Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | CommScope Holding Co., Inc.: Overnight Gain 86.3%, Stock Surges on Major Business Unit Sale to Amphenol, Boosting Financial Outlook and Strategic Focus

CommScope Holding Co., Inc. COMM | 19.58 | 0.00% |

Steelcase Inc. Class A SCS | 16.14 | Delist |

Zepp Health Corp ZEPP | 22.50 | +8.96% |

IDEXX Laboratories, Inc. IDXX | 712.12 | +0.23% |

Energizer Holdings, Inc. ENR | 21.24 | -1.35% |

Editor's Note: the "Trending USA Stocks" column tracks the day's top bullish stocks in the USA market, aiding investors in promptly identifying opportunities for potential gains.

04/08/2025 Eastern Time in USA The Dow Jones Industrial Average rose by 1.34%, closing at 44173.64 points; the Nasdaq Composite rose by 1.95%, closing at 21053.58 points; the S&P 500 Index rose by 1.47%, closing at 6329.94 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

CommScope Holding Co., Inc.: Overnight gain 86.3%, Stock surges on major business unit sale to Amphenol, boosting financial outlook and strategic focus.

CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in communication infrastructure solutions, has been at the forefront of the industry since its inception in 2010. The company specializes in providing cutting-edge solutions for wireless, enterprise, and residential broadband network connectivity. CommScope's comprehensive portfolio encompasses a wide range of offerings, including advanced RF solutions, intelligent connectivity and cabling platforms, data center infrastructure, smart building technologies, and broadband access solutions. This diverse product line positions the company as a key player in addressing the evolving needs of the modern telecommunications landscape. With a focus on innovation and customer-centric solutions, CommScope continues to play a pivotal role in helping clients overcome complex communication challenges. The company's expertise is instrumental in supporting and enhancing the critical infrastructure that underpins today's sophisticated communication networks. As the demand for high-performance connectivity solutions continues to grow across various sectors, CommScope remains well-positioned to capitalize on emerging opportunities in the global telecommunications market.

CommScope Holding Co., Inc. (COMM) shares surged 86.3% following Amphenol Corporation's (APH) announcement of a $10.5 billion acquisition of CommScope's Broadband Networks business. This landmark deal, Amphenol's largest to date, marks a significant step in CommScope's strategy to streamline operations and improve its balance sheet. The transaction aligns with CommScope's ongoing debt reduction efforts, addressing its substantial $9.4 billion debt burden as of December. The divestiture is expected to enhance CommScope's financial position and allow it to refocus on core operations. Market reaction to this strategic move was overwhelmingly positive, driving COMM's stock up 178.5% year-to-date. This development underscores the potential for strategic divestitures to unlock shareholder value in the telecommunications equipment sector.

Steelcase Inc. Class A: Overnight gain 62.9%, Acquisition by HNI drives stock surge amid complementary synergies and enhanced market competitiveness.

Steelcase Inc. (NYSE: SCS), a global leader in the office furniture industry, has maintained its position as the world's largest office furniture manufacturer by revenue since 1974. Founded in 1912 and headquartered in Grand Rapids, Michigan, the company boasts a workforce of approximately 12,700 employees. The firm operates an extensive network of manufacturing facilities and distribution centers across 25 key locations worldwide. Steelcase's products reach customers through a robust distribution network comprising over 800 independent and company-owned dealers globally. With a century-long legacy in the office environment solutions sector, Steelcase continues to innovate and adapt to changing workplace dynamics. The company's strong market presence and diverse product portfolio position it well to capitalize on evolving office trends and maintain its industry leadership. As businesses increasingly focus on creating efficient and ergonomic workspaces, Steelcase's expertise in office furniture design and manufacturing remains a valuable asset in the competitive global market.

Steelcase Inc. Class A (SCS) shares surged 62.9% following HNI Corporation's announcement of its intention to acquire Steelcase in a cash and stock transaction valued at approximately $2.2 billion. Under the terms of the agreement, Steelcase shareholders will receive $7.20 in cash and 0.2192 shares of HNI common stock per share, representing a premium to the current market valuation. The merger is expected to enhance the combined company's market competitiveness due to the highly complementary geographic footprints and dealer networks of HNI and Steelcase. Additionally, HNI anticipates that the merger will significantly boost non-GAAP earnings per share starting in 2027. These factors collectively propelled Steelcase's stock price, resulting in a year-to-date gain of 42.7%. The acquisition is poised to create a formidable entity in the office furniture and workspace solutions industry.

Zepp Health Corp: Overnight gain 34.0%, Strong Q2 performance and positive outlook drive stock price upward

Zepp Health Corp, established in 2014, is a leading provider of cloud-based health services with cutting-edge smart wearable technology. The company made its debut on the New York Stock Exchange in 2018, becoming the first Chinese smart hardware innovation enterprise to list on the U.S. capital market. Implementing its "chip-device-cloud" strategy, Zepp Health has strategically positioned itself across the spectrum of semiconductor development, smart wearable devices, and health cloud services, thereby constructing a comprehensive global health ecosystem. The company leverages artificial intelligence algorithms and big data analytics to offer users round-the-clock health monitoring services. Through the integration of Internet of Things (IoT) technology, Zepp Health is committed to creating a smarter and more convenient lifestyle for consumers. This approach underscores the company's dedication to innovation in the rapidly evolving wearable technology and digital health sectors. As a key player in the burgeoning health tech industry, Zepp Health continues to expand its market presence and technological capabilities, positioning itself at the forefront of the global smart wearables and health monitoring market.

