Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Al Sagr Cooperative Insurance Co.: The Daily Gain Is 10.0%, Resumes Mandatory Vehicle Insurance Sales After Temporary Suspension

ALSAGR INSURANCE 8180.SA | 9.80 | -1.71% |

KEC 4310.SA | 12.01 | +0.33% |

SAUDI CABLE 2110.SA | 130.70 | +2.35% |

APC 2200.SA | 4.90 | +0.62% |

SALAMA 8050.SA | 9.22 | -1.18% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

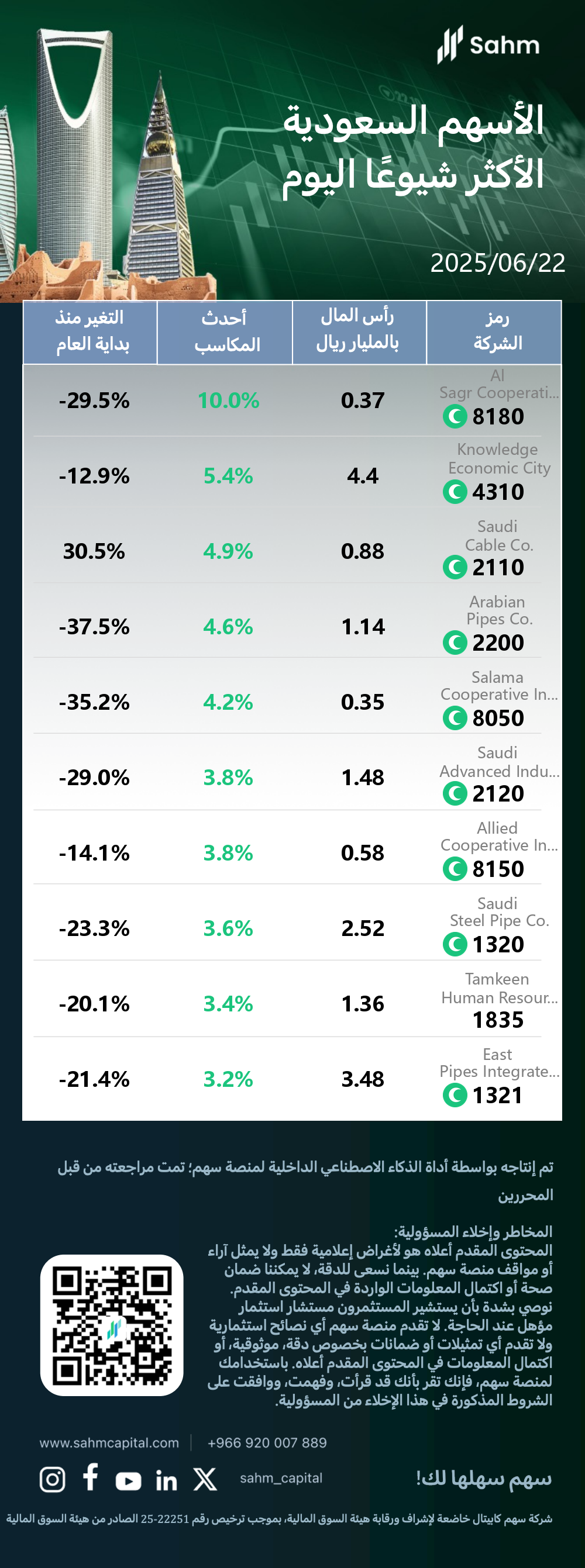

At the close of 22/06/2025, the Tadawul All Shares Index dropped by 0.34%, closing at 10574.27 points; the Parallel Market Capped Index dropped by 0.1%, closing at 26148.69 points. Sahm has compiled the KSA market's Top 10 Daily Stock Price Gainers.

The Top 10 Daily Gainers in the KSA market are listed as follows:

Al Sagr Cooperative Insurance Co.: The daily gain is 10.0%, resumes mandatory vehicle insurance sales after temporary suspension.

