Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | Cheetah Net Supply Chain Service Inc: Overnight gain 437.8%, Stock Rises on Diverse Positive Business and Market Factors

Cheetah Net Supply Chain Service Inc. CTNT | 1.32 | -5.04% |

MMTec, Inc. MTC | 2.93 | -0.68% |

GameStop Corp. Class A GME | 23.03 | +3.37% |

Sunpower Corp Ordinary Shares SPWR | 1.70 | +1.19% |

Maxeon Solar Technologies, Ltd. MAXN | 3.24 | -2.11% |

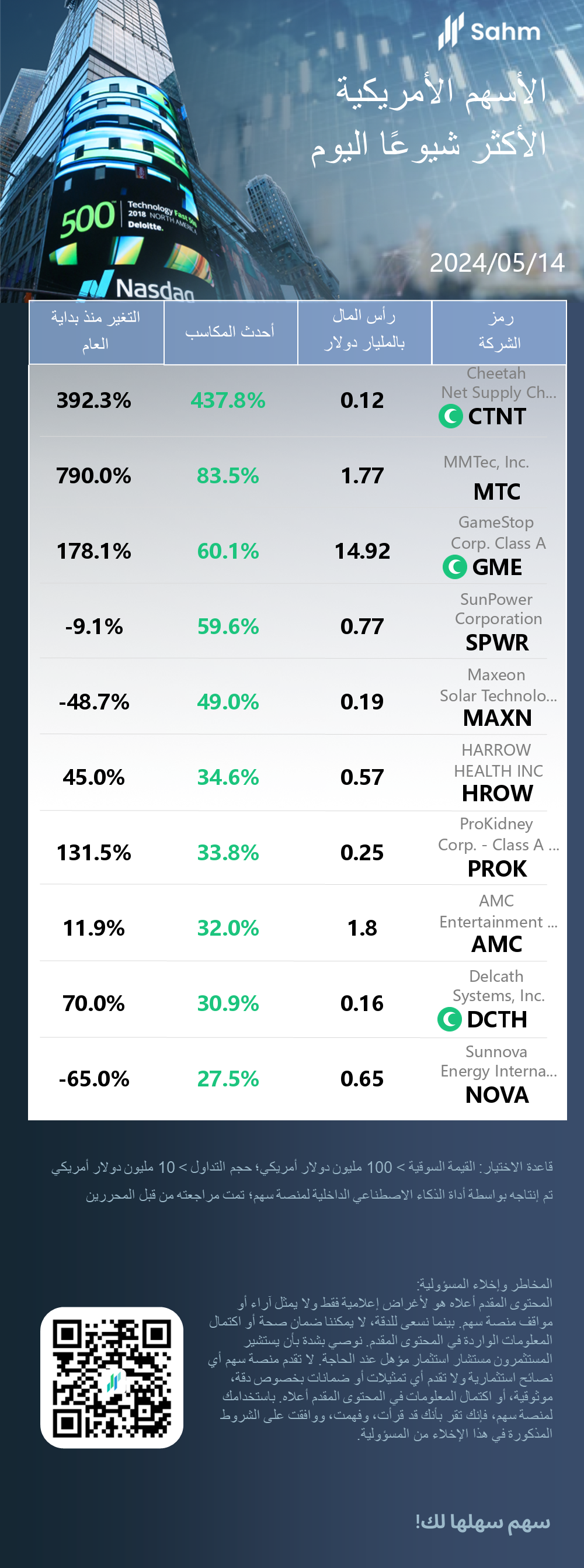

14/05/2024 Eastern Time in USA The Dow Jones Industrial Average rose by 0.32%, closing at 39558.11 points; the Nasdaq Composite rose by 0.75%, closing at 16511.18 points; the S&P 500 Index rose by 0.48%, closing at 5246.68 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

1、Cheetah Net Supply Chain Service Inc.: Overnight gain 437.8%, Stock Rises on Diverse Positive Business and Market Factors

Cheetah Net Supply Chain Service Inc., established on August 9, 2016, and registered under the laws of North Carolina, USA, is a supplier specializing in the parallel import of vehicles. The company focuses on the procurement of luxury automotive brands from the US market, including Mercedes-Benz, BMW, Porsche, Lexus, and Bentley, for resale in the Chinese market. Cheetah Net operates by directly importing vehicles from overseas markets, circumventing the official distribution systems of the brand manufacturers. It then resells these vehicles to parallel import car dealers in both the United States and China. The company's primary source of profit is derived from the price differentials in the buying and selling of vehicles.

