Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | SHL Finance Co.: The daily gain is 4.8%, gains advantage from Saudi Arabia's new property policy, boosting its market position.

SHL 1183.SA | 17.60 | +0.06% |

CENOMI CENTERS 4321.SA | 19.13 | +0.53% |

CARE 4005.SA | 133.40 | -0.67% |

MUTAKAMELA 8040.SA | 11.67 | +0.78% |

ALYAMAMAH STEEL 1304.SA | 31.70 | +0.83% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

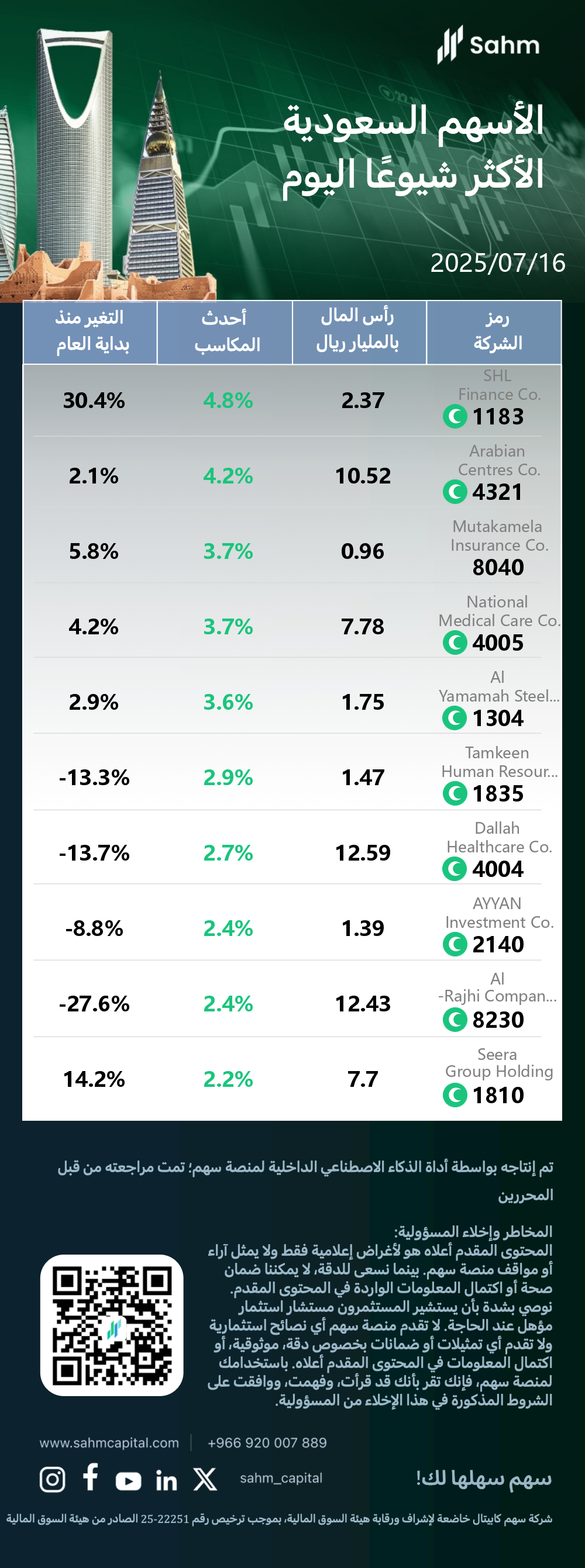

At the close of 16/07/2025, the Tadawul All Shares Index dropped by 0.51%, closing at 11038.74 points; the Parallel Market Capped Index rose by 0.16%, closing at 27345.08 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

SHL Finance Co.(1183.SA) : The daily gain is 4.8%, gains advantage from Saudi Arabia's new property policy, boosting its market position.

SHL Finance Co., operating under the ticker symbol SHL, has been publicly traded on the Saudi Stock Exchange (Tadawul) since April 2022. The company specializes in Mortgage Finance and REITs within the non-banking financial sector. Headquartered in Riyadh, Saudi Arabia, SHL was founded in December 2007 and has since established itself as a significant player in the regional financial market.

