Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Red Sea International Co.: The daily gain is 10.0%, Stock rebounds, attracting investors with improved performance and technical strength.

RED SEA 4230.SA | 34.76 | -0.23% |

ALRAJHI TAKAFUL 8230.SA | 82.85 | -0.78% |

NGC 2090.SA | 16.30 | +1.12% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

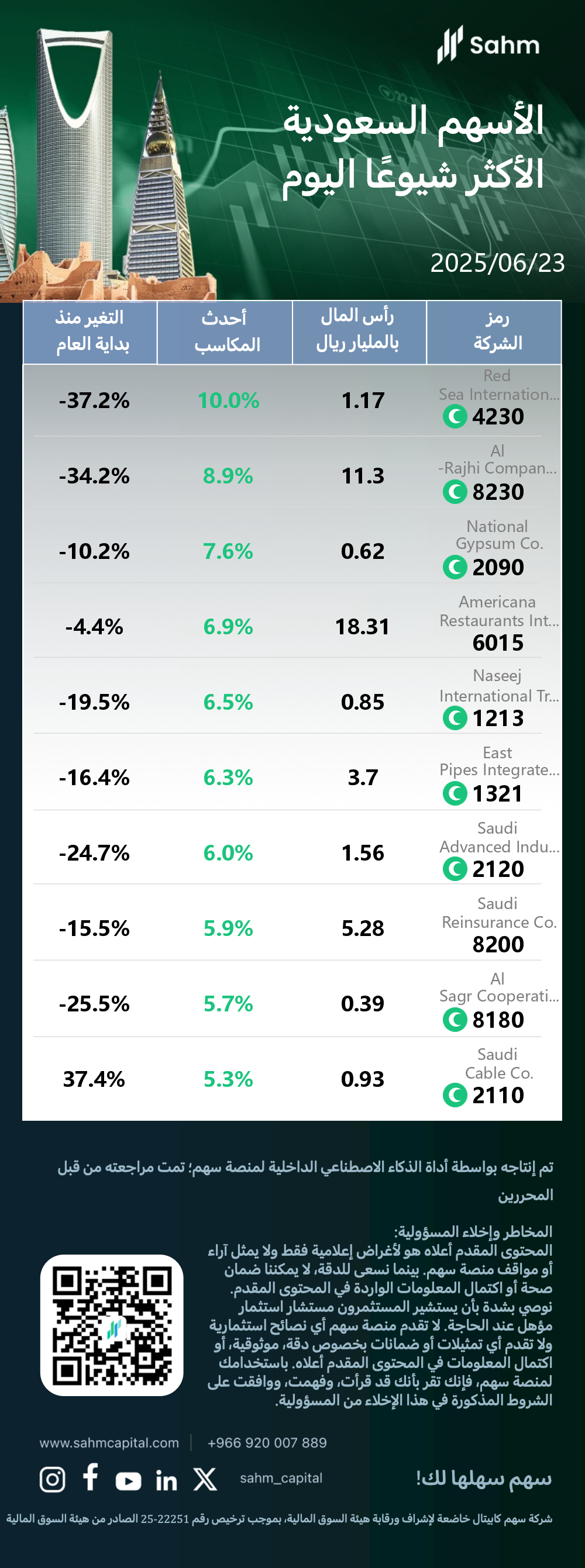

At the close of 23/06/2025, the Tadawul All Shares Index rose by 1.29%, closing at 10710.24 points; the Parallel Market Capped Index rose by 0.8%, closing at 26358.07 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

Red Sea International Co.(4230.SA) : The daily gain is 10.0%, Stock rebounds, attracting investors with improved performance and technical strength.

Red Sea International Co, a publicly traded entity on the Saudi Stock Exchange (Tadawul) since 2006, specializes in diversified real estate activities. Headquartered in Jeddah, Saudi Arabia, the company was founded in 1986. It operates within the real estate sector, offering a range of services and solutions. Red Sea's listing on Tadawul underscores its significance in the Saudi Arabian market and its commitment to transparency and shareholder value.

In a noteworthy development, the possible reason for the stock price increase of 4230.SA (Red Sea International Co.) may be attributed to a technical rebound following a significant year-to-date decline of 37.2%. The 10.0% daily gain suggests investors may perceive the stock as oversold, prompting a short-term recovery. Additionally, the company's strong five-year performance, delivering a 34% return to shareholders and outperforming the broader market, could be attracting value investors. Furthermore, Red Sea International's impressive 41% annual revenue growth rate over the past five years, surpassing many unprofitable companies, may be viewed as a positive signal by market participants, contributing to renewed investor interest.

Al-Rajhi Company for Cooperative Insurance(8230.SA) : The daily gain is 8.9%, Potential recovery despite YTD decline; outlook remains cautious.

Al-Rajhi Company for Cooperative Insurance, operating as AlRajhi Takaful, is a publicly traded entity on the Saudi Stock Exchange (Tadawul) since 2009. Established in 2008 and headquartered in Riyadh, Saudi Arabia, the company specializes in multi-line insurance within the broader insurance sector.

In a noteworthy development, the possible reason for the stock price increase of 8230.SA (Al-Rajhi Company for Cooperative Insurance) may be a partial recovery from its significant year-to-date decline. The 8.9% daily gain comes against the backdrop of a 34.2% drop since the beginning of the year, suggesting a potential market correction or renewed investor interest. This surge could also be attributed to positive developments in Saudi Arabia's insurance sector or company-specific news that has bolstered investor confidence in Al-Rajhi Takaful's prospects. The stock's movement may also reflect broader trends in the Saudi stock market or changes in economic factors affecting the insurance industry.

National Gypsum Co.(2090.SA) : The daily gain is 7.6%, shares recover following recent downturn, signaling renewed investor confidence in the company.

National Gypsum Co (NGC) is a publicly traded company on the Saudi Stock Exchange (Tadawul) since 1993. Operating in the Materials sector, NGC specializes in Construction Materials. The company, established in 1959, is headquartered in Riyadh, Saudi Arabia. NGC has maintained a significant presence in the construction materials industry for over six decades.

In a noteworthy development, the possible reason for the stock price increase of 2090.SA (National Gypsum Co.) may be a technical rebound following a period of downward pressure. The stock's 7.6% daily gain comes against a backdrop of a 10.2% year-to-date decline, suggesting a potential correction in market sentiment. With a market capitalization of approximately 590 million Saudi Riyals, investors may perceive the stock as undervalued after its recent decline, spurring renewed buying interest. This uptick could also reflect broader market dynamics or sector-specific factors affecting construction materials stocks in Saudi Arabia.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| 4230.SA | 1.17 | 10.0% | -37.2% |

| 8230.SA | 11.3 | 8.9% | -34.2% |

| 2090.SA | 0.62 | 7.6% | -10.2% |

| 6015.SA | 18.31 | 6.9% | -4.4% |

| 1213.SA | 0.85 | 6.5% | -19.5% |

| 1321.SA | 3.7 | 6.3% | -16.4% |

| 2120.SA | 1.56 | 6.0% | -24.7% |

| 8200.SA | 5.28 | 5.9% | -15.5% |

| 8180.SA | 0.39 | 5.7% | -25.5% |

| 2110.SA | 0.93 | 5.3% | 37.4% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.