Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Nice One Beauty Digital Marketing Co.: The daily gain is 10.0%, Strong performance boosts investor confidence in the company's growth potential.

NICE ONE 4193.SA | 18.60 | +0.81% |

MEDGULF 8030.SA | 12.47 | -2.50% |

JAMJOOM PHARMA 4015.SA | 140.40 | -1.75% |

ALAKARIA 4020.SA | 13.13 | -2.52% |

ALMAJED OUD 4165.SA | 130.00 | -1.37% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

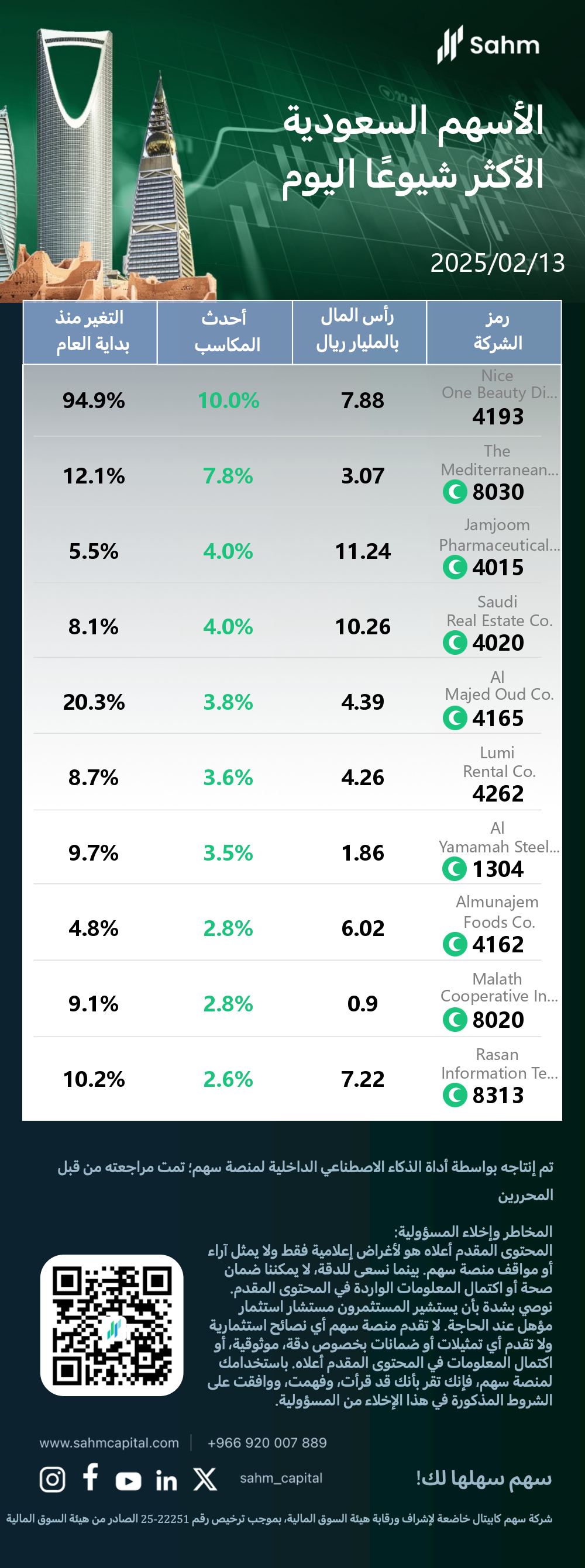

At the close of 13/02/2025, the Tadawul All Shares Index dropped by 0.01%, closing at 12385.0 points; the Parallel Market Capped Index rose by 1.0%, closing at 31615.42 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

Nice One Beauty Digital Marketing Co.: The daily gain is 10.0%, Strong performance boosts investor confidence in the company's growth potential.

