Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | SatixFy Communications Ltd. Ordinary Share: Overnight Gain 44.1%, Acquisition Deal Improvement Boosts Investor Confidence, Driving Stock Surge Amid Enhanced Shareholder Value

SatixFy Communications Ltd. Ordinary Share SATX |

| |

METAPLANET INC MTPLF | 2.74 | -1.62% |

DeFi Development DFDV | 5.56 | -2.63% |

Cantor Equity Partners Inc. Ordinary Shares - Class A CEP | 14.27 | 0.00% |

Regencell Bioscience Holdings Ltd. RGC | 16.60 | -1.48% |

Editor's Note: the "Trending USA Stocks" column tracks the day's top bullish stocks in the USA market, aiding investors in promptly identifying opportunities for potential gains.

20/05/2025 Eastern Time in USA The Dow Jones Industrial Average dropped by 0.27%, closing at 42677.24 points; the Nasdaq Composite dropped by 0.38%, closing at 19142.71 points; the S&P 500 Index dropped by 0.39%, closing at 5940.46 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

SatixFy Communications Ltd. Ordinary Share: Overnight gain 44.1%, Acquisition deal improvement boosts investor confidence, driving stock surge amid enhanced shareholder value.

SatixFy Communications Ltd. (NYSE: SATX) is a leading innovator in next-generation satellite communication systems. The company's comprehensive product portfolio encompasses satellite payloads, user terminals, and modems, all powered by their proprietary chip sets. SatixFy's cutting-edge ASIC technology has demonstrated significant advancements in satellite communication system performance while simultaneously reducing the weight and power consumption of both terminals and payloads. This breakthrough positions the company at the forefront of the rapidly evolving satellite communications industry. The firm's state-of-the-art VSAT and multi-beam electronically steered antenna arrays are engineered to support a diverse range of mobile applications. These solutions are compatible with Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Earth Orbit (GEO) satellite communication systems, catering to various sectors including in-flight connectivity, mobile communications, satellite IoT, and consumer terminals. SatixFy's innovative approach and technological prowess have positioned it as a key player in addressing the growing demand for high-performance, cost-effective satellite communication solutions across multiple industries and applications.

SatixFy Communications Ltd. Ordinary Share (SATX) experienced a significant surge in stock price following amendments to its merger agreement with MDA. The revised terms include an increased acquisition price of $3.00 per share, valuing the company at $280 million. This adjustment substantially enhances shareholder value, sparking investor enthusiasm. Concurrently, SatixFy announced the cessation of considering alternative acquisition proposals, while the board reaffirmed its support for the merger, bolstering confidence in the deal's completion. These factors collectively propelled SATX shares to a remarkable 44.1% gain, bringing the year-to-date increase to 92.2%. The market's robust response underscores the positive sentiment surrounding this strategic merger, as investors anticipate potential synergies and growth opportunities arising from the transaction.

METAPLANET INC: Overnight gain 41.6%, Aggressive Bitcoin acquisition strategy and accumulation plans drive significant stock price surge

Company profile missing.

METAPLANET INC (MTPLF) has experienced a significant stock price surge, primarily attributed to its substantial Bitcoin acquisitions and clearly defined digital asset accumulation strategy. The company recently announced the purchase of 1,004 Bitcoins, bringing its total holdings to 7,800 units at an average acquisition cost of $91,300 per Bitcoin. Currently, MTPLF's Bitcoin portfolio is valued at over $806 million, demonstrating considerable investment gains. METAPLANET INC (MTPLF) has publicly declared its intention to increase its Bitcoin holdings to 10,000 units by the end of 2025, financing this strategy through 15 bond issuances. The most recent bond sale raised $15 million, coinciding with Bitcoin's price approaching all-time highs. These factors collectively contributed to MTPLF's stock price surging 41.6% in a single day and recording a year-to-date increase of 221.3%.

DeFi Development Corp. Ordinary Shares: Overnight gain 40.7%, Bullish on Solana, major SOL purchases and ecosystem partnerships drive stock surge

DeFi Development Corp. (NASDAQ: DEFI), a Delaware-based fintech company established in 2018, is making significant strides in the commercial real estate (CRE) finance sector. The firm operates a cutting-edge B2B platform designed to bridge the gap between CRE borrowers and lenders. The company's primary mission is to revolutionize the commercial real estate lending industry by enhancing efficiency, increasing transparency, and expanding market access. By leveraging advanced technology and innovative financial solutions, DeFi Development Corp. aims to streamline the traditionally complex and opaque CRE lending process. In a move to democratize the CRE finance market, the company is working to break down long-standing barriers to entry. This initiative is expected to open up opportunities for a broader range of market participants, moving beyond the historically exclusive domain of elite financial institutions. By fostering a more inclusive and accessible CRE lending ecosystem, DeFi Development Corp. is positioning itself at the forefront of a potential paradigm shift in the industry. The company's efforts could lead to increased liquidity, more competitive pricing, and a wider array of financing options for commercial real estate projects. As the fintech revolution continues to reshape various sectors of the financial industry, DeFi Development Corp.'s focus on the CRE market represents a significant opportunity for growth and innovation in this traditionally conservative space.