It is noteworthy that the share price of Cheetah Net Supply Chain Service Inc. (CTNT) has recently witnessed a significant uptick, an occurrence that may be attributable to a confluence of factors. Primarily, the company's successful capital raise through a follow-on public offering underscores market confidence in its growth trajectory, drawing in new investors. Additionally, CTNT's core business in the procurement and sales of luxury brand automobiles stands to benefit from a buoyant parallel import vehicle market, where increased demand could directly bolster the company's revenue and profit margins.Further contributing factors include improved trade relations between China and the United States, potentially cutting import costs and enhancing CTNT's competitive edge in the market. Operational efficiency gains and strategic planning optimizations may also have provided impetus for the stock's appreciation. Lastly, a broadly positive market sentiment is likely to exert a favorable impact on the share price.In sum, these elements collectively underpin the rising trend observed in the stock price of Cheetah Net Supply Chain Service Inc. (CTNT).

2、MMTec, Inc.: Overnight gain 83.5%, Stock Surge Attributed to Tech Innovation, Team Expertise, and Strategic Expansion

MMTec, Inc., a financial technology firm specializing in securities market infrastructure and trading services, has announced the establishment of Haichuan Securities Limited on January 4, 2018. The company, which is registered in the British Virgin Islands, leverages its proprietary ETN technology and a U.S. internet-based brokerage platform to offer comprehensive overseas asset management services.Boasting a team with over a decade of experience in the internet and securities industries, Haichuan Securities personnel have previously held positions at well-known companies such as Baidu and Sohu, underscoring their deep industry expertise.Notably, MMTec's subsidiary, Mei Mei Securities, stands out as the first company from Mainland China to wholly own a U.S. broker-dealer license. This strategic move has allowed Mei Mei Securities to acquire a venerable U.S. securities firm with an 81-year legacy. The company's operational footprint spans Beijing, New York, and Shanghai, where it has established professional teams that bring together local insights and cross-cultural competencies.MMTec, Inc. has successfully garnered early-stage investments worth tens of millions of yuan from multiple renowned institutions, positioning itself as a leading player in the international asset management service sector.

MMTec, Inc. (MTC) has observed a notable uptick in its stock price, which can be attributed to the company's proactive performance across various fronts including technological innovation, team building expertise, market expansion strategies, financing capacity, and alignment with industry trends. Specifically, MMTec, Inc. has potentially carved out a strong competitive edge in the market with its proprietary ETN technology and turnkey overseas asset management services, garnering keen investor attention. Additionally, the company's team boasts significant experience in the internet and securities sectors, and potential management reshuffles and team accomplishments have heightened market expectations for its growth trajectory.Strategically, MMTec, Inc.'s vision and execution in market expansion and resource integration, particularly highlighted by its acquisition of a historic U.S. securities firm, indicate a global approach to business operations. The company's early-stage investments from renowned institutions, coupled with potentially positive financing news in the market, have bolstered investor confidence. Moreover, an upward trend in the internet brokerage industry or company earnings reports that exceed market forecasts could directly spur substantial stock price increases.Lastly, the impact of market sentiment should not be underestimated. An optimistic overall mood in the U.S. internet brokerage sector could trigger trend-following buy-ins from investors, further propelling the stock price. When these factors are combined, they may lead to a significant rise in the stock value of MMTec, Inc. (MTC).

3、GameStop Corp. Class A: Overnight gain 60.1%, Stock Rises on New Business Ventures and Market Sentiment

Founded in 1996, GameStop Corp., a global leader in the video game retail industry, offers an extensive portfolio of products and services. The company's business encompasses a wide array of offerings, including new and pre-owned video game hardware, physical and digital video game software, gaming accessories, computer entertainment software, pre-owned mobile devices, and other consumer electronics. GameStop Corp. continues to evolve its business model to meet the changing demands of the gaming market and consumer electronics space.

