Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | SHL Finance Co.: The daily gain is 5.2%, benefits from Saudi Arabia's booming real estate market, showing strong growth.

SHL 1183.SA | 17.60 | +0.06% |

TECO 4170.SA | 11.88 | -0.67% |

ADVANCED 2330.SA | 28.74 | -1.30% |

TASHEEL 4083.SA | 157.90 | +0.13% |

ALMOOSA 4018.SA | 163.30 | -0.24% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

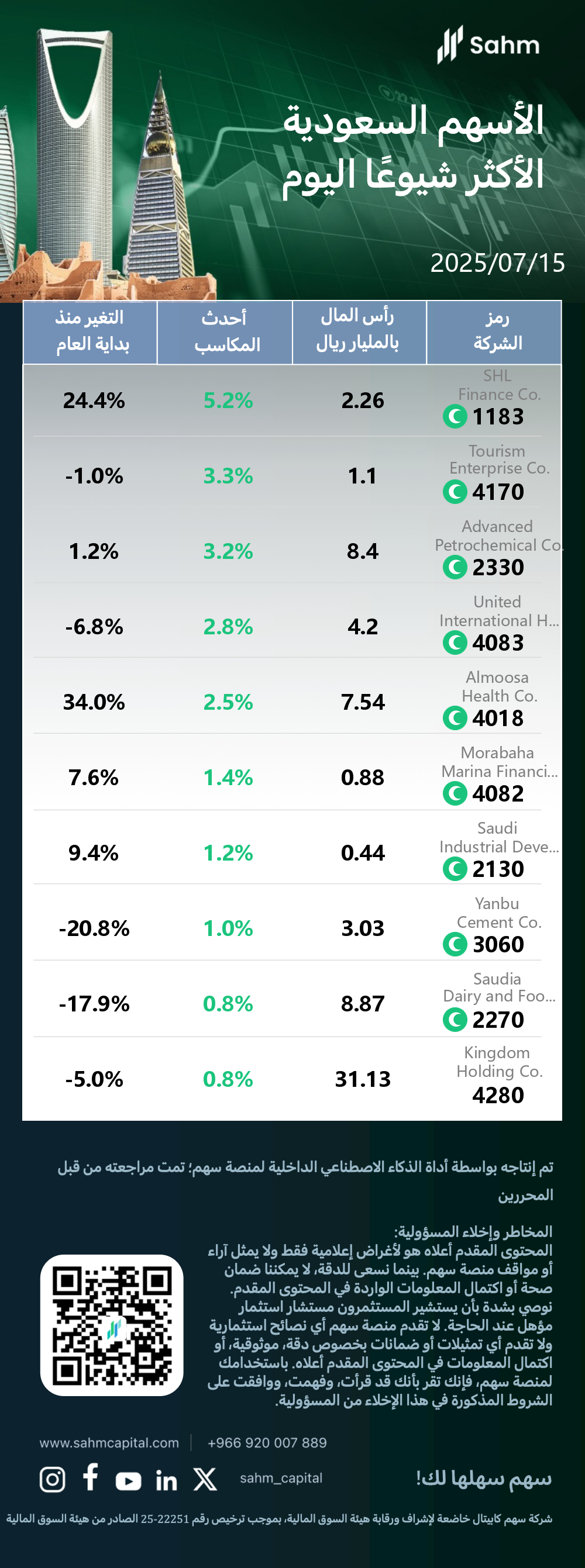

At the close of 15/07/2025, the Tadawul All Shares Index dropped by 1.05%, closing at 11095.41 points; the Parallel Market Capped Index dropped by 0.2%, closing at 27301.46 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

SHL Finance Co.(1183.SA) : The daily gain is 5.2%, benefits from Saudi Arabia's booming real estate market, showing strong growth.

SHL Finance Co., operating under the ticker symbol SHL, has been publicly traded on the Saudi Stock Exchange (Tadawul) since April 2022. The company specializes in mortgage finance and REITs within the non-bank financial sector. Headquartered in Riyadh, Saudi Arabia, SHL was founded in December 2007 and has since established itself as a significant player in the regional financial market.

