Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Fawaz Abdulaziz Alhokair Co.: The daily gain is 10.0%, secures 2.95 billion SAR in financing agreements.

CENOMI RETAIL 4240.SA | 19.46 | -1.82% |

SAUDI CERAMICS 2040.SA | 27.38 | -2.49% |

BAHRI 4030.SA | 29.00 | +0.14% |

TASHEEL 4083.SA | 157.70 | -1.44% |

GULF GENERAL 8260.SA | 4.19 | -2.33% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

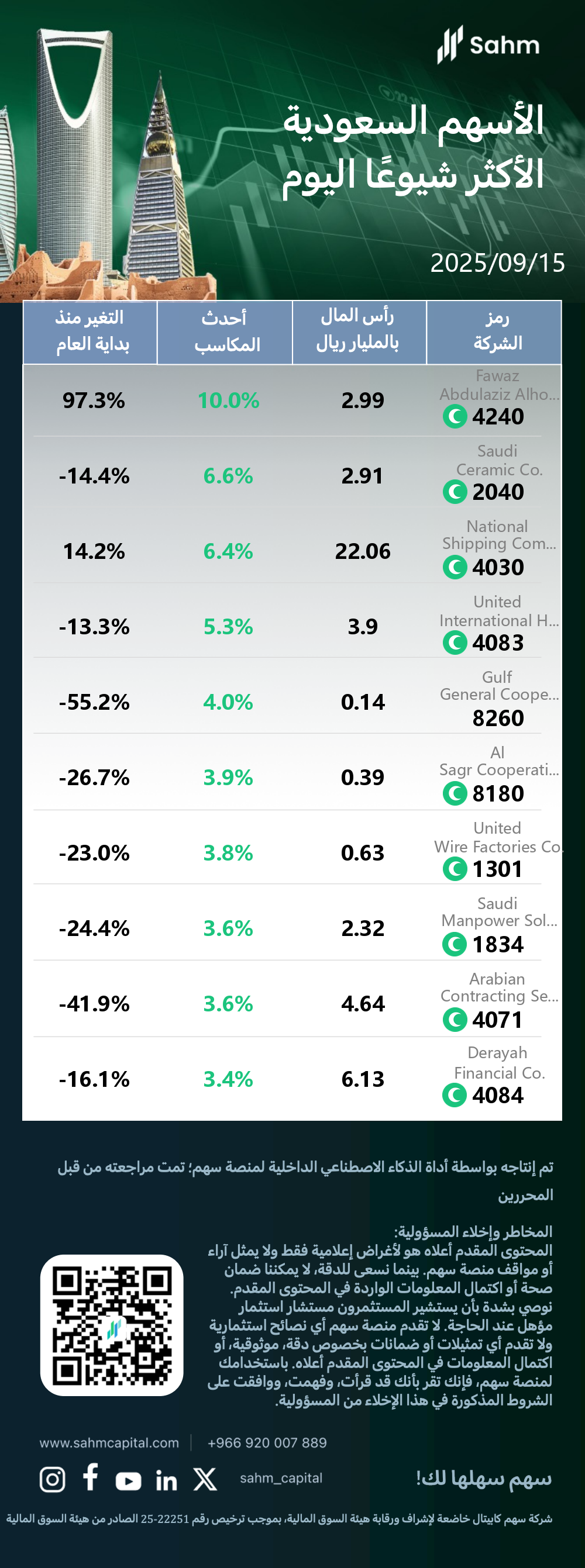

At the close of 15/09/2025, the Tadawul All Shares Index dropped by 0.07%, closing at 10427.06 points; the Parallel Market Capped Index rose by 0.15%, closing at 24950.56 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

Fawaz Abdulaziz Alhokair Co.: The daily gain is 10.0%, secures 2.95 billion SAR in financing agreements.

Cenomi Retail, formerly known as Fawaz Abdulaziz Al Hokair Co, is a publicly traded company listed on the Saudi Stock Exchange (Tadawul) since 2006. Specializing in apparel retail within the broader retailing sector, the company was founded in 1990 and is headquartered in Riyadh, Saudi Arabia.

In a noteworthy development, the possible reason for the stock price increase of 4240.SA (Fawaz Abdulaziz Alhokair Co.) may be attributed to significant financing agreements totaling 2.95 billion Saudi Riyals (SAR). The company secured a 1.6 billion SAR credit facility with Emirates NBD Bank and a 1.35 billion SAR shareholder loan from Al Futtaim Retail Company. These agreements aim to refinance existing debt and strengthen the company's balance sheet. Additionally, the stock's strong market performance, ranking 12th in Saudi Arabia's long-term strong stocks list with an impressive Relative Price Strength score of 98.35, likely contributed to investor confidence. The company's year-to-date stock price surge of 97.3% further underscores its positive momentum in the luxury retail sector.

Saudi Ceramic Co.: The daily gain is 6.6%, the stock price has risen.

Saudi Ceramic Co, commonly referred to as Saudi Ceramics, is a publicly traded entity listed on the Saudi Stock Exchange (Tadawul) since 1993. The company specializes in building products within the Capital Goods sector. Headquartered in Riyadh, Saudi Arabia, it was founded in 1977. Saudi Ceramics has established itself as a significant player in the construction materials industry in the region.

It is worth noting that the daily gain of Saudi Ceramic Co.(2040.SA) is 6.6%, and the year-to-date gain/loss is -14.4%.

National Shipping Company of Saudi Arabia: The daily gain is 6.4%, Strong financials boost investor confidence in Saudi shipping giant.

National Shipping Company of Saudi Arabia (Bahri) is a publicly traded entity on the Saudi Stock Exchange (Tadawul) since 1993. It specializes in energy sector operations, particularly oil and gas storage and transportation. Founded in 1979 and headquartered in Riyadh, Bahri plays a crucial role in Saudi Arabia's maritime logistics and energy infrastructure.

In a noteworthy development, the possible reason for the stock price increase of 4030.SA (National Shipping Company of Saudi Arabia) may be attributed to its robust financial performance and attractive valuation metrics. The company has demonstrated impressive growth, with an 85% compound annual growth rate in earnings per share over the past three years. Additionally, its current price-to-earnings ratio of 10.27 suggests potential undervaluation. The stock has outperformed the broader market, rising 39% over three years, while delivering a total shareholder return of 48% during the same period. Recent momentum is evident in the 6.4% daily increase and 14.2% year-to-date gain, indicating growing investor confidence in the company's prospects.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| Fawaz Abdulaziz Alhokair Co.(4240.SA) | 2.99 | 10.0% | 97.3% |

| Saudi Ceramic Co.(2040.SA) | 2.91 | 6.6% | -14.4% |

| National Shipping Company of Saudi Arabia(4030.SA) | 22.06 | 6.4% | 14.2% |

| United International Holding Co.(4083.SA) | 3.9 | 5.3% | -13.3% |

| Gulf General Cooperative Insurance Co.(8260.SA) | 0.14 | 4.0% | -55.2% |

| Al Sagr Cooperative Insurance Co.(8180.SA) | 0.39 | 3.9% | -26.7% |

| United Wire Factories Co.(1301.SA) | 0.63 | 3.8% | -23.0% |

| Saudi Manpower Solutions Co.(1834.SA) | 2.32 | 3.6% | -24.4% |

| Arabian Contracting Services Co.(4071.SA) | 4.64 | 3.6% | -41.9% |

| Derayah Financial Co.(4084.SA) | 6.13 | 3.4% | -16.1% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.