Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Sport Clubs Co.: The Daily Gain Is 18.6%, IPO Oversubscribed Due to High Investor Interest, Signaling Strong Market Demand

SPORT CLUBS 6018.SA | 8.70 | -0.57% |

MESC 2370.SA | 22.50 | +0.72% |

TECO 4170.SA | 11.88 | -0.67% |

MAADANIYAH 2220.SA | 13.68 | +0.29% |

ETIHAD ETISALAT 7020.SA | 64.60 | -0.69% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

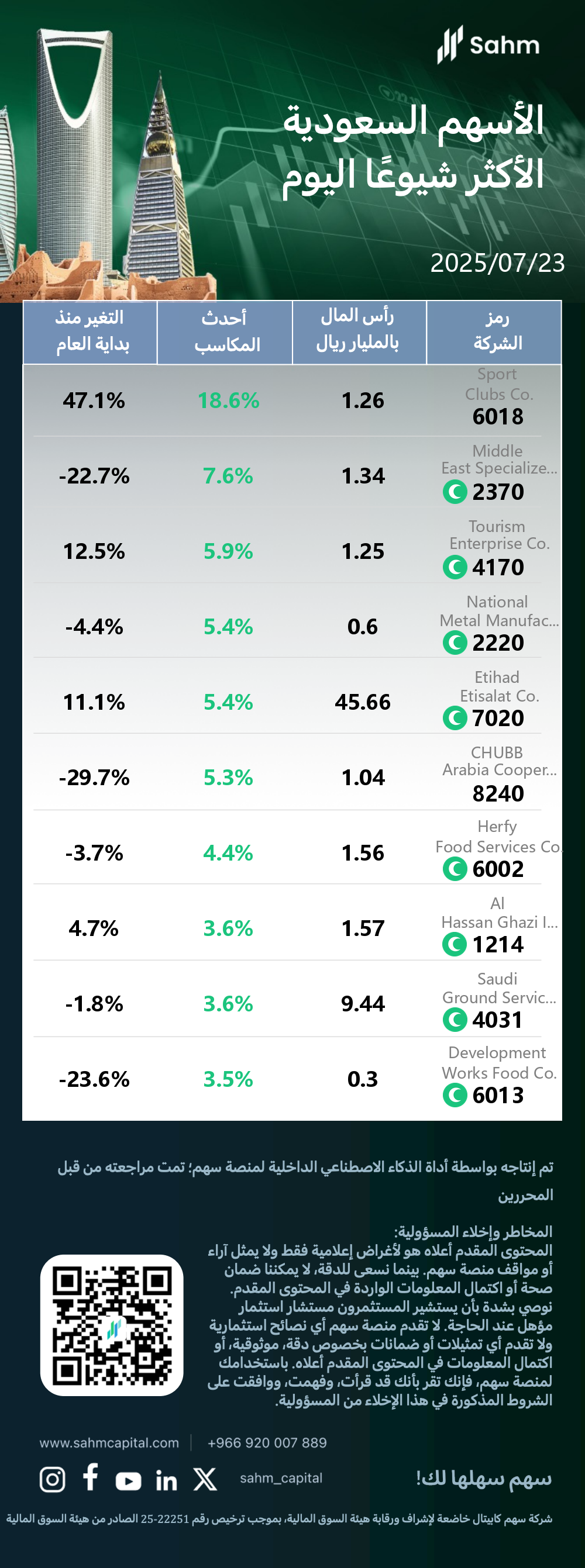

At the close of 23/07/2025, the Tadawul All Shares Index rose by 1.3%, closing at 10983.93 points; the Parallel Market Capped Index rose by 0.14%, closing at 26778.15 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

The Top 10 Daily Gainers in the KSA market are listed as follows:

Sport Clubs Co.: The daily gain is 18.6%, IPO oversubscribed due to high investor interest, signaling strong market demand.

