Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | CHUBB Arabia Cooperative Insurance Co.: The daily gain is 9.9%, approves 33.33% capital increase through bonus share issuance.

CHUBB 8240.SA | 23.69 | -0.46% |

LIVA 8280.SA | 11.55 | -1.03% |

SAUDI ARAMCO 2222.SA | 25.64 | +1.50% |

ETIHAD ETISALAT 7020.SA | 71.35 | +0.99% |

AZM 7211.SA | 23.51 | -2.04% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

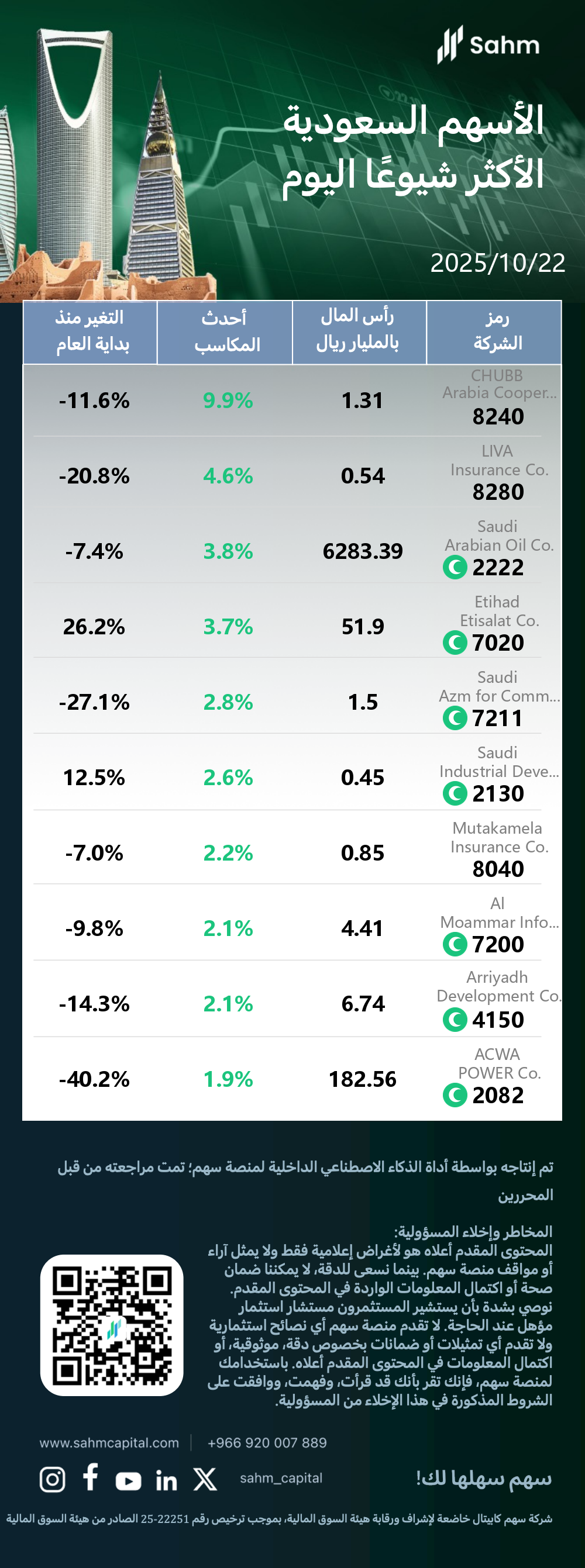

At the close of 22/10/2025, the Tadawul All Shares Index rose by 0.35%, closing at 11585.9 points; the Parallel Market Capped Index dropped by 0.15%, closing at 25035.13 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

CHUBB Arabia Cooperative Insurance Co.: The daily gain is 9.9%, approves 33.33% capital increase through bonus share issuance.

Chubb Arabia Cooperative Insurance Co, a public entity listed on the Saudi Stock Exchange (Tadawul) since July 2009, operates in the insurance sector with a focus on multi-line insurance. Established in May 2008 and headquartered in Khobar, Saudi Arabia, the company provides a range of insurance products and services to meet diverse client needs in the Kingdom.