In a noteworthy development, the possible reason for the stock price increase of 4193.SA (Nice One Beauty Digital Marketing Co.) may be its exceptional market performance and strong investor confidence. The stock has demonstrated remarkable growth, surging 10.0% in a single day and an impressive 94.9% year-to-date. This consistent upward trajectory suggests robust market demand for the company's digital marketing services in the beauty sector. Additionally, the stock's high rating of 96.13, outperforming 80% of other stocks, indicates solid fundamentals and potential for continued expansion in the consumer discretionary distribution and retail industry.

The Mediterranean and Gulf Insurance and Reinsurance Co.: The daily gain is 7.8%, secures significant contract with Saudi Data Authority.

Mediterranean and Gulf Cooperative Insurance and Reinsurance (Medgulf) is a publicly traded company on the Saudi Stock Exchange (Tadawul) since 2007. Specializing in multi-line insurance, Medgulf operates within the insurance sector. The company, established in 2006, is headquartered in Riyadh, Saudi Arabia.

In a noteworthy development, the possible reason for the stock price increase of 8030.SA (The Mediterranean and Gulf Insurance and Reinsurance Co.) may be the company's recent contract win with the Saudi Data and Artificial Intelligence Authority (SDAIA). The one-year agreement, valued at over 5% of MEDGULF's 2023 revenue, involves providing cooperative health insurance services for SDAIA employees and their families. This significant contract, expected to be signed on March 3, 2025, follows a similar deal with Saudi Electricity Company announced in December 2024. These consecutive wins demonstrate MEDGULF's strong market position and growth potential in Saudi Arabia's insurance sector, likely fueling investor optimism and contributing to the stock's 7.8% daily gain and 12.1% year-to-date increase.

Saudi Real Estate Co.: The daily gain is 4.0%, gains investor trust as market expands, boosting confidence in Saudi property sector.

Saudi Real Estate Co (ALAKARIA) is a publicly traded company listed on the Saudi Stock Exchange (Tadawul) since 1993. It specializes in diversified real estate activities within the real estate sector. Headquartered in Riyadh, Saudi Arabia, ALAKARIA was founded in 1976. The company's operations encompass various aspects of the real estate industry, contributing to its prominent position in the Saudi market.

In a noteworthy development, the possible reason for the stock price increase of 4020.SA (Saudi Real Estate Co.) may be attributed to its strong performance in the current market. The company's shares surged 4.0% in a single day, contributing to an impressive year-to-date gain of 8.1%. This upward trend suggests growing investor confidence in Saudi Real Estate Co.'s business prospects and the broader Saudi real estate sector. The company's diversified real estate activities and long-standing presence in the market since 1976 may be attracting investors seeking exposure to the Kingdom's property market. Additionally, Saudi Arabia's ongoing economic reforms and infrastructure investments could be bolstering the outlook for real estate companies, further fueling investor interest in 4020.SA.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| Nice One Beauty Digital Marketing Co.(4193.SA) | 7.88 | 10.0% | 94.9% |

| The Mediterranean and Gulf Insurance and Reinsurance Co.(8030.SA) | 3.07 | 7.8% | 12.1% |

| Jamjoom Pharmaceuticals Factory Co.(4015.SA) | 11.24 | 4.0% | 5.5% |

| Saudi Real Estate Co.(4020.SA) | 10.26 | 4.0% | 8.1% |

| Al Majed Oud Co.(4165.SA) | 4.39 | 3.8% | 20.3% |

| Lumi Rental Co.(4262.SA) | 4.26 | 3.6% | 8.7% |

| Al Yamamah Steel Industries Co.(1304.SA) | 1.86 | 3.5% | 9.7% |

| Almunajem Foods Co.(4162.SA) | 6.02 | 2.8% | 4.8% |

| Malath Cooperative Insurance Co.(8020.SA) | 0.9 | 2.8% | 9.1% |

| Rasan Information Technology Co.(8313.SA) | 7.22 | 2.6% | 10.2% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.