Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Kingdom Holding Co. Leads Saudi Market with 8.9% Daily Surge

KINGDOM 4280.SA | 8.19 | +0.74% |

ACIG 8150.SA | 8.42 | -1.86% |

CARE 4005.SA | 133.40 | -0.67% |

MBC GROUP 4072.SA | 32.02 | -1.54% |

TCC 3090.SA | 9.38 | -0.74% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

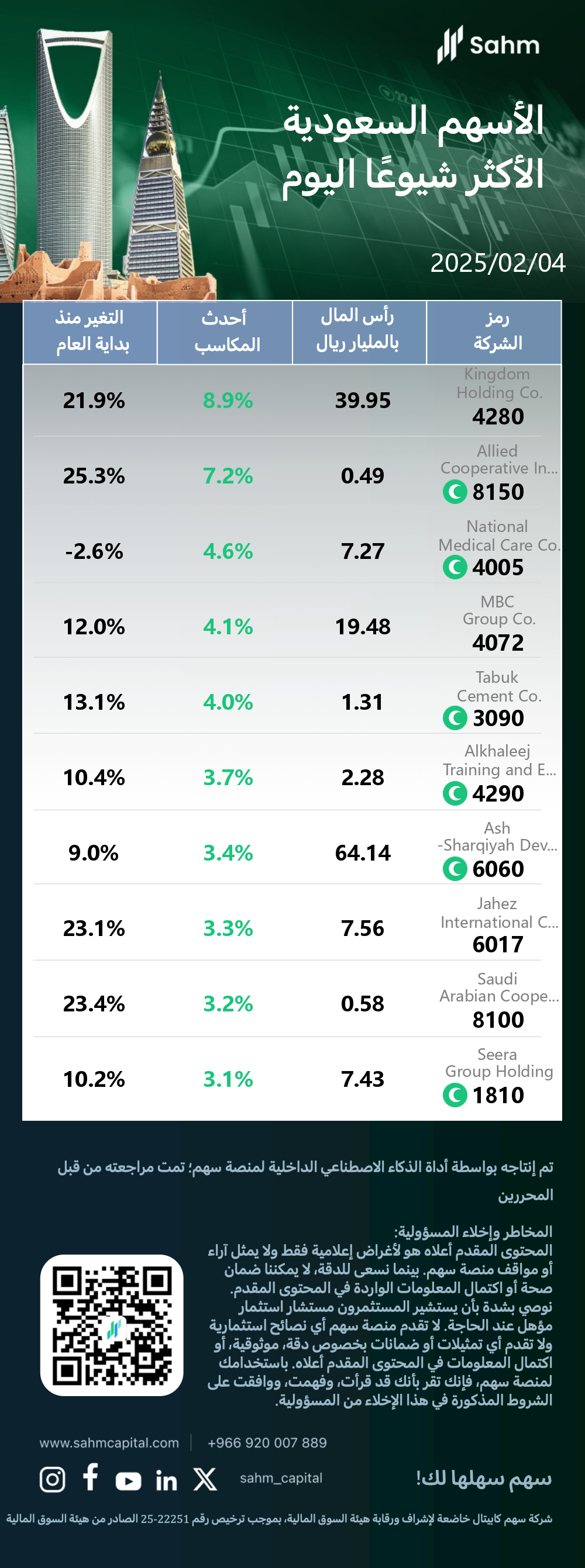

At the close of 04/02/2025, the Tadawul All Shares Index rose by 0.46%, closing at 12433.93 points; the Parallel Market Capped Index rose by 0.45%, closing at 31196.37 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

Kingdom Holding Co.: The daily gain is 8.9%, Leading Saudi firm with robust performance and market dominance.

Kingdom Holding Co.(4280.SA), a publicly traded entity on the Saudi Stock Exchange (Tadawul) since 2007, has operated in the Diversified Financials sector with a focus on Multi-Sector Holdings. Established in 1996 and headquartered in Riyadh, Saudi Arabia, the company has maintained a significant presence in the financial landscape for over two decades, leveraging its diverse portfolio to navigate market fluctuations and capitalize on strategic investment opportunities.

