Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | CHUBB Arabia Cooperative Insurance Co.: Daily Gain of 10.0% as Stock Recovers from Positive Catalyst, Showing Promising Outlook

CHUBB 8240.SA | 21.81 | -0.05% |

NASEEJ 1213.SA | 27.00 | +2.58% |

EAST PIPES 1321.SA | 157.00 | -1.75% |

STC 7010.SA | 44.44 | +0.36% |

JAMJOOM PHARMA 4015.SA | 130.80 | -1.95% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

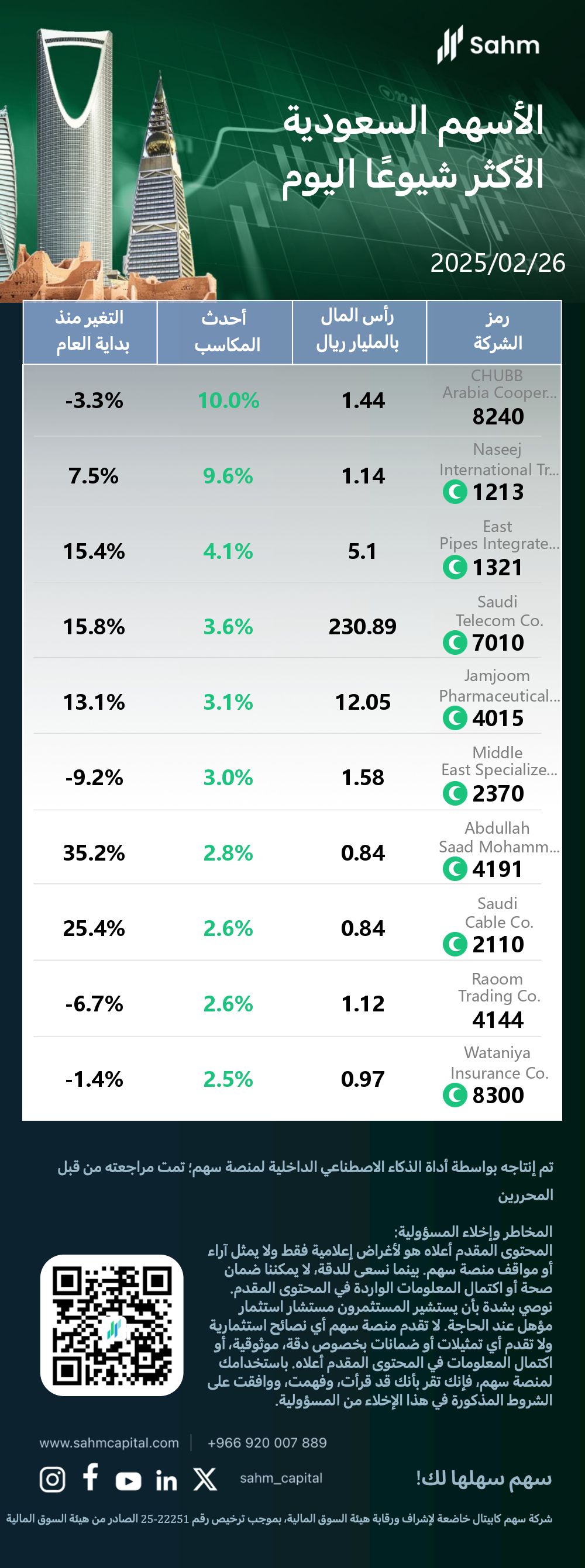

At the close of 26/02/2025, the Tadawul All Shares Index dropped by 0.56%, closing at 12232.65 points; the Parallel Market Capped Index rose by 0.04%, closing at 31286.23 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

CHUBB Arabia Cooperative Insurance Co.: The daily gain is 10.0%, Stock recovers due to positive catalyst, showing promising outlook.

Chubb Arabia Cooperative Insurance Co, publicly traded on the Saudi Stock Exchange since July 2009, specializes in multi-line insurance within the broader insurance sector. Headquartered in Khobar, Saudi Arabia, the company was founded in May 2008. It operates under the ticker symbol "Chubb" on the Tadawul exchange, providing a range of insurance products and services to the Saudi market.