In a noteworthy development, the possible reason for the stock price increase of 6018.SA (Sport Clubs Co.) may be the strong investor demand demonstrated during its recent initial public offering (IPO). The retail portion was 5.3 times oversubscribed, while the institutional tranche attracted an impressive 44.1 times oversubscription. This high level of interest led to the IPO being priced at 7.5 Saudi riyals per share, at the top end of the proposed range. The company's market-leading position in Saudi Arabia's fitness industry, with 56 fitness centers and three decades of experience, likely contributed to investor enthusiasm. Additionally, Sport Clubs Co.'s ambitious expansion plans, including opening at least 50 new branches in the next five years, may have fueled positive sentiment. The limited float of only 30% of the company's shares could also be driving up demand due to scarcity.

Middle East Specialized Cables Co.: The daily gain is 7.6%, secures major financing to boost operations and expand market presence.

Middle East Specialized Cables (Mesc) is a publicly traded company on the Saudi Stock Exchange (Tadawul) since 2007. It operates in the Capital Goods sector, specializing in Electrical Components and Equipment. Headquartered in Riyadh, Saudi Arabia, Mesc was founded in 1992 and has established itself as a significant player in the industry.

In a noteworthy development, the possible reason for the stock price increase of 2370.SA (Middle East Specialized Cables Co.) may be the recent financing agreements secured by the company. The firm's subsidiary signed a bank financing agreement for 120 million dirhams, while the parent company renewed a financing agreement with Alrajhi Bank for 150 million Saudi riyals. These agreements, aimed at supporting working capital, issuing bank guarantees, and funding capital expenditures, have likely boosted investor confidence. Despite the stock's 22.7% year-to-date decline, today's 7.6% surge suggests a positive market reaction to the company's improved financial flexibility and potential for operational growth.

Tourism Enterprise Co.: The daily gain is 5.9%, Volume up, revenue grows. Share consolidation planned. Positive outlook for company.

Tourism Enterprises (TECO) operates in the Consumer Services sector, specializing in Hotels, Resorts and Cruise Lines. Established in July 1991 and headquartered in Dammam, Saudi Arabia, TECO has been publicly traded on the Saudi Stock Exchange "Tadawul" (TDWL) since October 1999. The company's primary focus is on providing hospitality services within the tourism industry.

In a noteworthy development, the possible reasons for the stock price increase of 4170.SA (Tourism Enterprise Co.) may be attributed to several factors. The company's shares surged 5.9% in a single day, contributing to a year-to-date gain of 12.5%. This impressive performance has likely caught investors' attention. Additionally, the stock experienced a significant spike in trading volume, with 151,165,215 shares changing hands, marking a 422.40% increase over the 3-month average. The company's inclusion as the second-highest stock on a "significant volume increase" list further amplified market interest. Despite reporting a Q2 net loss, Tourism Enterprise Co. saw a 20.4% revenue growth to 3.47 million Saudi Riyals, potentially signaling operational improvements. The firm's planned share consolidation to maintain its listing status and boost its share price above the 3 Saudi Riyal minimum requirement may have also fueled investor optimism. With a market capitalization of 1.18 billion Saudi Riyals, the company appears to be attracting attention in the tourism sector.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| Sport Clubs Co.(6018.SA) | 1.26 | 18.6% | 47.1% |

| Middle East Specialized Cables Co.(2370.SA) | 1.34 | 7.6% | -22.7% |

| Tourism Enterprise Co.(4170.SA) | 1.25 | 5.9% | 12.5% |

| National Metal Manufacturing and Casting Co.(2220.SA) | 0.6 | 5.4% | -4.4% |

| Etihad Etisalat Co.(7020.SA) | 45.66 | 5.4% | 11.1% |

| CHUBB Arabia Cooperative Insurance Co.(8240.SA) | 1.04 | 5.3% | -29.7% |

| Herfy Food Services Co.(6002.SA) | 1.56 | 4.4% | -3.7% |

| Al Hassan Ghazi Ibrahim Shaker Co.(1214.SA) | 1.57 | 3.6% | 4.7% |

| Saudi Ground Services Co.(4031.SA) | 9.44 | 3.6% | -1.8% |

| Development Works Food Co.(6013.SA) | 0.3 | 3.5% | -23.6% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.