Sagr Insurance, a publicly traded entity on the Saudi Stock Exchange since 2008, specializes in multi-line insurance within the broader insurance sector. Headquartered in Khobar, Saudi Arabia, the company has been operational for over a decade. Its listing on Tadawul underscores its significance in the regional financial landscape and its commitment to transparency and shareholder value.

In a noteworthy development, the possible reason for the stock price increase of 8180.SA (Al Sagr Cooperative Insurance Co.) may be the resumption of mandatory vehicle insurance sales. The company announced it has been permitted to restart selling this key product, which was previously suspended due to governance issues. This positive news likely boosted investor confidence, as vehicle insurance is a major revenue source for Al Sagr. Implementing corrective measures by the board of directors, leading to the sales approval on June 19, 2025, further demonstrates the company's commitment to improving operations. The anticipated positive impact on financial performance, coupled with a significant 289.93% increase in trading volume, suggests heightened investor interest in the stock.

Knowledge Economic City: The daily gain is 5.4%, KEC stock may rebound due to sector sentiment and market cap factors.

Knowledge Economic City (KEC) is a publicly traded entity on the Saudi Stock Exchange (Tadawul) since August 2010. Operating in the Real Estate sector, KEC specializes in diversified real estate activities. The company is headquartered in Medina, Saudi Arabia. KEC's business model focuses on developing and managing various real estate projects within the Kingdom.

In a noteworthy development, the possible reason for the stock price increase of 4310.SA (Knowledge Economic City) may be attributed to a combination of factors. The 5.4% daily gain could represent a partial recovery from the 12.9% year-to-date decline, as investors perceive the stock as undervalued at current levels. Market sentiment towards the Saudi Arabian real estate sector may have improved, driving renewed interest in KEC's diversified property portfolio in Medina. Additionally, the company's current market capitalization of 440 billion Saudi Riyals suggests a significant market presence, potentially attracting investors seeking exposure to large-cap real estate stocks in the region.

Saudi Cable Co.: The daily gain is 4.9%, leads stock ranking with top financial scores, showing strong market performance.

Saudi Cable Co (SCC) is a publicly traded entity on the Saudi Stock Exchange (Tadawul) since 1993. Operating in the Capital Goods sector, SCC specializes in Electrical Components and Equipment. Founded in 1975 and headquartered in Jeddah, Saudi Arabia, the company has established itself as a significant player in the electrical industry within the region.

In a noteworthy development, the possible reason for the stock price increase of 2110.SA (Saudi Cable Co.) may be its outstanding market performance and strong financial indicators. The company has secured the top position in the long-term strong stock ranking for the Saudi stock market, boasting a high composite score of 94.61. With an impressive RPS score of 97.82 and an earnings score of 89.80, Saudi Cable Co. demonstrates robust financial health and market positioning. The stock's inclusion in the TOP30 watchlist and its improved ranking from 2nd to 1st place in recent weeks indicate growing investor confidence. The company's consistent growth, evidenced by a daily increase of 4.9% and a year-to-date growth of 30.5%, further underpins its attractiveness to investors in the capital goods sector.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| Al Sagr Cooperative Insurance Co.(8180.SA) | 0.37 | 10.0% | -29.5% |

| Knowledge Economic City(4310.SA) | 4.4 | 5.4% | -12.9% |

| Saudi Cable Co.(2110.SA) | 0.88 | 4.9% | 30.5% |

| Arabian Pipes Co.(2200.SA) | 1.14 | 4.6% | -37.5% |

| Salama Cooperative Insurance Co.(8050.SA) | 0.35 | 4.2% | -35.2% |

| Saudi Advanced Industries Co.(2120.SA) | 1.48 | 3.8% | -29.0% |

| Allied Cooperative Insurance Group(8150.SA) | 0.58 | 3.8% | -14.1% |

| Saudi Steel Pipe Co.(1320.SA) | 2.52 | 3.6% | -23.3% |

| Tamkeen Human Resource Co.(1835.SA) | 1.36 | 3.4% | -20.1% |

| East Pipes Integrated Company for Industry(1321.SA) | 3.48 | 3.2% | -21.4% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.