Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | REPLIMUNE GROUP, INC.: Overnight gain 101.3%, Soars on breakthrough cancer treatment results, potential pharma partnership rumors

Replimune REPL | 9.61 9.61 | -3.42% 0.00% Pre |

Supertex, Inc. SUPX | 16.57 16.60 | -7.94% +0.18% Pre |

Global Industrial Company Common Stock GIC | 30.08 30.08 | +0.91% 0.00% Pre |

Wingstop, Inc. WING | 246.56 246.56 | +2.86% 0.00% Pre |

Fortress Transportation & Infrastructure Investors LLC FTAI | 168.63 168.63 | -1.21% 0.00% Pre |

Editor's Note: the "Trending USA Stocks" column tracks the day's top bullish stocks in the USA market, aiding investors in promptly identifying opportunities for potential gains.

30/07/2025 Eastern Time in USA The Dow Jones Industrial Average dropped by 0.38%, closing at 44461.28 points; the Nasdaq Composite rose by 0.15%, closing at 21129.67 points; the S&P 500 Index dropped by 0.12%, closing at 6362.9 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

REPLIMUNE GROUP, INC.: Overnight gain 101.3%, Soars on breakthrough cancer treatment results, potential pharma partnership rumors

REPLIMUNE GROUP, INC.(REPL.US) , a clinical-stage biotechnology firm founded in 2015 and incorporated in Delaware, is at the forefront of oncolytic immunotherapy development. The company's mission is to revolutionize cancer treatment and enhance patient outcomes through innovative therapeutic approaches. At the core of Replimune's competitive advantage lies its proprietary Immulytic platform, a cutting-edge technology designed to engineer and develop novel drug candidates that maximize the activation of the body's immune system against cancer. This platform underpins the company's efforts to achieve significant advancements in the field of tumor immunotherapy. Replimune's pipeline focuses on harnessing the potential of oncolytic immunotherapies to transform the treatment landscape for cancer patients. By leveraging its state-of-the-art Immulytic platform, the company aims to deliver breakthrough therapies that could potentially redefine the standard of care in oncology. As Replimune continues to progress its clinical programs, investors and industry observers are closely monitoring the company's developments, which could have significant implications for the broader biotechnology sector and cancer treatment paradigms.

Replimune Group, Inc. (REPL), a clinical-stage biotechnology company specializing in oncolytic immunotherapy, has experienced a significant surge in its stock price. The company's shares skyrocketed 101.3% overnight, likely driven by the release of positive clinical trial results demonstrating the efficacy of its cancer treatment approach. This breakthrough has garnered substantial investor attention. Market speculation regarding potential collaborations or acquisition talks with major pharmaceutical companies has further fueled the stock's upward momentum. Additionally, the sharp increase can be partially attributed to a technical rebound, considering the stock's 37.6% decline year-to-date. The multifaceted reasons behind REPL's price surge underscore the company's promising developments in its research and development efforts, positioning it as a noteworthy player in the competitive oncology therapeutics landscape.

Supertex, Inc.(SUPX.US) : Overnight gain 44.0%, Expansion into Japan's AI market boosts investor confidence, driving stock surge.

Super X AI Technology Limited, incorporated on August 25, 2021, in the British Virgin Islands, operates as a holding company without direct business operations. The company conducts its primary business activities through its wholly-owned subsidiary, OPS HK, which is focused on the Hong Kong market. OPS HK specializes in interior design and renovation services, offering professional spatial solutions to clients in the Hong Kong region. This subsidiary serves as the operational arm of Super X AI Technology Limited, leveraging its expertise in the local market to deliver customized interior design and fit-out services. The corporate structure, with Super X AI Technology Limited as the parent company and OPS HK as the operating entity, allows for strategic management and potential expansion opportunities while maintaining a focused operational presence in the Hong Kong market.

Supertex, Inc. (SUPX) shares surged following the announcement of a significant business expansion plan. The company revealed its intention to establish a regional supply center in Japan through its subsidiary, Super X AI Technology Limited. The facility, slated to commence operations in the latter half of 2025, will boast an annual production capacity of 10,000 high-performance AI servers. This strategic move is expected to substantially enhance the company's manufacturing capabilities and global supply chain presence. The expansion reinforces Supertex's position as a "one-stop AI data center solutions provider" while offering Japanese clients expedited delivery and localized support services. The market responded enthusiastically to Supertex's AI-focused strategy, driving the stock price up by 44.0% on the day of the announcement. Year-to-date, SUPX shares have skyrocketed an impressive 518.9%, reflecting strong investor confidence in the company's AI sector initiatives.

Global Industrial Company Common Stock(GIC.US) : Overnight gain 26.8%, Strong earnings boost investor confidence, driving significant stock price surge

Global Industrial Company, incorporated in Delaware in 1995 with operations dating back to 1949, is a leading distributor of branded and private label products. The company operates through two primary business segments: Technology Products and Industrial Products. The Technology Products division specializes in the direct marketing and distribution of Information and Communications Technology (ICT) and Consumer Electronics (CE) products. This segment's portfolio encompasses a wide range of offerings, including computers, computer peripherals, and various consumer electronic devices. The company's sales efforts in this division are primarily focused on North America, Puerto Rico, and European markets. Meanwhile, the Industrial Products segment caters to a diverse array of industrial and commercial needs, leveraging the company's extensive product catalog and distribution network. Global Industrial Company's business model, centered on direct sales of both proprietary and third-party brands, positions it as a significant player in the industrial and technology distribution sectors. The company's long-standing history and strategic market focus underscore its established presence in the industry.