In a noteworthy development, the possible reasons for the stock price increase of 4280.SA (Kingdom Holding Co.) may be:

1. Robust performance: The company's 8.9% weekly gain and impressive 21.9% year-to-date increase suggest strong financial results and positive investor sentiment.

2. Market leadership: Kingdom Holding Co.'s inclusion in the top 10 gainers in the Saudi Arabian market indicates its competitive position and attractiveness to investors.

3. Substantial market capitalization: With a market value of 37.06 billion Saudi Riyals, the company's size and stability may be drawing investor interest.

4. Sustained growth trajectory: The consistent upward trend in stock price throughout the year points to ongoing business success and effective management strategies.

5. Positive market conditions: The overall strength of the Saudi Arabian stock market may be contributing to Kingdom Holding Co.'s impressive performance.

Allied Cooperative Insurance Group: The daily gain is 7.2%, granted extension to increase capital by regulatory authorities.

Allied Cooperative Insurance Group(8150.SA) is a publicly traded company on the Saudi Stock Exchange (Tadawul) since August 2007. Headquartered in Riyadh, Saudi Arabia, Acig specializes in multi-line insurance within the broader insurance sector. The company has been operational for over a decade, providing various insurance products and services to meet the diverse needs of its clientele in the Saudi market.

In a noteworthy development, the possible reason for the stock price increase of 8150.SA (Allied Cooperative Insurance Group) may be the regulatory approval to extend its capital increase period. The insurance authority granted a six-month extension for the company's preferred shares issuance, potentially boosting investor confidence. The firm's commitment to regulatory compliance and transparency, evidenced by its promise to meet all requirements and promptly announce developments, likely contributed to positive market sentiment. Additionally, the stock's strong year-to-date performance, with a 25.3% gain, suggests ongoing market momentum. These factors, combined with the company's efforts to strengthen its capital position, appear to have driven the recent 7.2% daily price surge.

National Medical Care Co.: The daily gain is 4.6%, Strong ROCE growth and market confidence boost the outlook for healthcare providers.

National Medical Care Co.(4005.SA), commonly referred to as Care, is a publicly traded company on the Saudi Stock Exchange (Tadawul) since March 2013. Operating in the Health Care Equipment and Services sector, Care specializes in providing health care services. The company, founded in October 2003, is headquartered in Riyadh, Saudi Arabia.

In a noteworthy development, the possible reason for the stock price increase of 4005.SA (National Medical Care Co.) may be its impressive financial performance and growth prospects. The company's Return on Capital Employed (ROCE) has significantly improved to 14% over the past five years, aligning with industry averages. This, coupled with a 56% increase in capital usage, suggests enhanced operational efficiency and strategic investments. Investors appear encouraged by the company's robust 247% total return over five years, indicating strong market confidence. Analysts' optimism about the stock's multi-bagger potential and the company's sound business model with profitable reinvestment opportunities likely contributed to the 4.6% daily price surge, despite a 2.6% year-to-date decline.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| Kingdom Holding Co.(4280.SA) | 39.95 | 8.9% | 21.9% |

| Allied Cooperative Insurance Group(8150.SA) | 0.49 | 7.2% | 25.3% |

| National Medical Care Co.(4005.SA) | 7.27 | 4.6% | -2.6% |

| MBC Group Co.(4072.SA) | 19.48 | 4.1% | 12.0% |

| Tabuk Cement Co.(3090.SA) | 1.31 | 4.0% | 13.1% |

| Alkhaleej Training and Education Co.(4290.SA) | 2.28 | 3.7% | 10.4% |

| Ash-Sharqiyah Development Co.(6060.SA) | 64.14 | 3.4% | 9.0% |

| Jahez International Company for Information System Technolog(6017.SA) | 7.56 | 3.3% | 23.1% |

| Saudi Arabian Cooperative Insurance Co.(8100.SA) | 0.58 | 3.2% | 23.4% |

| Seera Group Holding(1810.SA) | 7.43 | 3.1% | 10.2% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.