Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | Cantor Equity Partners Inc. Ordinary Shares - Class A: Overnight Gain 55.4%, SPAC Merger Anticipation Drives Stock Surge Amid Market Optimism

Cantor Equity Partners Inc. Ordinary Shares - Class A CEP | 14.27 | 0.00% |

EPWK Holdings Ltd. EPWK | 1.21 | +6.14% |

Pony AI Inc. PONY | 14.32 | -5.60% |

Healthcare Services Group, Inc. HCSG | 19.37 | -0.21% |

Pegasystems Inc. PEGA | 59.63 | -2.93% |

Editor's Note: the "Trending USA Stocks" column tracks the day's top bullish stocks in the USA market, aiding investors in promptly identifying opportunities for potential gains.

23/04/2025 Eastern Time in USA The Dow Jones Industrial Average rose by 1.07%, closing at 39606.57 points; the Nasdaq Composite rose by 2.5%, closing at 16708.05 points; the S&P 500 Index rose by 1.67%, closing at 5375.86 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

Cantor Equity Partners Inc. Ordinary Shares - Class A: Overnight gain 55.4%, SPAC Merger Anticipation Drives Stock Surge Amid Market Optimism

Cantor Equity Partners, Inc. (CEPI), a special purpose acquisition company (SPAC), was incorporated as an exempted company in the Cayman Islands on November 11, 2020. The firm's primary objective is to identify and execute a business combination with one or more target enterprises. The company is exploring various transaction structures, including mergers, share exchanges, asset acquisitions, stock purchases, reorganizations, or other similar business combinations. As a blank check company, CEPI aims to create shareholder value through these strategic transactions. CEPI's management team is actively seeking potential targets across diverse sectors, leveraging their extensive network and industry expertise to identify promising opportunities. The SPAC's focus remains on completing a business combination that aligns with its investment criteria and offers significant growth potential for investors. As with all SPACs, investors should note that CEPI has a limited time frame to complete a business combination or face the possibility of returning funds to shareholders. The company's progress in identifying and pursuing potential targets will be closely monitored by market participants in the coming months.

Cantor Equity Partners Inc. Ordinary Shares - Class A (CEP) experienced a significant surge in stock price, primarily attributed to its status as a Special Purpose Acquisition Company (SPAC). The blank check company's primary objective of identifying merger opportunities has fueled market speculation. The overnight jump of 55.4% and year-to-date increase of 58.8% suggest strong investor anticipation of an imminent major acquisition announcement or completion. Market participants believe CEP has identified an attractive merger target, driving the substantial price appreciation. Additionally, shifts in overall SPAC market sentiment have contributed to CEP's stock performance. As a SPAC, CEP's value is largely tied to its potential for executing a successful business combination, making it susceptible to speculative trading based on merger expectations.

EPWK Holdings Ltd.: Overnight gain 50.6%, Unique e-commerce model and growth potential drive investor enthusiasm for newly listed stock.

EPWK Holdings Ltd., incorporated in March 2022 as a Cayman Islands exempted company with limited liability, operates a leading creative e-commerce platform catering to small and medium-sized enterprises (SMEs) and service providers in China. The company aims to establish itself as a dominant player in the non-physical product transaction sector. The platform is designed to offer convenient and professional services to businesses while creating low-carbon, flexible work opportunities for service providers. EPWK Holdings is committed to building a trusted network that connects SMEs with skilled knowledge workers through the optimization of its platform ecosystem, exploration of innovative business models, and implementation of precise recommendation technologies. Looking ahead, the company plans to develop an industry ecosystem centered around creative services. This strategic initiative underscores EPWK Holdings' commitment to fostering a comprehensive marketplace for non-tangible products and services, potentially positioning the firm for sustained growth in the evolving digital economy. As the company continues to expand its operations and enhance its platform capabilities, investors may want to closely monitor its performance metrics and market penetration strategies in the competitive Chinese e-commerce landscape.

EPWK Holdings Ltd. (EPWK) has experienced a notable surge in stock price, driven by multiple factors. The company's unique business model as an e-commerce platform specializing in non-physical product transactions has garnered significant investor attention. EPWK's focus on China's vast small and medium-sized enterprise market presents substantial growth potential. The company's advanced task recommendation engine technology enhances platform efficiency, aligning with the growing trends of remote work and online services. Investors have also responded positively to EPWK's plans to develop a creative product industry ecosystem. As a newly listed entity, EPWK has attracted considerable interest, with its strong short-term performance fueling investor enthusiasm and contributing to the substantial stock price appreciation.

Pony AI Inc.: Overnight gain 30.5%, Autonomous driving firm rebounds on tech sector optimism and business progress

Pony AI Inc., a Cayman Islands-incorporated artificial intelligence company specializing in autonomous driving technology, was founded in 2016. The company operates across both China and the United States, primarily through its subsidiaries and Variable Interest Entity (VIE) structure. Over years of research and development, Pony AI has established three core business segments centered around its proprietary "virtual driver" technology: autonomous ride-hailing services, autonomous trucking, and intelligent driving solutions for passenger vehicles. The company is committed to commercializing autonomous driving technology by launching production-ready products and innovative partnership models. This strategic approach aims to bridge the gap between technological concepts and practical applications in the autonomous vehicle industry. Pony AI's multi-faceted business model and international presence position it as a notable player in the rapidly evolving autonomous driving sector, as it seeks to transform cutting-edge technology into viable commercial solutions across multiple transportation segments.