In a noteworthy development, the possible reason for the stock price increase of 8240.SA (CHUBB Arabia Cooperative Insurance Co.) may be the shareholders' approval of a significant capital increase. The company plans to raise its capital by 33.33%, from 300 million SAR to 400 million SAR, through a bonus share issuance. This move, aimed at strengthening the company's capital base and supporting future business activities, likely boosted investor confidence. The 1-for-3 bonus share offer and the company's stated intention to create long-term value through investment opportunities may have further attracted market interest, contributing to the 9.9% stock price surge.

Saudi Arabian Oil Co.: The daily gain is 3.8%, Global oil giant, world's largest company by market cap, key player in energy markets.

Saudi Arabian Oil Co, commonly known as Saudi Aramco, operates in the oil and energy sector, specializing in production, extraction, and refining services. Established in November 1988 and headquartered in Dhahran, Saudi Arabia, the company went public in December 2019, listing on the Saudi Stock Exchange (Tadawul). As a major player in the global energy market, Saudi Aramco continues to be a significant contributor to the Kingdom's economy.

In a noteworthy development, the possible reasons for the stock price increase of 2222.SA (Saudi Arabian Oil Co.) may be: 1. A significant contract signed with AlMeer Saudi Technical Services for power infrastructure projects across Saudi Arabia, demonstrating long-term growth commitment. 2. Rising oil prices, with a 2% increase for the second consecutive day, directly benefiting Saudi Aramco as a major oil producer. 3. The CEO's warning of potential global oil shortages, potentially increasing investor interest in the company. 4. Improved economic expectations for Saudi Arabia, with economists predicting increased oil production. 5. Strong performance of the energy sector index (TENI.SA), which rose 1.42%, positively impacting Saudi Aramco's stock. 6. Optimism surrounding a possible US-China trade agreement, potentially boosting global economic growth and oil demand.

Etihad Etisalat Co.: The daily gain is 3.7%, posts robust Q3 results with significant profit and revenue growth.

Etihad Etisalat Co, operating under the brand name Mobily, is a publicly traded telecommunications company listed on the Saudi Stock Exchange (Tadawul) since 2004. The firm specializes in wireless telecommunication services within the broader telecom sector. Headquartered in Riyadh, Saudi Arabia, Mobily was founded in December 2004 and has since established itself as a significant player in the Saudi telecom market.

In a noteworthy development, the possible reason for the stock price increase of 7020.SA (Etihad Etisalat Co.) may be its robust financial performance and positive market sentiment. The company reported a 10.494% year-on-year increase in Q3 2025 net profit to 916 million SAR, while revenue grew by 7.779% to 4.849 billion SAR. For the first nine months of 2025, net profit surged 18.1% to 2.513 billion SAR, with revenue up 7.002% to 14.455 billion SAR. The improved EBITDA margin of 38.5% and significant capital expenditure of 3.629 billion SAR also indicate operational efficiency and future growth potential. Additionally, recent board restructuring and a long-term incentive plan may have boosted investor confidence, contributing to the stock's 3.7% daily gain and impressive 26.2% year-to-date increase.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| CHUBB Arabia Cooperative Insurance Co.(8240.SA) | 1.31 | 9.9% | -11.6% |

| LIVA Insurance Co.(8280.SA) | 0.54 | 4.6% | -20.8% |

| Saudi Arabian Oil Co.(2222.SA) | 6283.39 | 3.8% | -7.4% |

| Etihad Etisalat Co.(7020.SA) | 51.9 | 3.7% | 26.2% |

| Saudi Azm for Communication and Information Technology Co.(7211.SA) | 1.5 | 2.8% | -27.1% |

| Saudi Industrial Development Co.(2130.SA) | 0.45 | 2.6% | 12.5% |

| Mutakamela Insurance Co.(8040.SA) | 0.85 | 2.2% | -7.0% |

| Al Moammar Information Systems Co.(7200.SA) | 4.41 | 2.1% | -9.8% |

| Arriyadh Development Co.(4150.SA) | 6.74 | 2.1% | -14.3% |

| ACWA POWER Co.(2082.SA) | 182.56 | 1.9% | -40.2% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.