In recent financial news, a noteworthy development is the surge in GameStop Corp. Class A (GME) share prices, which appears to be fueled by a combination of the company's strategic expansion and prevailing market sentiment. GameStop announced its foray into the niche market of acquiring and selling rare Pokémon trading cards, a venture that is anticipated to carve out new avenues for growth and has sparked optimistic expectations for the company's future trajectory among investors.Furthermore, a resurgence of activity on the social media platforms of Keith Gill, also known as "Roaring Kitty," a recognized leader among retail investors, has reignited enthusiasm within the retail community. His bullish commentary on the stock has once again kindled a collective buying fervor among retail investors. This sentiment, coupled with robust capital inflows, has jointly contributed to a significant uptick in the company's stock value.Additionally, heightened activity in the options market for GameStop, particularly a surge in open interest for call options, underscores traders' strong anticipation of further stock appreciation. Since becoming a focal point of the "meme stock" phenomenon in 2021, GameStop has experienced significant stock price volatility influenced by pop culture trends and the sway of social media within the stock market.

4、SunPower Corporation: Overnight gain 59.6%, Stock Rises on Trade Policies, Market Support, and Influencer Activity

SunPower Corporation, a vertically integrated enterprise dedicated to solar energy products and solutions, operates globally and specializes in the design, production, and sales of high-efficiency solar systems. The company offers comprehensive services to residential, commercial, and utility-scale power plant customers, priding itself on the leading conversion efficiency of its solar cells within the industry. Established in 1985, SunPower was initially registered in California before relocating its registration to Delaware in 2005. The company went public in November 2011.

In a noteworthy development for the solar energy sector, U.S.-based SunPower Corporation (NASDAQ:SPWR) has seen a significant uptick in its stock price, driven by a confluence of factors. Initially, the imposition of tariffs on Chinese solar panels by the Biden administration signals an anticipated increase in domestic demand for solar products, potentially giving SunPower and other U.S. suppliers a competitive edge in the market. Additionally, the resurgence of famed trader Keith Gill, also known as "Roaring Kitty," on social media platforms has reignited interest in stocks with high short interest rates, including shares of SunPower Corporation (SPWR).Furthermore, the rising sentiment in favor of the renewable energy sector, coupled with SunPower's technological edge over competitors, may have contributed to the bullish trend in its stock value. Market data indicates that SunPower Corporation (SPWR) has a relatively high short interest in its floating shares, suggesting a certain level of bearish expectations among investors. However, the recent increase in its share price could potentially trigger a short squeeze, exerting further upward pressure on the stock. Taken together, these elements paint a robust upward trajectory for SunPower Corporation (SPWR)'s share performance.

5、Maxeon Solar Technologies, Ltd. : Overnight gain 49.0%

Maxeon Solar Technologies, Ltd., established on October 11, 2019, is strategically positioned to drive the investment of TZS into the international operations of SunPower Technologies. Headquartered in Singapore, this global energy company is not only at the forefront of technological innovation but also dedicated to the production and distribution of advanced solar panels. With manufacturing facilities for solar cells and panels located in France, Malaysia, Mexico, and the Philippines, Maxeon Solar Technologies is reinforcing its presence in the renewable energy sector on a global scale.

Shares of Maxeon Solar Technologies, Ltd. (MAXN) have recently experienced a notable surge, a trend that may be closely tied to the U.S. government's plans to impose tariffs on Chinese solar products. As Maxeon Solar Technologies is headquartered in Singapore with manufacturing facilities spread globally, the company's operations and supply chain are likely to remain unaffected by the new tariff policy directly. Conversely, this development could potentially enhance Maxeon's competitive edge in the U.S. market as Chinese competitors face the burden of tariffs, possibly rendering Maxeon's products more price-competitive.Furthermore, there appears to be a growing market interest in non-Chinese solar companies, and the policy announcement exempting certain solar panel component production machinery from tariffs may also have bolstered investor confidence in Maxeon as a manufacturer of solar panels. Collectively, these factors may provide favorable support for the upward momentum in Maxeon's stock price.