Pony AI Inc. (PONY) experienced a significant stock price surge, driven by multiple factors. The stock's overnight jump of 30.5% represents a technical rebound following a substantial year-to-date decline of 62.2%. As a leading autonomous driving technology company, Pony AI benefits from optimistic market expectations for the industry's future. Furthermore, the company's positive developments in core business areas, such as new product launches or strategic partnerships, have bolstered investor confidence. The overall improvement in market sentiment, particularly towards tech stocks, has also contributed to the price increase. This rally underscores the volatile nature of the autonomous driving sector and highlights the potential for rapid value shifts based on market perception and company performance.

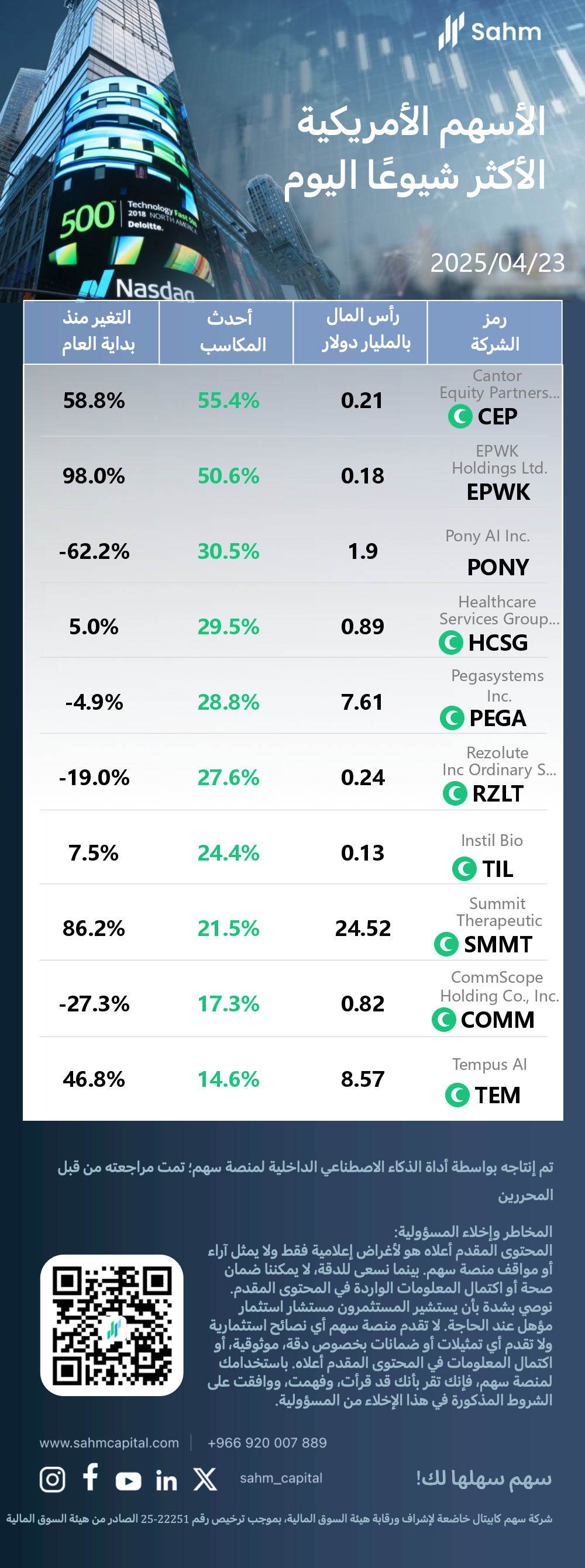

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

| Cantor Equity Partners Inc. Ordinary Shares - Class A(CEP.US) | 0.21 | 55.4% | 58.8% |

| EPWK Holdings Ltd.(EPWK.US) | 0.18 | 50.6% | 98.0% |

| Pony AI Inc.(PONY.US) | 1.9 | 30.5% | -62.2% |

| Healthcare Services Group, Inc.(HCSG.US) | 0.89 | 29.5% | 5.0% |

| Pegasystems Inc.(PEGA.US) | 7.61 | 28.8% | -4.9% |

| Rezolute Inc Ordinary Shares(RZLT.US) | 0.24 | 27.6% | -19.0% |

| Instil Bio(TIL.US) | 0.13 | 24.4% | 7.5% |

| Summit Therapeutic(SMMT.US) | 24.52 | 21.5% | 86.2% |

| CommScope Holding Co., Inc.(COMM.US) | 0.82 | 17.3% | -27.3% |

| Tempus AI(TEM.US) | 8.57 | 14.6% | 46.8% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.