Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | PACS: Overnight gain 55.3%, Strong Q3 performance, financial restatement, and positive outlook boost investor confidence

PACS Group, Inc. PACS | 38.68 | +4.91% |

Allogene Therapeutics, Inc. ALLO | 1.69 | +3.68% |

Robo.ai Inc. Class B AIIO | 0.17 | +5.63% |

Luda Technology Group Limited LUD | 6.35 | -2.00% |

Magnera Corporation MAGN | 14.86 | -0.67% |

Editor's Note: the "Trending USA Stocks" column tracks the day's top bullish stocks in the USA market, aiding investors in promptly identifying opportunities for potential gains.

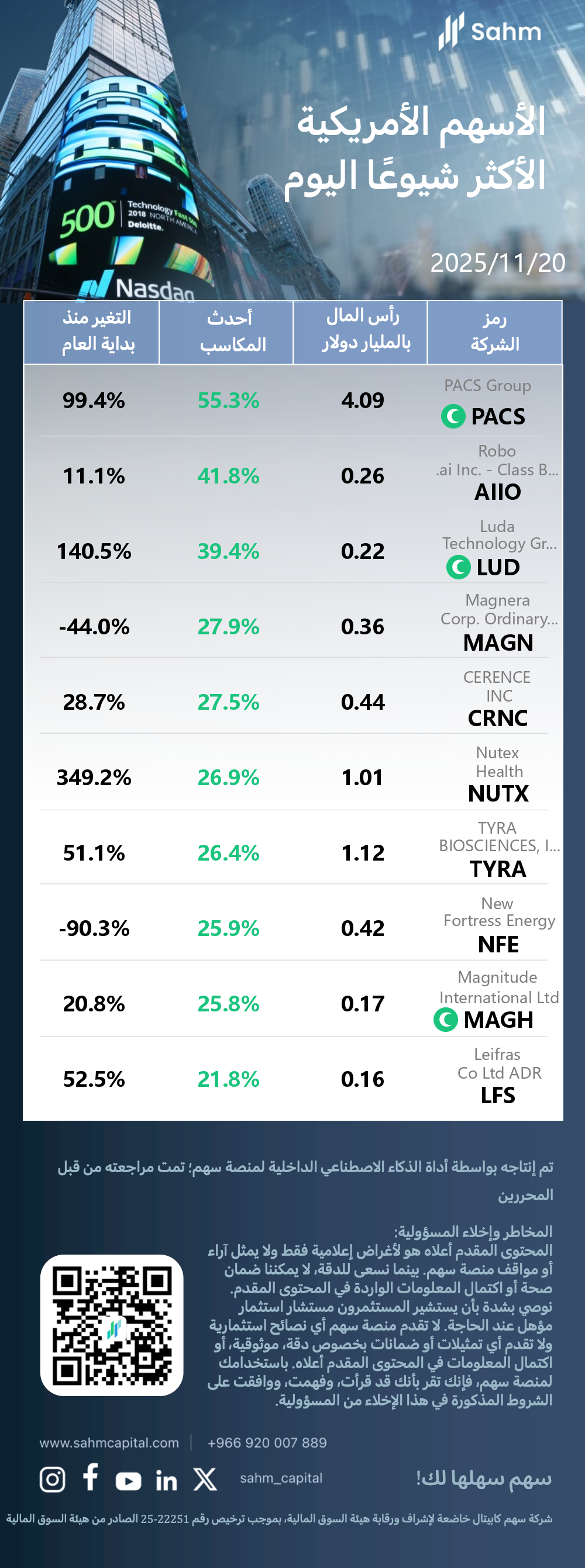

20/11/2025 Eastern Time in USA The Dow Jones Industrial Average dropped by 0.84%, closing at 45752.26 points; the Nasdaq Composite dropped by 2.15%, closing at 22078.05 points; the S&P 500 Index dropped by 1.56%, closing at 6538.76 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

PACS Group: Overnight gain 55.3%, Strong Q3 performance, financial restatement, and positive outlook boost investor confidence