6、HARROW HEALTH INC: Overnight gain 34.6%, Stock Rises on Strong Quarterly Performance, Strategic Market Positioning, and Investor Interest.

Harrow Health Inc., established in January 2006 with its headquarters domiciled in Delaware, initially operated under the name Bywater Resources Company with a primary focus on mineral development. On September 11, 2007, the company underwent a rebranding to Transdel Pharmaceuticals, before adopting its current name, Harrow Health, on December 13, 2018. The company has since pivoted to specialize in the ophthalmic sector, dedicating its efforts to the research, development, manufacture, and commercialization of innovative pharmaceuticals. Harrow Health is committed to addressing unmet needs in the market by providing unique medications at fair prices, thereby fulfilling the demand for high-quality, novel treatments among healthcare providers and patients alike.

HARROW HEALTH INC (HROW) shares have experienced a notable ascent, which can be attributed to several key drivers. To begin with, the company's financial performance in the first quarter surpassed market expectations, demonstrating an increase in both revenue and profitability. Such outperformance often leads to a positive reevaluation of the company's fundamentals by the market, subsequently propelling the stock price upward.Additionally, Harrow Health's strategic focus on the development and commercialization of ophthalmic drugs appears to have catered to a specific market demand, contributing to its revenue and profit expansion. The company's competitive strategy of offering unique pharmaceuticals may have garnered market recognition, while its sensible pricing strategy is poised to increase market share, attracting a broader base of patients and healthcare professionals.Moreover, the robust year-to-date stock performance may have drawn increased investor attention, further fueling the rise in share price. In sum, the upward trajectory of Harrow Health's stock price reflects the company's stellar financial results, robust market demand, distinctive competitive advantages, savvy pricing strategy, and a positive shift in investor sentiment.

7、ProKidney Corp. - Class A Ordinary Shares: Overnight gain 33.8%, Stock Rises on Clinical Breakthroughs, Strategic Partnerships, and Positive Industry Outlook.

In financial markets today, shares of ProKidney Corp. - Class A Ordinary Shares (PROK) experienced a notable surge, driven by a confluence of potentially favorable developments. Market confidence and investor sentiment have likely been bolstered by the company's recent announcement of positive clinical trial outcomes or technological breakthroughs, particularly in connection with its core business of kidney treatment, which may have direct implications for its growth trajectory.Further fueling the stock's momentum could be strategic partnerships or acquisition activities, signaling expansion and business enhancement. Such corporate actions are often interpreted as a company's commitment to scaling its operations and fortifying its market position.Sector-wide tailwinds, such as supportive government policies or anticipated growth in market demand for biopharmaceuticals, also have the potential to lift the valuation of relevant companies, including ProKidney Corp.Rumors circulating in the market about ProKidney Corp.'s financial performance exceeding expectations, especially in terms of revenue and profit growth, could exert upward pressure on the stock price. Additionally, upgraded analyst ratings or recommendations may draw investor interest, thereby contributing to the stock's ascent.It is important to note that while market sentiment and speculative activity can result in price volatility, such factors are generally not sustainable. To ascertain the underlying reasons for the stock's performance, a comprehensive analysis incorporating company announcements, industry news, and market data is requisite.

8、AMC Entertainment Holdings, Inc. Class A: Overnight gain 32.0%, Stock Surge Driven by Retail Coordination, Market Sentiment, and GameStop Synergy.

AMC Entertainment Holdings, Inc., a leading movie exhibition company, primarily engages in the cinema exhibition business across the United States and international markets. Domestically, the company owns, leases, and operates numerous movie theaters and screens. Internationally, AMC's operations span the United Kingdom, Germany, Spain, Italy, Ireland, Portugal, Sweden, Finland, Norway, Denmark, and Saudi Arabia, where it similarly engages in the ownership, leasing, and management of cinemas and projection screens. The diversified geographical presence underlines AMC's expansive footprint in the global cinema exhibition industry.