In a noteworthy development, the possible reason for the stock price increase of 1183.SA (SHL Finance Co.) may be attributed to several factors. The company's shares surged 4.8% following Saudi Arabia's announcement allowing foreigners to own property in designated areas. This policy change has boosted investor confidence in the real estate sector, benefiting SHL Finance Co., which specializes in mortgage financing. The firm's strong performance reflects optimism about increased demand for housing finance, with analysts expecting a rise in mortgage loans and project financing as real estate transactions grow. SHL Finance Co.'s focus on mortgage finance and REITs positions it well to capitalize on Saudi Arabia's booming property market. The stock's impressive 30.4% year-to-date growth and recent listing on the Saudi Stock Exchange (Tadawul) have attracted investor interest, as evidenced by an 857% increase in trading volume. These factors collectively contribute to the stock's upward trend and achievement of new 52-week highs.

Arabian Centres Co.(4321.SA) : The daily gain is 4.2%, plans to refinance debt, boosting investor confidence in the Saudi mall operator.

Arabian Centres Co, operating as CENOMI CENTERS, is a publicly traded entity on the Saudi Stock Exchange (Tadawul) since May 2019. The company specializes in Real Estate Management & Development Services within the Real Estate sector. Headquartered in Riyadh, Saudi Arabia, CENOMI CENTERS was founded in May 2005 and has established itself as a significant player in the regional real estate market.

In a noteworthy development, the possible reasons for the stock price increase of 4321.SA (Arabian Centres Co.) may be attributed to several factors. The company's shares surged 4.2% in the latest trading session, outperforming the broader market trend. This robust performance, coupled with a year-to-date gain of 2.1%, suggests growing investor confidence. The positive sentiment likely stems from Arabian Centres' proactive financial management, including its appointment of Rothschild & Co to refinance an $875 million sukuk due in 2026. Additionally, the company's plans to complete a USD-denominated refinancing in global debt markets by end-2025 and shareholder approval for issuing up to 3.75 billion Saudi riyals in Sharia-compliant sukuk have bolstered its financial outlook. As a leading shopping center developer in Saudi Arabia, the stock's performance may also reflect optimism in the Saudi real estate market.

National Medical Care Co.(4005.SA) : The daily gain is 3.7%, rises amid broader healthcare sector gains in the stock market.

National Medical Care, commonly referred to as Care, is a publicly traded company on the Saudi Stock Exchange (Tadawul) since March 2013. Operating in the Health Care Equipment and Services sector, Care specializes in Health Care Services. The company, founded in October 2003, is headquartered in Riyadh, Saudi Arabia.

In a noteworthy development, the possible reason for the stock price increase of 4005.SA (National Medical Care Co.) may be attributed to positive sector performance and strong financial results. The company's 3.7% daily gain and 4.2% year-to-date growth suggest investor confidence in the healthcare sector. This upward trend could be driven by Saudi Arabia's Vision 2030 plan, which emphasizes healthcare improvement. Additionally, increased demand for healthcare services and potential expansion plans may be contributing to investor optimism, bolstering the stock's performance in the Saudi market.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| SHL Finance Co.(1183.SA) | 2.37 | 4.8% | 30.4% |

| Arabian Centres Co.(4321.SA) | 10.52 | 4.2% | 2.1% |

| Mutakamela Insurance Co.(8040.SA) | 0.96 | 3.7% | 5.8% |

| National Medical Care Co.(4005.SA) | 7.78 | 3.7% | 4.2% |

| Al Yamamah Steel Industries Co.(1304.SA) | 1.75 | 3.6% | 2.9% |

| Tamkeen Human Resource Co.(1835.SA) | 1.47 | 2.9% | -13.3% |

| Dallah Healthcare Co.(4004.SA) | 12.59 | 2.7% | -13.7% |

| AYYAN Investment Co.(2140.SA) | 1.39 | 2.4% | -8.8% |

| Al-Rajhi Company for Cooperative Insurance(8230.SA) | 12.43 | 2.4% | -27.6% |

| Seera Group Holding(1810.SA) | 7.7 | 2.2% | 14.2% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.