Please use a PC Browser to access Register-Tadawul

Day's Trending Saudi Stocks | Thimar Development Holding Co.: The daily gain is 5.8%, Saudi food distributor sees high trading volume and strong investor interest.

THIMAR 4160.SA | 38.54 | -1.48% |

AYYAN 2140.SA | 12.99 | +0.46% |

RAYDAN 6012.SA | 25.54 | -3.48% |

MIS 7200.SA | 154.10 | -1.09% |

TAIBA 4090.SA | 32.30 | -1.16% |

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market, aiding investors in promptly identifying opportunities for potential gains.

At the close of 11/09/2025, the Tadawul All Shares Index dropped by 0.43%, closing at 10453.06 points; the Parallel Market Capped Index dropped by 0.2%, closing at 25026.22 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

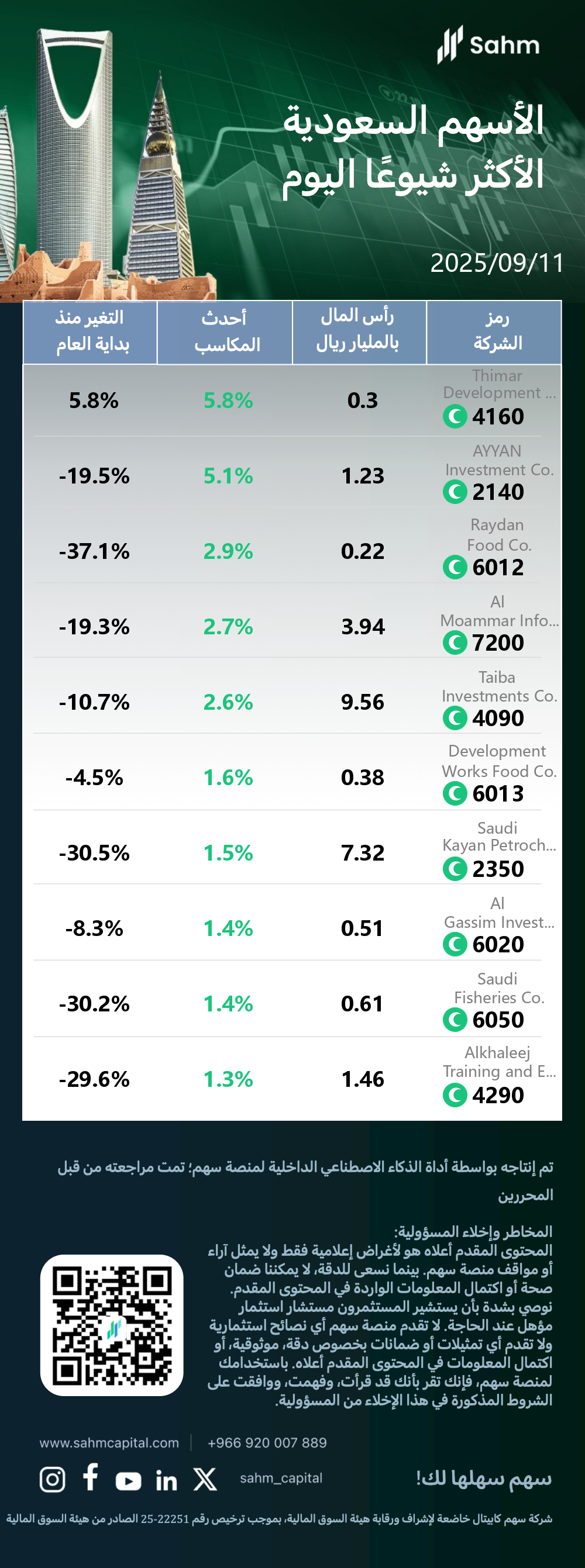

The Top 10 Daily Gainers in the KSA market are listed as follows:

Thimar Development Holding Co.: The daily gain is 5.8%, Saudi food distributor sees high trading volume and strong investor interest.