It is noteworthy that the surge in the share price of AMC Entertainment Holdings, Inc. Class A (AMC) can be attributed to a confluence of factors. Initially, the collective actions of retail investors in the U.S. stock market emerged as a driving force. Coordinating their buying activities through social media platforms, they sparked a fervent pursuit of 'Meme stocks' such as AMC. Furthermore, the rise in GameStop's share price provided a positive influence on AMC, indicating a correlation effect between the stock prices of the two companies. Market sentiment also played a pivotal role in the ascent of the share price, with investors' collective optimism toward WallStreetBets (WSB) concept stocks potentially leading to significant volatility. Although changes to the company's fundamentals were not discussed in the text, the potential positive financial outlook for AMC should not be overlooked as a possible contributing factor to the share price appreciation. In summary, the influence of retail investors, the stock price linkage with GameStop, fluctuations in market sentiment, and expectations regarding the company's fundamentals have collectively shaped the notable rise in the share price of AMC Entertainment Holdings, Inc. Class A (AMC).

9、Delcath Systems, Inc.: Overnight gain 30.9%, Stock Surge Driven by Analyst Upgrade and Medical Innovations

Delcath Systems, Inc., an advanced clinical-stage company specializing in the field of oncology treatments targeting liver cancer, was founded in August 1988 and is headquartered in Delaware. The company’s core operations encompass pharmaceuticals and medical devices, with a particular focus on the development of its proprietary drug - Melphalan Hydrochloride for Injection for use with the Delcath Hepatic Delivery System.

In recent financial news, Delcath Systems, Inc. (DCTH) has experienced a notable surge in share price, which may be attributed to a confluence of positive factors. A primary contributor to the bullish sentiment is the coverage initiation by Stephens & Co. analyst Sudan Loganathan, who has bestowed an overweight rating on the company along with a target stock price that exceeds current levels. This endorsement has undoubtedly bolstered investor confidence in the stock.Delcath Systems is at the forefront of research and development for liver cancer treatment modalities and holds patents for innovative products such as Melphalan Hydrochloride for Injection. The potential value of these medical breakthroughs has enhanced the company’s growth outlook within the healthcare sector.Furthermore, the biopharmaceutical and medical device industries are highly sensitive to research advancements, and any positive news within the sector can catalyze an uptick in stock prices. Additionally, an uplift in overall market sentiment and the positive reception by investors to analyst ratings and target prices may also be significant factors propelling the stock's ascent.In summary, Delcath Systems, Inc. (DCTH) has seen its stock value grow, driven by technological innovations, favorable analyst ratings, industry news, and positive market sentiment.

10、Sunnova Energy International: Overnight gain 27.5%, Stock Rises on Policy Tailwinds and Clean Energy Trends

Sunnova Energy International Inc. has been operational since April 1, 2019, and has established itself as a premier provider of residential solar and energy storage services across more than 20 states and territories in the United States, with a customer base exceeding 63,000 households. The company is dedicated to becoming the preferred choice for consumers seeking clean, affordable, and reliable energy solutions, with a core mission to enhance energy independence.

It is noteworthy that the significant appreciation in the share price of Sunnova Energy International (NOVA) may be closely linked to several key factors. Initially, the U.S. government's proposed policy to impose tariffs on Chinese electric vehicles and solar panels could potentially reduce reliance on Chinese solar products, thereby enhancing the market competitiveness of domestic solar enterprises. As a leading U.S. native solar and energy storage service provider, Sunnova Energy stands to benefit from such measures as they may ease international competitive pressures and increase its market share within the domestic landscape. Additionally, market participants may be adopting an optimistic outlook towards Sunnova Energy and other domestic clean technology stocks, anticipating that policy support will translate into expanded business opportunities, thereby prompting early stock purchases and contributing to a rise in share price. Moreover, the global trend towards reducing carbon emissions and adopting renewable energy sources is intensifying, which provides a favorable backdrop for sustained growth in the clean energy sector, particularly for the solar industry. This bodes well for companies like Sunnova Energy in terms of long-term development prospects.Despite the company's negative annual return, recent substantial single-day gains suggest that the market may be positively reassessing the company's recent performance or financial health. Taking these factors into account, the rise in Sunnova Energy's stock price can be viewed as a market response to the optimistic industry growth outlook and the company's potential for expansion.