Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | LiveWire Group, Inc. Common Stock: Overnight gain 153.5%, Electric motorcycle leader gains investor attention amid market demand and innovation focus.

LiveWire LVWR | 4.94 | +0.61% |

Digital Ally, Inc. DGLY | 1.13 | -9.60% |

iRobot IRBT | 4.32 | -13.60% |

Editor's Note: the "Trending USA Stocks" column tracks the day's top bullish stocks in the USA market, aiding investors in promptly identifying opportunities for potential gains.

27/05/2025 Eastern Time in USA The Dow Jones Industrial Average rose by 1.78%, closing at 42343.65 points; the Nasdaq Composite rose by 2.47%, closing at 19199.16 points; the S&P 500 Index rose by 2.05%, closing at 5921.54 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

LiveWire Group, Inc. Common Stock: Overnight gain 153.5%, Electric motorcycle leader gains investor attention amid market demand and innovation focus.

LiveWire Group, Inc. (LiveWire Group, Inc. Common Stock(LVWR.US) ), a Delaware-incorporated electric motorcycle manufacturer, is positioning itself as an industry pioneer through innovative design and cutting-edge technology. The company, which began testing electric models in 2014, launched its standalone brand LiveWire in 2021, accompanied by the release of its flagship product, the LiveWire ONE. Since its inception, LiveWire has been steadily establishing a dominant presence in the premium electric motorcycle market. The company's strategic focus on high-performance, eco-friendly two-wheelers has allowed it to capitalize on the growing demand for sustainable transportation solutions. Industry analysts note that LiveWire's commitment to research and development, coupled with its heritage as a spin-off from Harley-Davidson, provides a solid foundation for future growth. The company's product lineup and brand positioning have garnered attention from both traditional motorcycle enthusiasts and a new generation of environmentally conscious consumers. As the electric vehicle market continues to expand, LiveWire Group, Inc. is demonstrating robust growth potential and competitive edge. The company's performance will be closely watched by investors looking to gain exposure to the burgeoning electric motorcycle sector.

LiveWire Group, Inc. Common Stock (LVWR) experienced a significant overnight surge of 153.5%, despite a 46.8% year-to-date decline. This remarkable rally can be attributed to multiple factors. As a leading brand in the electric motorcycle sector, LVWR is benefiting from the growing global demand for electric vehicles. The company's focus on design and technological innovation has captured investor attention. The sudden shift in market sentiment may reflect a reassessment of the company's prospects. Additionally, positive news releases, such as new product launches or improved sales performance, have likely contributed to the stock's upward momentum. This rebound underscores the volatile nature of the electric vehicle market and highlights LiveWire Group's potential for growth in this rapidly evolving industry.

Digital Ally, Inc.: Overnight gain 66.0%, Law enforcement equipment supplier's stock surges on potential demand increase and technical rebound.

Digital Ally, Inc. (Digital Ally, Inc.(DGLY.US) ) is a leading provider of advanced video recording products and other critical safety solutions for law enforcement, security, and commercial applications. The company's diverse product portfolio includes in-car digital video mirror systems, body-worn cameras, mobile video recording systems, portable digital video devices, speed detection equipment, and thermal imaging cameras. These state-of-the-art devices offer standalone video and audio recording capabilities, with data storage facilitated through flash memory cards. This technology enables seamless capture and preservation of crucial evidence and operational data. Digital Ally's go-to-market strategy employs both direct sales and third-party distribution channels to reach its target markets, which encompass law enforcement agencies, security organizations, individual consumers, and commercial fleet operators. Founded on December 13, 2000, Digital Ally has established itself as a key player in the video surveillance and safety solutions sector, leveraging its innovative technology to enhance accountability and safety across various industries. The company's continued focus on research and development, coupled with its strategic market positioning, underscores its commitment to delivering cutting-edge solutions in an increasingly security-conscious global environment.

Digital Ally, Inc. (DGLY) experienced a notable surge in its stock price, driven by multiple factors. The company's shares, which had plummeted by 99.6% year-to-date, rebounded sharply with a 66.0% gain, indicating a technical correction to the previous oversold condition. As a provider of law enforcement and security equipment, recent policies or events potentially increasing demand for such products may have bolstered investor expectations for the company's growth prospects. Furthermore, Digital Ally's small market capitalization of $693 million makes it susceptible to short-term speculative trading, contributing to heightened stock price volatility. This combination of factors likely fueled the significant uptick in DGLY's share price, attracting investor attention in the process.

iRobot: Overnight gain 54.3%, Significant rally suggests positive news, market reevaluates prospects for robotics leader amid tech innovations.

iRobot Corporation (iRobot(IRBT.US) ) is a leading innovator in the robotics industry, specializing in the design and manufacture of advanced robotic systems. Founded in 1990, the company has amassed a robust portfolio of proprietary technologies over the past three decades, with particular expertise in navigation, mobility, manipulation, and artificial intelligence. The firm's diverse product lineup encompasses a range of robotic solutions, including household cleaning robots, outdoor maintenance robots, military reconnaissance units, and underwater gliding robots. This broad offering allows iRobot to cater to both consumer and government markets, effectively diversifying its revenue streams. iRobot employs a multi-channel distribution strategy, leveraging relationships with retail partners, direct-to-consumer e-commerce platforms, and government agencies to maximize market penetration. The company's commitment to quality and innovation is underscored by its AS9100 certification and Capability Maturity Model Integration (CMMI) certification, which qualify iRobot to supply products and services to military and defense sectors. With its strong technological foundation and strategic market positioning, iRobot continues to capitalize on the growing demand for autonomous robotic solutions across various industries, positioning itself for sustained growth in the evolving robotics market.

