Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Miahona Co.: The daily gain is 29.9%, IPO thrives on debut due to strong demand; More with Today's Top 10 Gainers

MIAHONA 2084.SA | 19.33 | +1.36% |

SAUDI CEMENT 3030.SA | 35.00 | -0.23% |

TAIBA 4090.SA | 32.70 | +0.18% |

NAQI 2282.SA | 55.95 | -0.62% |

QACCO 3040.SA | 41.40 | -0.14% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

At the close of 06/06/2024, the Tadawul All Shares Index(TASI.SA) rose by 0.06%, closing at 11560.39 points; the Parallel Market Capped Index (NomuC)(NOMUC.SA) rose by 1.18%, closing at 26230.43 points.

Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

1、Miahona Co.: The daily gain is 29.9%,IPO thrives on debut due to strong demand, strategic pricing, and trading caps.

In a noteworthy development, the debut of Miahona Co. on the Saudi Tadawul stock exchange was marked by a sharp incline in the stock's opening price, catalyzed by a confluence of market dynamics and investor sentiment. The initial public offering, which saw considerable oversubscription, underscored a robust demand for the company's shares, signaling confidence in its prospects within the water and wastewater infrastructure sector. The limited offering of shares further amplified the stock's scarcity, creating a competitive environment for investors keen on securing a stake. The strategic pricing at 11.50 SAR per share was received favorably, perceived as an attractive valuation that encouraged active participation. The convergence of these elements, alongside heightened media visibility, likely contributed to the vigorous trading activity and the resultant surge in Miahona Co.'s stock price on its maiden trading day.

2、Saudi Cement Co.: The daily gain is 3.8%,Announces significant semi-annual dividend, spurring stock rise.

In a noteworthy development, Saudi Cement Co., a leading cement manufacturer in the Kingdom of Saudi Arabia, has declared a considerable semi-annual dividend of SAR 1.25 per share, amounting to a substantial payout to shareholders that underscores the company's robust financial posture and commitment to rewarding investors. This generous dividend, representing 12.5% of the company's capital, is set for distribution on June 26, 2024, with shareholders on record as of June 9, 2024, poised to benefit.

The announcement has likely fueled investor confidence, reflected in a 3.8% surge in the stock's daily price change. Dividend payouts are often perceived as indicators of a company’s profitability and sustainable cash flow, which can attract income-focused investors and bolster stock demand. Furthermore, the payout may be seen as a testament to Saudi Cement Co.'s operational resilience and its ability to navigate the cyclical nature of the construction materials market, which is critical in a region where infrastructure and construction projects are prevalent.Investment sentiment may also be buoyed by the company's strategic positioning within the industry and the potential growth prospects of the sector, considering ongoing and future infrastructure developments in the region. With a clear distribution timeline and a significant yield, the dividend announcement is a prominent factor influencing Saudi Cement Co.'s positive stock price movement.

3、Taiba Investments Co.: The daily gain is 2.7%,Expands digital outreach, targets Chinese visitors, promotes Saudi heritage.

In a noteworthy development, Taiba Investments Co. has embarked on a significant digital and strategic expansion, reinforcing its presence in the hospitality and real estate sectors. The company's alliance with Sitecore announced during the Arabian Travel Market in Dubai, underscores a commitment to leveraging technology to enhance customer experience management. This strategic move is poised to transform the digital experiences offered by Taiba Investments, potentially boosting customer engagement and satisfaction.Furthermore, the memorandum of understanding with the Saudi Tourism Authority to attract more Chinese tourists reflects a targeted strategy to capitalize on the increasing Chinese outbound tourism market. By forging a comprehensive residential ecosystem and customized hospitality services for this demographic, Taiba Investments is strategically positioning Saudi Arabia as a premier destination for Chinese travelers.

The company's collaboration with the Saudi Tourism Authority facilitates the formation of specialized sales and marketing teams in Riyadh and Shanghai. This initiative, paired with joint promotional efforts, is aimed at penetrating the Chinese market more effectively, thereby enhancing the brand's recognition and attracting a significant tourist segment.Additionally, the concerted effort to promote Saudi Arabia's cultural heritage and diverse tourism offerings to the Chinese market through upcoming conferences in Riyadh could stimulate tourism inflows and create new business opportunities for Taiba Investments.These strategic initiatives are likely to foster positive market sentiment and investor confidence, which could be instrumental in driving an uptick in Taiba Investments Co.'s stock price, as the market anticipates the successful implementation of these growth strategies.