In a noteworthy development, the possible reason for the stock price increase of 8240.SA (CHUBB Arabia Cooperative Insurance Co.) may be attributed to a combination of factors. The 10.0% daily gain suggests a significant positive catalyst, potentially stemming from robust quarterly financial results or favorable industry trends in the Saudi Arabian insurance sector. Despite the substantial daily increase, the stock remains down 3.3% year-to-date, indicating that this surge could represent a recovery from previous losses or a response to recent company-specific developments. Market sentiment or analyst upgrades may have also played a role in driving investor interest in CHUBB Arabia's shares.

Naseej International Trading Co.: The daily gain is 9.6%, Key factors driving investor confidence in the leading home furnishings company.

Naseej International Trading Co., operating under the ticker NASEEJ, has been publicly traded on the Saudi Stock Exchange (Tadawul) since 2010. The company specializes in home furnishings within the Consumer Durables and Apparel sector. Founded in 1953 and headquartered in Jeddah, Saudi Arabia, NASEEJ has established a significant presence in the regional market over its decades-long history.

In a noteworthy development, the possible reason for the stock price increase of 1213.SA (Naseej International Trading Co.) may be attributed to several factors. The company, operating in the Consumer Durables and Apparel sector with a focus on Home Furnishings, has seen a significant 9.6% surge in its stock price, making it one of the top gainers of the day. This substantial daily increase, coupled with a 7.5% year-to-date gain, suggests growing investor confidence in Naseej's performance and prospects. The company's long-standing presence in the Saudi market since 1953 may contribute to its perceived stability and appeal to investors seeking established players in the home furnishings industry.

Saudi Telecom Co.: The daily gain is 3.6%, reports 85.7% profit increase and raises dividend payout.

Saudi Telecom Company (STC) is a publicly traded entity on the Saudi Stock Exchange (Tadawul) since 2003. Operating in the telecommunications sector, STC specializes in integrated services. The company, headquartered in Riyadh, Saudi Arabia, was founded in 1998. STC has established itself as a prominent player in the Middle Eastern telecommunications market.

In a noteworthy development, the possible reason for the stock price increase of 7010.SA (Saudi Telecom Co.) may be attributed to its exceptional financial performance and strategic initiatives. The company reported a remarkable 85.7% year-on-year increase in net profit for 2024, reaching 24.69 billion Saudi Riyals, significantly surpassing analysts' expectations. This robust growth was complemented by a 5.73% rise in revenue to 75.89 billion Saudi Riyals. STC's generous dividend policy, including a 37.5% increase in Q4 2024 cash dividend and a proposed special dividend of 2 Riyals per share, has likely bolstered investor confidence. The successful sale of 51% of TAWAL to the Public Investment Fund contributed substantially to non-continuing operations profit. Additionally, STC's launch of a digital banking business and securing contracts worth 32.64 billion Saudi Riyals for telecom infrastructure services have further strengthened its market position.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| CHUBB Arabia Cooperative Insurance Co.(8240.SA) | 1.44 | 10.0% | -3.3% |

| Naseej International Trading Co.(1213.SA) | 1.14 | 9.6% | 7.5% |

| East Pipes Integrated Company for Industry(1321.SA) | 5.1 | 4.1% | 15.4% |

| Saudi Telecom Co.(7010.SA) | 230.89 | 3.6% | 15.8% |

| Jamjoom Pharmaceuticals Factory Co.(4015.SA) | 12.05 | 3.1% | 13.1% |

| Middle East Specialized Cables Co.(2370.SA) | 1.58 | 3.0% | -9.2% |

| Abdullah Saad Mohammed Abo Moati for Bookstores Co.(4191.SA) | 0.84 | 2.8% | 35.2% |

| Saudi Cable Co.(2110.SA) | 0.84 | 2.6% | 25.4% |

| Raoom Trading Co.(4144.SA) | 1.12 | 2.6% | -6.7% |

| Wataniya Insurance Co.(8300.SA) | 0.97 | 2.5% | -1.4% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.