In a notable development, DeFi Development Corp. Ordinary Shares (DFDV) has experienced a significant surge in its stock price, driven by multiple factors. The company's strategic accumulation of Solana (SOL) tokens, including a recent purchase of 172,670 SOL valued at approximately $23.6 million, demonstrates its bullish long-term outlook on the cryptocurrency. DFDV has emerged as the largest SOL holder among publicly traded companies, with a total of 609,190 SOL worth about $107 million, attracting investor attention. Furthermore, DFDV's strategic partnership with BONK, a prominent meme coin in the Solana ecosystem, for joint validator node operations, underscores its active participation in the Solana network. These factors collectively contributed to DFDV's impressive 40.7% daily gain and a staggering 3,574.6% year-to-date increase.

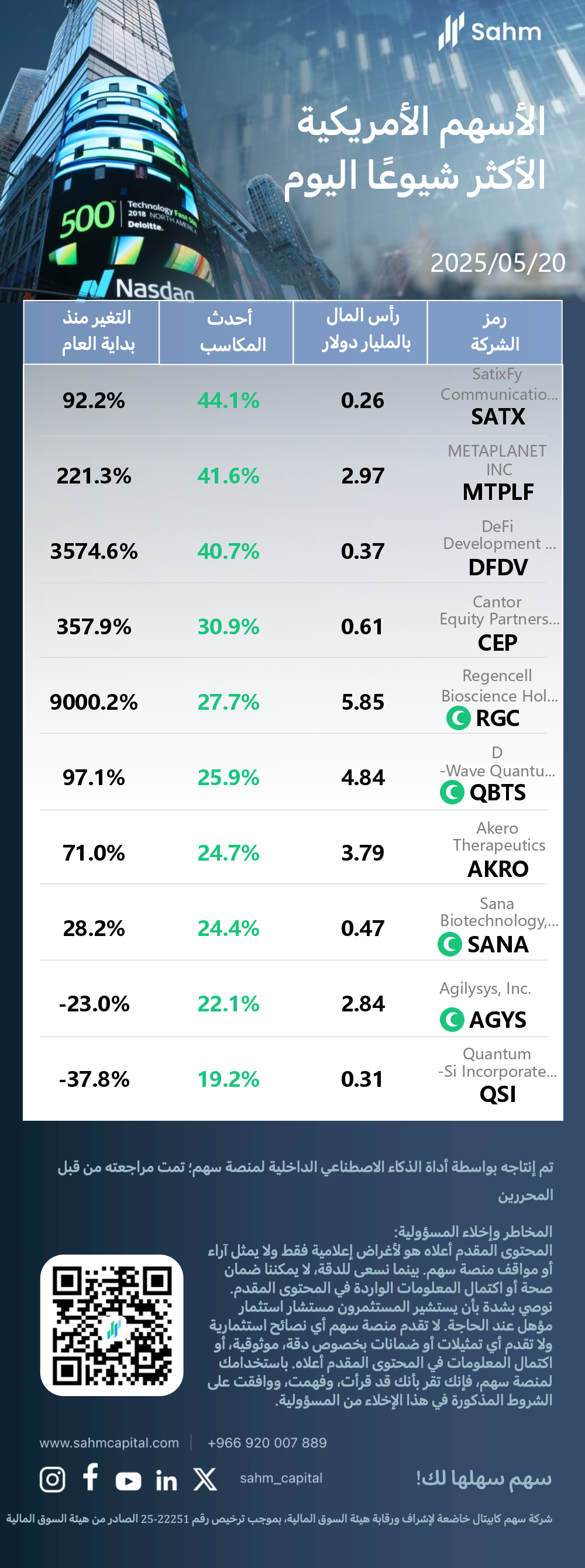

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

| SatixFy Communications Ltd. Ordinary Share(SATX.US) | 0.26 | 44.1% | 92.2% |

| METAPLANET INC(MTPLF.US) | 2.97 | 41.6% | 221.3% |

| DeFi Development Corp. Ordinary Shares(DFDV.US) | 0.37 | 40.7% | 3574.6% |

| Cantor Equity Partners Inc. Ordinary Shares - Class A(CEP.US) | 0.61 | 30.9% | 357.9% |

| Regencell Bioscience Holdings Ltd.(RGC.US) | 5.85 | 27.7% | 9000.2% |

| D-Wave Quantum Inc. Common Shares(QBTS.US) | 4.84 | 25.9% | 97.1% |

| Akero Therapeutics(AKRO.US) | 3.79 | 24.7% | 71.0% |

| Sana Biotechnology, Inc.(SANA.US) | 0.47 | 24.4% | 28.2% |

| Agilysys, Inc.(AGYS.US) | 2.83 | 22.1% | -23.0% |

| Quantum-Si Incorporated - Class A Common Stock(QSI.US) | 0.31 | 19.2% | -37.8% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.