closing at 29141.3 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

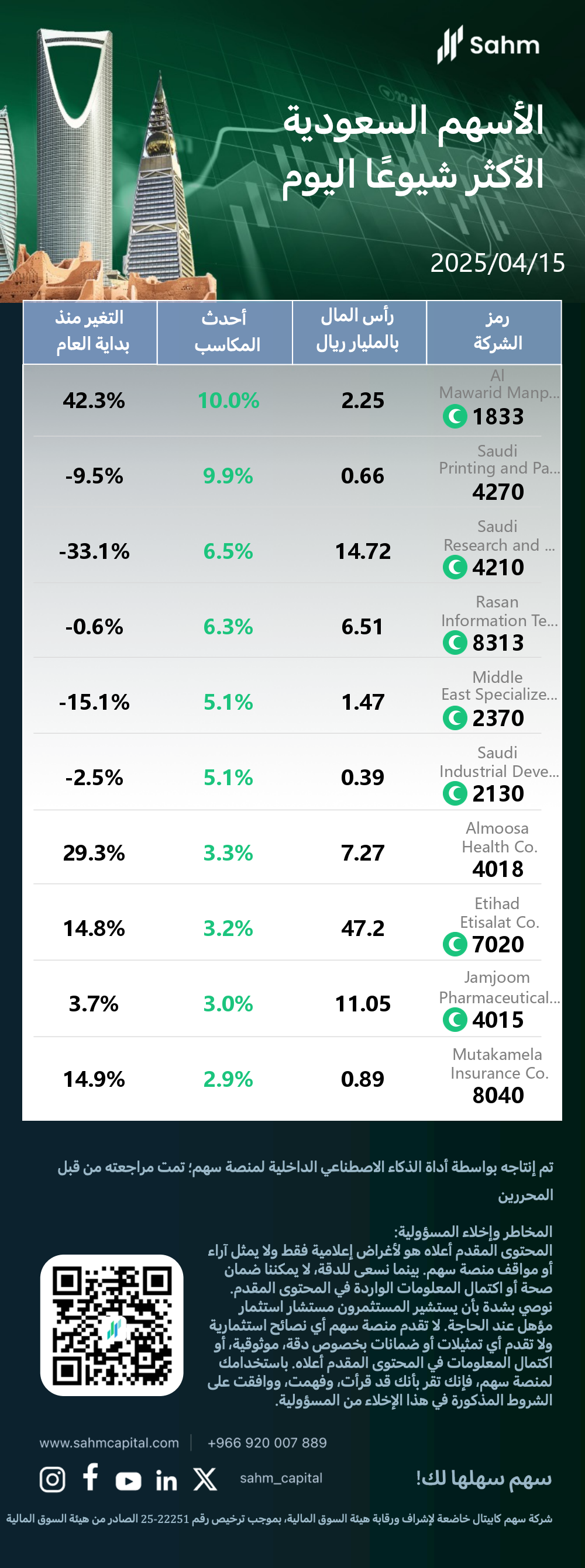

The Top 10 Daily Gainers in the KSA market are listed as follows:

Al Mawarid Manpower Co.: The daily gain is 10.0%, Solid financials and high dividends attract investors to this Saudi recruitment firm.

Al Mawarid Manpower Co. (ALMAWARID) is a publicly traded entity on the Saudi Exchange (Tadawul) since June 2023. The company specializes in Human Resource Services within the Commercial & Professional Services sector. Headquartered in Riyadh, Saudi Arabia, ALMAWARID was founded in July 2012 and has since established itself as a key player in the regional HR industry.