In a noteworthy development, the possible reason for the stock price increase of 1183.SA (SHL Finance Co.) may be its strong market performance and strategic positioning in the Saudi real estate sector. The company's shares surged 5.2% today, bringing its year-to-date gain to an impressive 24.4%. As a specialist in mortgage finance and REITs, SHL Finance Co. is well-positioned to benefit from the burgeoning Saudi real estate market. Analysts anticipate increased demand for mortgage and project financing services as property transactions rise. The company's robust performance reflects investor optimism towards Saudi Arabia's real estate and financial sectors. With a market capitalization of 1.93 billion Saudi Riyals, SHL Finance Co. maintains a significant market presence since its listing on the Saudi Stock Exchange (Tadawul) in April 2022.

Tourism Enterprise Co.(4170.SA) : The daily gain is 3.3%, Saudi firm gains as tourism sector outlook improves amid economic reforms.

Tourism Enterprises (TECO) is a publicly traded company on the Saudi Stock Exchange (Tadawul) since 1999. Operating in the Consumer Services sector, it specializes in Hotels, Resorts and Cruise Lines. Headquartered in Dammam, Saudi Arabia, TECO was founded in 1991. The company's shares are traded under the ticker symbol TECO on the Tadawul exchange.

In a noteworthy development, the possible reason for the stock price increase of 4170.SA (Tourism Enterprise Co.) may be attributed to a combination of factors. The 3.3% daily gain could reflect improving sentiment in the Saudi tourism sector, as the company's focus on hotels, resorts, and cruise lines aligns with potential growth expectations. Seasonal trends in tourism demand might also be playing a role. Additionally, the uptick may represent a partial recovery from the year-to-date decline of 1.0%, suggesting investors see value at current levels. Market-wide positive momentum or specific company developments, though unconfirmed, could further explain the stock's performance.

Advanced Petrochemical Co.(2330.SA) : The daily gain is 3.2%, expands operations and reports increased profits in latest financial results.

Advanced Petrochemical, a publicly traded company on the Saudi Stock Exchange since 2007, operates in the Materials sector with a focus on Commodity Chemicals. Established in 2005 and headquartered in Jubail, Saudi Arabia, the firm has maintained a significant presence in the petrochemical industry. Its listing on Tadawul has provided investors with exposure to the growing Saudi chemical sector.

In a noteworthy development, the possible reason for the stock price increase of 2330.SA (Advanced Petrochemical Co.) may be attributed to several positive factors. The company has successfully completed and commenced operations of a Propane Dehydrogenation (PDH) plant and two Polypropylene (PP) plants in Jubail Industrial City. The PDH plant boasts an annual design capacity of 843,000 tons of propylene, while the PP plants have a combined capacity of 800,000 tons per year. This expansion is likely to boost production output and potential revenue. Additionally, Advanced Petrochemical reported improved financial performance, with Q2 2023 net profit rising to 82 million Saudi Riyals from 42 million in the same period last year. The company's strategic joint venture, Advanced Polyolefins Industry Co., and its substantial investment of 7.05 billion Saudi Riyals in the new integrated complex further underscore its growth prospects.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| SHL Finance Co.(1183.SA) | 2.26 | 5.2% | 24.4% |

| Tourism Enterprise Co.(4170.SA) | 1.1 | 3.3% | -1.0% |

| Advanced Petrochemical Co.(2330.SA) | 8.4 | 3.2% | 1.2% |

| United International Holding Co.(4083.SA) | 4.2 | 2.8% | -6.8% |

| Almoosa Health Co.(4018.SA) | 7.54 | 2.5% | 34.0% |

| Morabaha Marina Financing Co.(4082.SA) | 0.88 | 1.4% | 7.6% |

| Saudi Industrial Development Co.(2130.SA) | 0.44 | 1.2% | 9.4% |

| Yanbu Cement Co.(3060.SA) | 3.03 | 1.0% | -20.8% |

| Saudia Dairy and Foodstuff Co.(2270.SA) | 8.87 | 0.8% | -17.9% |

| Kingdom Holding Co.(4280.SA) | 31.13 | 0.8% | -5.0% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.