Zepp Health Corp (ZEPP) has experienced a notable stock price increase, driven by significant performance improvements and positive market outlook. The company's Q2 2025 financial report revealed a substantial 46.2% year-over-year revenue growth, surpassing previous guidance and marking its first overall revenue increase since 2021. The core Amazfit brand demonstrated robust performance, with multiple smartwatch products fueling sales growth. Despite ongoing losses, the company has significantly narrowed its deficit. Zepp Health has introduced a new AI-enabled system, deepened partnerships with third-party platforms, and enhanced product competitiveness. International market expansion efforts have yielded positive results, particularly during Amazon Prime Day. Oriental Securities' research report highlights the potential for AI applications and sports-related demands to drive growth in the smartwatch industry, positioning Zepp Health as a potential beneficiary in this evolving market landscape.

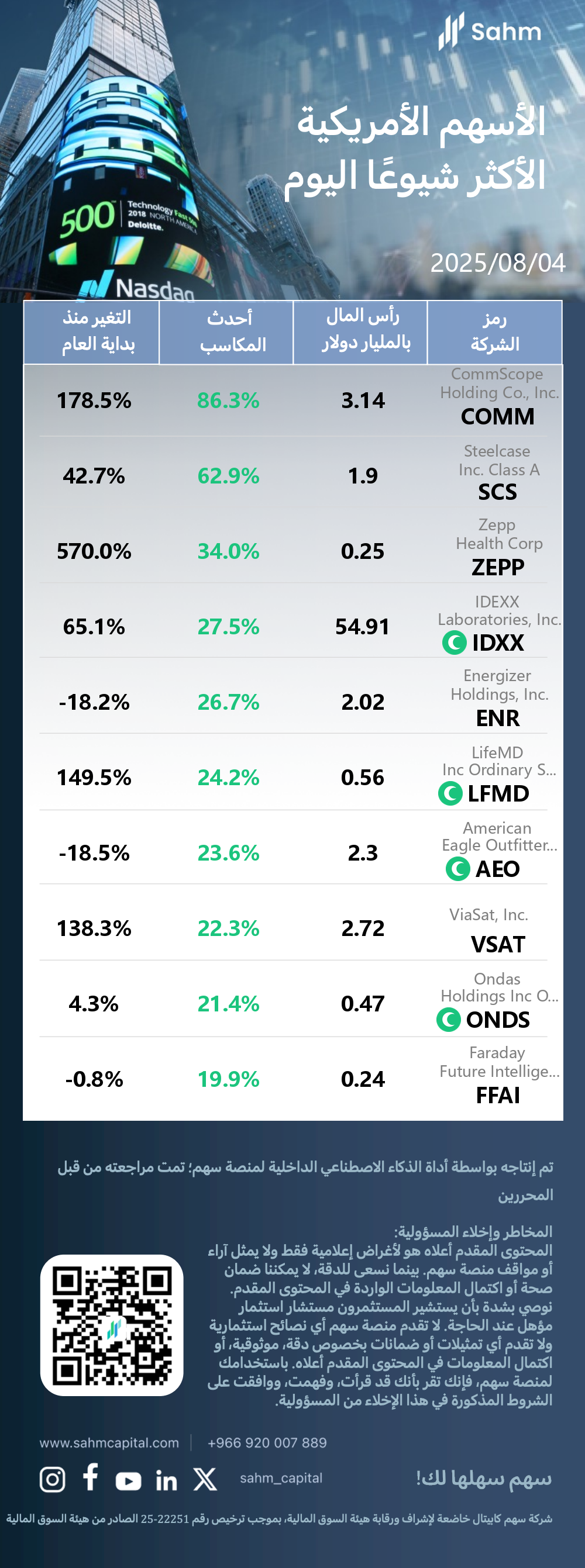

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

| CommScope Holding Co., Inc.(COMM.US) | 3.14 | 86.3% | 178.5% |

| Steelcase Inc. Class A(SCS.US) | 1.9 | 62.9% | 42.7% |

| Zepp Health Corp(ZEPP.US) | 0.25 | 34.0% | 570.0% |

| IDEXX Laboratories, Inc.(IDXX.US) | 54.91 | 27.5% | 65.1% |

| Energizer Holdings, Inc.(ENR.US) | 2.02 | 26.7% | -18.2% |

| LifeMD Inc Ordinary Shares(LFMD.US) | 0.56 | 24.2% | 149.5% |

| American Eagle Outfitters, Inc.(AEO.US) | 2.3 | 23.6% | -18.5% |

| ViaSat, Inc.(VSAT.US) | 2.72 | 22.3% | 138.3% |

| Ondas Holdings Inc Ordinary Shares(ONDS.US) | 0.47 | 21.4% | 4.3% |

| Faraday Future Intelligent Electric Inc (FFAI.US) | 0.24 | 19.9% | -0.8% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.