Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Saudi Arabia Refineries Co.: The daily gain is 9.8%, reports major profit increase in Q1 2025, reversing previous losses.

SARCO 2030.SA | 52.40 | -1.13% |

SENAAT 2240.SA | 36.84 | -0.49% |

ARTEX 2340.SA | 10.94 | +0.37% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

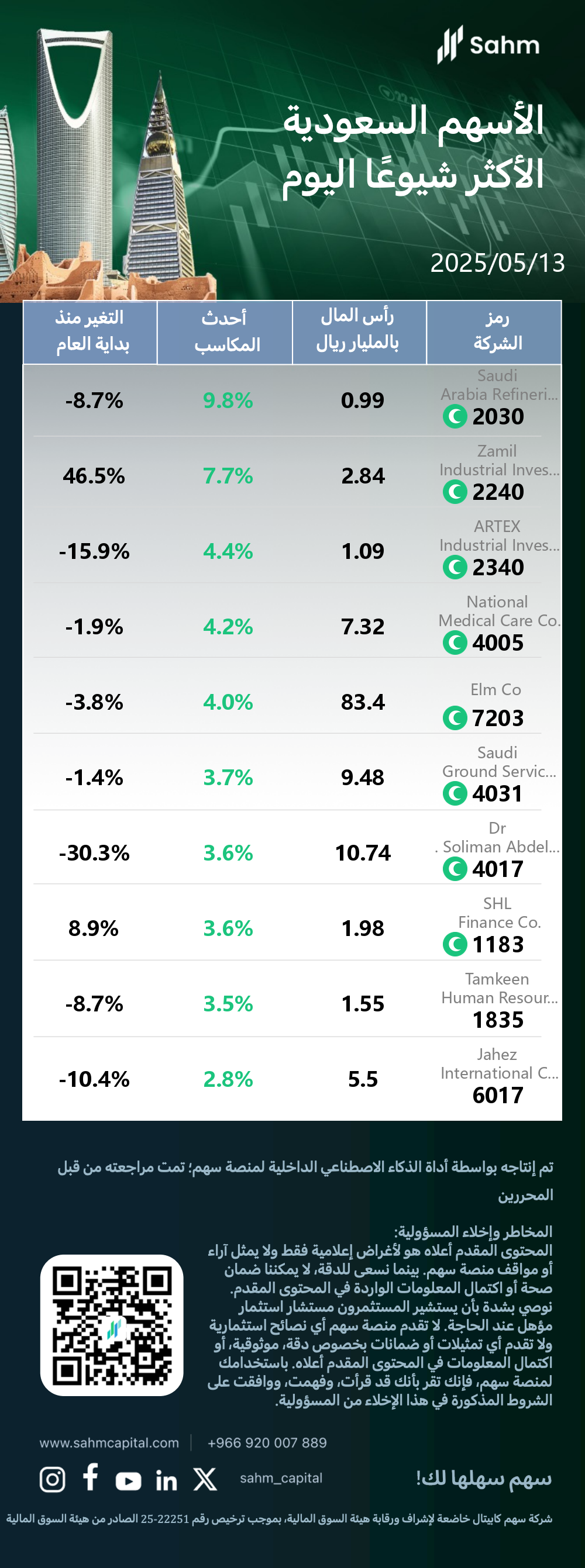

At the close of 13/05/2025, the Tadawul All Shares Index rose by 0.38%, closing at 11532.27 points; the Parallel Market Capped Index rose by 2.14%, closing at 27928.99 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

Saudi Arabia Refineries Co.: The daily gain is 9.8%, reports major profit increase in Q1 2025, reversing previous losses.

Saudi Arabia Refineries Co (Saudi Arabia Refineries Co.(2030.SA) ) is a publicly traded entity on the Saudi Stock Exchange (Tadawul) since 1993. Operating in the energy sector, it specializes in oil and gas refining and marketing. Headquartered in Jeddah, Saudi Arabia, SARCO was founded in 1960. The company plays a significant role in the kingdom's petroleum industry, contributing to its refining capacity and market distribution.

In a noteworthy development, the possible reason for the stock price increase of 2030.SA (Saudi Arabia Refineries Co.) may be its impressive financial turnaround. The company reported a net profit of 2.08 million Saudi Riyals in Q1 2025, compared to a loss of 599,000 Saudi Riyals in the same period of 2024. This significant improvement was attributed to increased investment income from associated companies and higher dividend income from fair value investments. Additionally, the company's total sales revenue surged by 2430% year-on-year to 6.75 million Saudi Riyals in Q1 2025. The 9.8% daily gain could also represent a short-term recovery within the context of the stock's 8.7% year-to-date decline.

Zamil Industrial Investment Co.: The daily gain is 7.7%, Top performer in Saudi market with strong financial results and high ranking.

Zamil Industrial Investment Co.(2240.SA) , trading as Zamil Indust, has been publicly listed on the Saudi Stock Exchange (Tadawul) since February 2002. The company, founded in September 1976 and headquartered in Dammam, Saudi Arabia, operates in the Materials sector with a focus on steel production. Zamil Indust plays a significant role in the industrial landscape of the Kingdom.

In a noteworthy development, the possible reason for the stock price increase of 2240.SA (Zamil Industrial Investment Co.) may be its strong market performance and financial health. The company ranks 2nd in Saudi Arabia's long-term strong stock list, boasting a high composite score of 95.07, including an impressive RPS score of 99.18. Operating in the materials sector, Zamil Industrial has maintained its top-tier position, potentially benefiting from increased demand in construction and industrial materials. The stock's inclusion in the TOP30 watchlist and its significant daily gain of 7.7%, coupled with a year-to-date increase of 46.5%, indicate robust investor confidence and positive momentum in the market.

ARTEX Industrial Investment Co.: The daily gain is 4.4%, Reports Q1 growth and signs asset sale deal.

ARTEX Industrial Investment Co.(2340.SA) , commonly referred to as Al Abdullatif, is a publicly traded company on the Saudi Stock Exchange (Tadawul) since 2007. The firm specializes in home furnishings within the Consumer Durables and Apparel sector. Headquartered in Riyadh, Saudi Arabia, the company was founded in 1981 and has since established itself as a significant player in the industry.

In a noteworthy development, the possible reason for the stock price increase of 2340.SA (ARTEX Industrial Investment Co.) may be attributed to several positive factors. The company recently announced a binding agreement to transfer a land lease contract and sell associated buildings and equipment for 41.31 million Saudi Riyals, as part of its asset restructuring plan. Additionally, ARTEX reported strong Q1 2025 financial results, with net profit surging 298.6% year-over-year to 5.7 million Saudi Riyals. Revenue also grew by 5.99% to 172.32 million Saudi Riyals, driven by increased sales volume and improved pricing. The company's successful turnaround from a loss in Q4 2024 to profitability in Q1 2025, coupled with improved operational efficiency, likely boosted investor confidence, contributing to the 4.4% stock price increase.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| 2030.SA | 0.99 | 9.8% | -8.7% |

| 2240.SA | 2.84 | 7.7% | 46.5% |

| 2340.SA | 1.09 | 4.4% | -15.9% |

| 4005.SA | 7.32 | 4.2% | -1.9% |

| 7203.SA | 83.4 | 4.0% | -3.8% |

| 4031.SA | 9.48 | 3.7% | -1.4% |

| 4017.SA | 10.74 | 3.6% | -30.3% |

| 1183.SA | 1.98 | 3.6% | 8.9% |

| 1835.SA | 1.55 | 3.5% | -8.7% |

| 6017.SA | 5.5 | 2.8% | -10.4% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.