iRobot Corporation (IRBT) experienced a significant surge in its stock price, driven by multiple factors. The company's shares skyrocketed 54.3% overnight, suggesting the presence of substantial positive news stimulating market sentiment. This remarkable rebound comes after a steep 48.6% decline year-to-date, potentially indicating a dramatic shift in market perception regarding the company's prospects. As a leader in both consumer and military robotics, iRobot's relatively modest market capitalization of $124 million has prompted investors to reassess its valuation. Furthermore, the company's ongoing technological innovations in navigation and artificial intelligence, coupled with potential strategic adjustments, may have contributed to the stock's upward momentum. This sudden reversal in iRobot's stock performance underscores the volatile nature of the robotics sector and highlights the potential for rapid value reassessment in technology-driven markets.

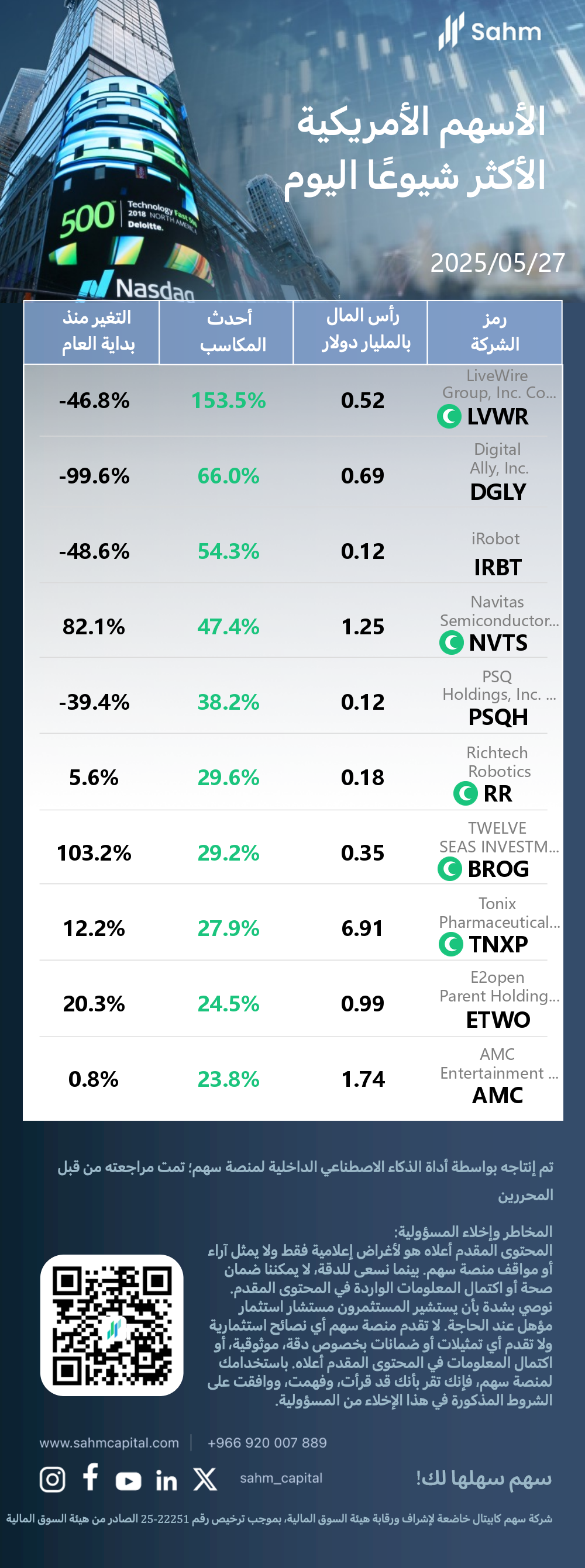

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

LiveWire Group, Inc. Common Stock LVWR | 0.52 | 153.5% | -46.8% |

Digital Ally, Inc. DGLY | 0.69 | 66.0% | -99.6% |

iRobot IRBT | 0.12 | 54.3% | -48.6% |

Navitas Semiconductor Corp Ordinary Shares - Class A NVTS | 1.25 | 47.4% | 82.1% |

PSQ Holdings, Inc. Class A Common Stock PSQH | 0.12 | 38.2% | -39.4% |

Richtech Robotics RR | 0.18 | 29.6% | 5.6% |

TWELVE SEAS INVESTMENT COMPANY BROG | 0.35 | 29.2% | 103.2% |

Tonix Pharmaceuticals Holding Corp. TNXP | 6.91 | 27.9% | 12.2% |

E2open Parent Holdings Inc Ordinary Shares - Class A ETWO | 0.99 | 24.5% | 20.3% |

AMC Entertainment Holdings, Inc. Class A AMC | 1.74 | 23.8% | 0.8% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.