PACS Group(PACS.US), a Delaware corporation established in 2023, is a leading provider of post-acute care services. The company operates an extensive network of independently managed facilities, spanning 314 locations across 17 states, and serves over 30,000 patients daily. Specializing in high-quality skilled nursing care, PACS Group has strategically positioned itself in the rapidly growing post-acute healthcare sector. The company's service portfolio extends beyond skilled nursing to include senior care and assisted living services in select communities, demonstrating its commitment to comprehensive eldercare solutions. A key differentiator for PACS Group is its centralized support system, which provides robust technological infrastructure and back-office services to its facilities. This innovative approach allows local teams to focus primarily on patient care, potentially enhancing operational efficiency and care quality. With its extensive footprint and diversified service offerings, PACS Group is well-positioned to capitalize on the increasing demand for post-acute care services in the United States. The company's business model reflects the ongoing trend of consolidation and professionalization in the healthcare services industry.

PACS Group (PACS) stock price surge can be attributed to multiple factors. The company's third-quarter financial performance exceeded expectations, with sales reaching $1.345 billion, a 31.09% year-over-year increase. Earnings per share saw a remarkable 220% growth to $0.32, indicating significantly improved profitability. PACS also completed its financial restatement and filed relevant documents, alleviating investor concerns about its financial status. The company reported impressive operational metrics, including high-quality ratings and occupancy rates, underscoring its competitive advantage in the industry. Furthermore, PACS expressed optimism for its full-year 2025 outlook, projecting revenues between $5.25 billion and $5.35 billion. This positive guidance has further bolstered market confidence in the company's growth trajectory.

Robo.ai Inc. - Class B Ordinary Shares: Overnight gain 41.8%, Smart EV maker gains traction on growth potential and innovative strategies.

Allogene Therapeutics(ALLO.US), a Cayman Islands exempted company incorporated on March 22, 2022, operates primarily through its key subsidiary, ICONIQ Holding Limited. The firm is strategically positioned in the intelligent electric vehicle (EV) sector, with a focus on integrating cutting-edge design, personalized lifestyle solutions, IoT connectivity, and autonomous driving technologies. The company's mission is to develop globally-oriented, premium green mobility solutions that place passenger experience at the forefront. By leveraging these advanced technologies, Robo.ai Inc. aims to revolutionize the future transportation ecosystem, offering users intelligent, environmentally-friendly, and tailored mobility experiences. This innovative approach underscores Robo.ai Inc.'s commitment to reshaping the automotive industry landscape, potentially disrupting traditional mobility paradigms and capitalizing on the growing demand for sustainable, high-tech transportation solutions in the global market. As the EV and autonomous vehicle sectors continue to evolve, Robo.ai Inc.'s strategic focus positions it to potentially capture significant market share in the burgeoning smart mobility space, subject to successful execution of its business model and favorable market conditions.

Robo.ai Inc. - Class B Ordinary Shares (AIIO) experienced a notable surge in stock price, driven by a confluence of factors. As an emerging player in the intelligent electric vehicle sector, AIIO is benefiting from rapid industry growth and increasing global demand for eco-friendly mobility solutions. The company's strategy of integrating cutting-edge design, personalized experiences, and autonomous driving technology, coupled with its global market positioning, has attracted investor attention. Moreover, as a relatively young enterprise, market expectations for high growth potential have contributed to the stock's upward momentum. The significant overnight gain of 41.8% may be attributed to short-term speculative behavior or potentially positive news. Investors should note that such substantial price movements often warrant careful analysis and consideration of underlying fundamentals.A

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

| PACS Group(PACS.US) | 4.09 | 55.3% | 99.4% |

| Robo.ai Inc. - Class B Ordinary Shares(AIIO.US) | 0.26 | 41.8% | 11.1% |

| Luda Technology Group(LUD.US) | 0.22 | 39.4% | 140.5% |

| Magnera Corp. Ordinary Shares(MAGN.US) | 0.36 | 27.9% | -44.0% |

| CERENCE INC(CRNC.US) | 0.44 | 27.5% | 28.7% |

| Nutex Health(NUTX.US) | 1.01 | 26.9% | 349.2% |

| TYRA BIOSCIENCES, INC.(TYRA.US) | 1.12 | 26.4% | 51.1% |

| New Fortress Energy(NFE.US) | 0.42 | 25.9% | -90.3% |

| Magnitude International Ltd(MAGH.US) | 0.17 | 25.8% | 20.8% |

| Leifras Co Ltd ADR(LFS.US) | 0.16 | 21.8% | 52.5% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.