Global Industrial Company Common Stock (GIC) experienced a significant stock price surge following its impressive second-quarter performance. The company's earnings per share reached $0.65, surpassing analyst expectations by 39.78% and marking a 25% year-over-year increase. Sales revenue also exceeded market forecasts, climbing 3.19% to $358.9 million compared to the same period last year. These robust figures underscore GIC's strong profitability and solid market position. Investors responded positively to the earnings report, driving the stock price up by 26.8%. This surge contributed to a year-to-date gain of 41.7%, reflecting market optimism regarding Global Industrial's future growth prospects. The company's ability to outperform expectations in a challenging economic environment has bolstered investor confidence and reinforced its position as a promising investment opportunity in the industrial sector.

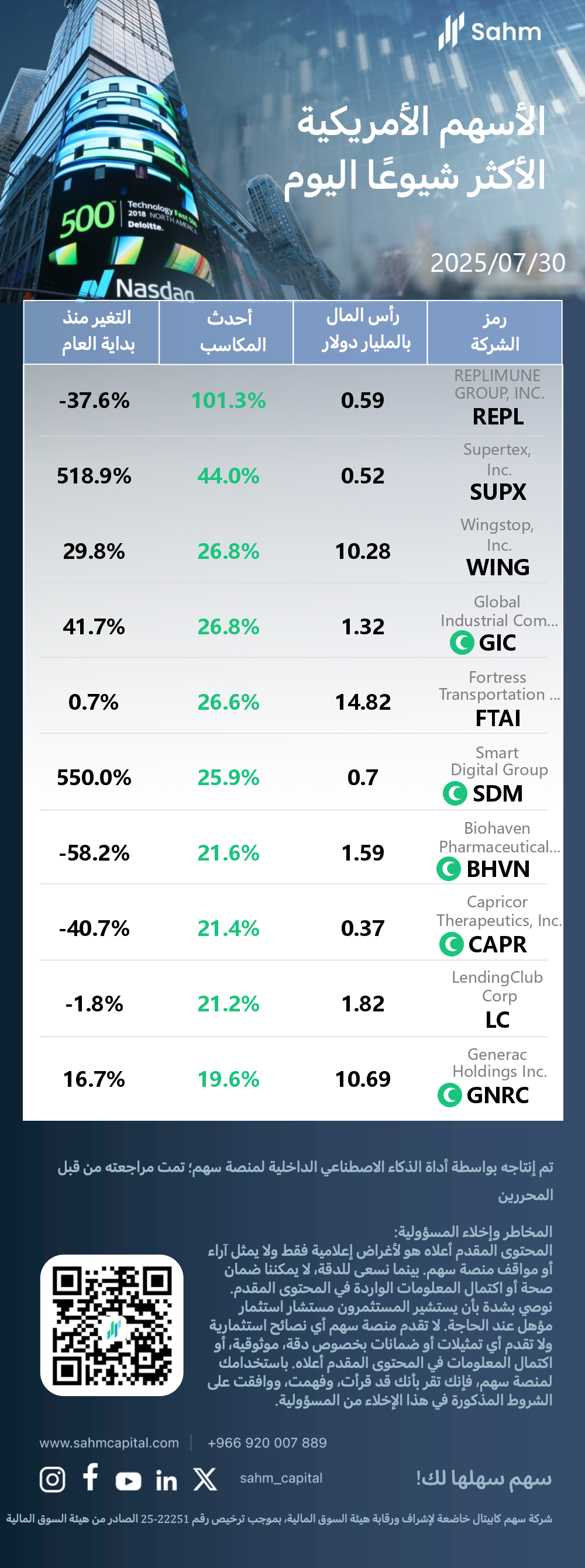

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

| REPLIMUNE GROUP, INC.(REPL.US) | 0.59 | 101.3% | -37.6% |

| Supertex, Inc.(SUPX.US) | 0.52 | 44.0% | 518.9% |

| Wingstop, Inc.(WING.US) | 10.28 | 26.8% | 29.8% |

| Global Industrial Company Common Stock(GIC.US) | 1.32 | 26.8% | 41.7% |

| Fortress Transportation & Infrastructure Investors LLC(FTAI.US) | 14.82 | 26.6% | 0.7% |

| Smart Digital Group(SDM.US) | 0.7 | 25.9% | 550.0% |

| Biohaven Pharmaceutical Holding Company Ltd.(BHVN.US) | 1.59 | 21.6% | -58.2% |

| Capricor Therapeutics, Inc.(CAPR.US) | 0.37 | 21.4% | -40.7% |

| LendingClub Corp(LC.US) | 1.82 | 21.2% | -1.8% |

| Generac Holdings Inc.(GNRC.US) | 10.69 | 19.6% | 16.7% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.