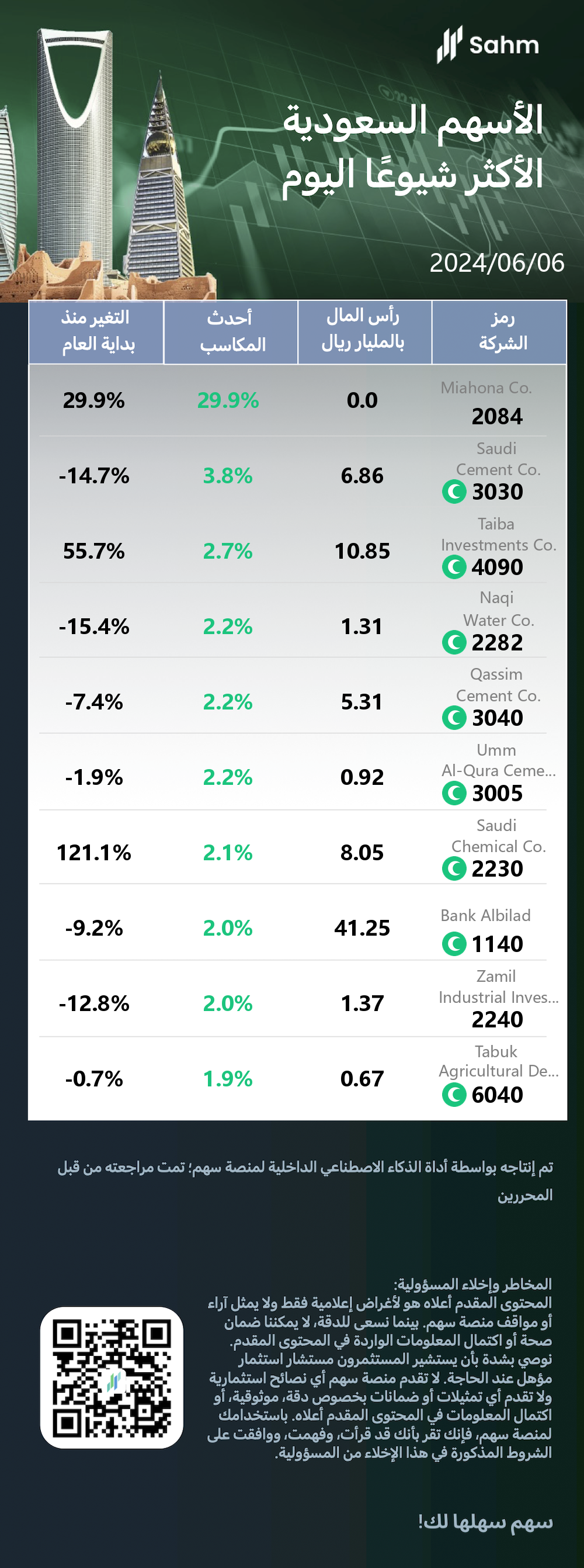

The Top 10 Daily Gainers in the KSA market are listed as follows:

| Company&Ticker | Capitalization SAR bn | Latest Gain | YTD Change |

|---|---|---|---|

مياهنا | 2.4 | 29.9% | 29.9% |

أسمنت السعودية | 6.86 | 3.8% | -14.7% |

طيبة | 10.85 | 2.7% | 55.7% |

نقي | 1.31 | 2.2% | -15.4% |

أسمنت القصيم | 5.31 | 2.2% | -7.4% |

أسمنت ام القرى | 0.92 | 2.2% | -1.9% |

الكيميائية | 8.05 | 2.1% | 121.1% |

البلاد | 41.25 | 2.0% | -9.2% |

الزامل للصناعة | 1.37 | 2.0% | -12.8% |

تبوك الزراعية | 0.67 | 1.9% | -0.7% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.