In a noteworthy development, the possible reason for the stock price increase of 1833.SA (Al Mawarid Manpower Co.) may be attributed to its robust financial performance and attractive dividend policy. The company reported a 61% year-on-year revenue growth to 20.3 billion Saudi Riyals in FY2024, surpassing analyst expectations by 17%. Despite a slight decline in profit margin, net profit rose 7.5% to 95.4 million Saudi Riyals. The announcement of a 1.25 Saudi Riyal per share dividend for H2 2024, coupled with a consistent dividend history and moderate payout ratio, has likely bolstered investor confidence. Additionally, the company's strong historical earnings growth of 33% annually over the past five years and its recent listing on the Saudi Exchange in June 2023 have contributed to increased market attention and the stock's impressive 42.3% year-to-date performance.

Saudi Printing and Packaging Co.: The daily gain is 9.9%, sees recovery as market adapts to digital trends and packaging demand grows.

Saudi Printing and Packaging (SPPC) is a publicly traded company listed on the Saudi Stock Exchange (Tadawul) since July 2007. The firm operates in the Commercial and Professional Services sector, specializing in Commercial Printing. Headquartered in Riyadh, Saudi Arabia, SPPC was founded in May 2007. The company's shares are traded under the ticker symbol SPPC on the Tadawul exchange.

In a noteworthy development, the possible reason for the stock price increase of 4270.SA (Saudi Printing and Packaging Co.) may be a market rebound after previous losses. The stock surged 9.9% in a single trading session, making it one of the day's top performers. This significant uptick comes despite the company's year-to-date decline of 9.5%, suggesting a potential shift in investor sentiment. The sharp rise could indicate renewed interest in the commercial printing and packaging sector, possibly driven by improved market conditions or company-specific developments. However, further analysis is needed to determine if this represents a sustained trend or a temporary fluctuation.

Saudi Research and Media Group: The daily gain is 6.5%, launches new media solutions and secures a major contract.

Saudi Research and Media Group (SRMG) is a publicly traded company listed on the Saudi Stock Exchange (Tadawul) since 2006. Headquartered in Riyadh, Saudi Arabia, SRMG was founded in 2000. The company operates in the media sector, with a primary focus on publishing activities. As a key player in the Saudi media landscape, SRMG contributes to the country's information and communication industry.

In a noteworthy development, the possible reasons for the stock price increase of 4210.SA (Saudi Research and Media Group) may be: 1. The launch of SRMG Media Solutions (SMS), a new data-driven media solutions company, aimed at providing innovative advertising strategies. 2. A significant three-year contract worth 252 million Saudi Riyals annually signed by SRMG's subsidiary, Taoq Public Relations, with a commercial advertising and public relations company. 3. SMS's ability to connect brands with over 170 million users globally through advanced digital, TV, audio, and print channels. 4. SRMG's recognition as one of LinkedIn's Top 15 Best Workplaces in Saudi Arabia for 2025, highlighting its commitment to innovation and digital-first operations. 5. The media and entertainment sector's strong performance, with SRMG outperforming the sector average. 6. A 71.36% increase in SRMG's trading volume compared to its 3-month average, indicating heightened investor interest.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| Al Mawarid Manpower Co.(1833.SA) | 2.25 | 10.0% | 42.3% |

| Saudi Printing and Packaging Co.(4270.SA) | 0.66 | 9.9% | -9.5% |

| Saudi Research and Media Group(4210.SA) | 14.72 | 6.5% | -33.1% |

| Rasan Information Technology Co.(8313.SA) | 6.51 | 6.3% | -0.6% |

| Middle East Specialized Cables Co.(2370.SA) | 1.47 | 5.1% | -15.1% |

| Saudi Industrial Development Co.(2130.SA) | 0.39 | 5.1% | -2.5% |

| Almoosa Health Co.(4018.SA) | 7.27 | 3.3% | 29.3% |

| Etihad Etisalat Co.(7020.SA) | 47.2 | 3.2% | 14.8% |

| Jamjoom Pharmaceuticals Factory Co.(4015.SA) | 11.05 | 3.0% | 3.7% |

| Mutakamela Insurance Co.(8040.SA) | 0.89 | 2.9% | 14.9% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.