Thimar Development Holding Co. (THIMAR) is a publicly traded entity on the Saudi Stock Exchange (Tadawul) since 1996. Operating in the Food and Staples Retailing sector, it specializes in food distribution. Headquartered in Riyadh, Saudi Arabia, THIMAR was founded in 1988. The company plays a significant role in the Kingdom's food distribution industry.

In a noteworthy development, the possible reason for the stock price increase of 4160.SA (Thimar Development Holding Co.) may be attributed to a confluence of factors. The Saudi food distributor's shares surged 5.8% in a single trading session, propelling its year-to-date gains to 5.8%. This performance ranks the stock third in monthly gains among Saudi Arabian equities, signaling robust investor confidence. The company's trading volume spiked 106.90% above its three-month average, reaching 914,950 shares, indicating heightened market interest. As a small-cap stock with a market capitalization of 370 million Saudi Riyals, Thimar's shares are prone to significant price fluctuations, potentially attracting speculative investors seeking rapid gains.

Al Moammar Information Systems Co.: The daily gain is 2.7%, wins significant contract and declares dividend payout to shareholders.

MIS, a publicly traded company on the Saudi Stock Exchange since 2019, specializes in software services within the IT sector. Founded in 1979 and headquartered in Riyadh, Saudi Arabia, the firm has established itself as a key player in the regional technology landscape. MIS's listing on Tadawul underscores its significant market presence and growth potential in the evolving Saudi IT industry.

In a noteworthy development, the possible reason for the stock price increase of 7200.SA (Al Moammar Information Systems Co.) may be attributed to several factors. The company recently secured a significant contract worth 227.8 million Saudi Riyals with the Saudi Data and Artificial Intelligence Authority (SDAIA) for expanding the Naqaa data center in Riyadh. Additionally, MIS announced a cash dividend distribution scheduled between September 7th and 11th, potentially attracting income-seeking investors. The stock also experienced a substantial 77.05% increase in trading volume compared to its 3-month average, indicating renewed investor interest. Despite a 19.3% year-to-date decline, today's 2.7% gain could represent a technical rebound as the market reassesses the company's value in light of these positive developments.

Taiba Investments Co.: The daily gain is 2.6%, secures 425M SAR Murabaha financing for expansion and development projects.

Taiba Investments Co, operating under the ticker TAIBA, has been publicly traded on the Saudi Stock Exchange (Tadawul) since 1993. The company, founded in 1988 and headquartered in Medina, Saudi Arabia, specializes in diversified real estate activities within the broader real estate sector. TAIBA's business model encompasses various property-related operations and investments.

In a noteworthy development, the possible reason for the stock price increase of 4090.SA (Taiba Investments Co.) may be the company's recent acquisition of Sharia-compliant Murabaha financing worth 425 million Saudi Riyals. This substantial funding could bolster the firm's real estate operations and expansion plans, potentially improving its market position. The 2.6% stock price rise today may reflect positive investor sentiment towards this new financing, despite the stock's 10.7% year-to-date decline. This uptick could signal a partial recovery and renewed investor confidence in Taiba Investments' growth prospects within the Saudi Arabian real estate sector.

Company Symbol | Capital (Billion Riyals) | Latest Gains | Change since the Beginning of the Year |

| Thimar Development Holding Co.(4160.SA) | 0.3 | 5.8% | 5.8% |

| AYYAN Investment Co.(2140.SA) | 1.23 | 5.1% | -19.5% |

| Raydan Food Co.(6012.SA) | 0.22 | 2.9% | -37.1% |

| Al Moammar Information Systems Co.(7200.SA) | 3.94 | 2.7% | -19.3% |

| Taiba Investments Co.(4090.SA) | 9.56 | 2.6% | -10.7% |

| Development Works Food Co.(6013.SA) | 0.38 | 1.6% | -4.5% |

| Saudi Kayan Petrochemical Co.(2350.SA) | 7.32 | 1.5% | -30.5% |

| Al Gassim Investment Holding Co.(6020.SA) | 0.51 | 1.4% | -8.3% |

| Saudi Fisheries Co.(6050.SA) | 0.61 | 1.4% | -30.2% |

| Alkhaleej Training and Education Co.(4290.SA) | 1.46 | 1.3% | -29.6% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.