Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | SelectQuote: Overnight gain 30.8%, Strong Q2 results, optimistic guidance, and strategic investment boost investor confidence

SelectQuote Inc SLQT | 1.37 | -2.84% |

Anterix Inc. ATEX | 22.23 | +1.83% |

Oramed Pharmaceuticals Incorporated ORMP | 2.91 | +2.11% |

Prairie Operating Co. PROP | 1.83 | +8.28% |

GDS Holdings Ltd. Sponsored ADR Class A GDS | 38.34 | +9.86% |

Editor's Note: the "Trending USA Stocks" column tracks the day's top bullish stocks in the USA market, aiding investors in promptly identifying opportunities for potential gains.

11/02/2025 Eastern Time in USA The Dow Jones Industrial Average rose by 0.28%, closing at 44593.65 points; the Nasdaq Composite dropped by 0.36%, closing at 19643.86 points; the S&P 500 Index rose by 0.03%, closing at 6068.5 points.

Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

SelectQuote: Overnight gain 30.8%, Strong Q2 results, optimistic guidance, and strategic investment boost investor confidence

SelectQuote, Inc. (NYSE: SLQT), established in 1999, is a leading insurance distribution platform that leverages technology-driven, direct-to-consumer channels to provide comprehensive insurance solutions. The company specializes in offering comparison and purchasing services for a diverse portfolio of insurance products, including senior health, life, auto, and home insurance. Operating as an intermediary rather than an underwriter, SelectQuote connects consumers with insurance carriers, generating revenue through commissions from the latter. The firm's business model is built on utilizing cutting-edge technology and a team of licensed insurance agents to deliver a transparent and streamlined insurance purchasing experience to consumers. By employing this approach, SelectQuote aims to enhance consumer choice and value in the insurance marketplace. The company's platform enables clients to efficiently compare multiple insurance options, thereby facilitating informed decision-making and potentially optimizing coverage and costs for policyholders. SelectQuote's innovative approach to insurance distribution positions it at the intersection of technology and financial services, capitalizing on the growing trend of digitalization in the insurance sector.

SelectQuote(SLQT.US) shares surged 30.8% in a single day, bringing the year-to-date gain to 54.0%, driven by multiple positive factors. The company's Q2 financial results exceeded market expectations, with GAAP EPS of $0.30 surpassing the anticipated $0.20, and revenue reaching $481.07 million, beating estimates by $34.07 million. Additionally, SelectQuote issued an optimistic FY2025 revenue guidance of $1.5-$1.575 billion, outpacing analysts' projections of $1.46 billion. Furthermore, the company secured a $350 million strategic investment from Bain Capital, Morgan Stanley Private Credit, and Newlight Partners, bolstering its financial position and validating institutional confidence in its prospects. This capital infusion will facilitate balance sheet restructuring, optimize capital structure, and provide increased flexibility for business expansion.

Anterix: Overnight gain 26.8%, Strategic review, industry engagement plan, and analyst endorsement boost investor confidence and stock performance.

Anterix Inc. (NASDAQ: ATEX) is a leading provider of licensed spectrum for nationwide dispatch networks. Founded in 1997 and reincorporated in Delaware in 2014, the company has strategically positioned itself to capitalize on the growing demand for secure and reliable communications infrastructure. The firm's core focus lies in deploying network infrastructure across 20 major metropolitan areas in the United States, primarily catering to dispatch centers serving small and medium-sized enterprises. Anterix's unique business model is underpinned by its exclusive nationwide spectrum holdings, which provide a solid foundation for its growth in the dispatch communications sector. With its proprietary spectrum assets, Anterix is well-positioned to address the evolving needs of critical infrastructure entities, utilities, and other enterprises requiring dedicated, private broadband networks. The company's strategic approach to spectrum utilization and network deployment positions it as a key player in the ongoing digital transformation of various industries. As the telecommunications landscape continues to evolve, Anterix's specialized offerings and nationwide reach make it a noteworthy entity for investors monitoring developments in the wireless communications and critical infrastructure sectors.

Anterix(ATEX.US) experienced a significant surge in its stock price, driven by multiple factors. The company's announcement of engaging Morgan Stanley to conduct a strategic review process, prompted by external interest, suggests potential merger and acquisition opportunities or major strategic shifts. Additionally, Anterix launched a new industry engagement program aimed at accelerating the deployment of 900 MHz private wireless broadband networks, potentially enhancing the company's market competitiveness. Furthermore, Craig-Hallum analyst George Sutton maintained a "Buy" rating on the stock and issued a research report, bolstering investor confidence. These catalysts collectively propelled Anterix's shares to a remarkable 26.8% overnight gain, bringing the year-to-date increase to 17.9%. The stock's performance underscores growing market optimism surrounding Anterix's strategic initiatives and future prospects.

Prairie Operating Co.: Overnight gain 17.6%, Announces Major Acquisition, Boosts Production Outlook, Driving Stock Price Surge

Prairie Operating Co., an energy firm established in 2001, focuses on oil and natural gas exploration and development. The company's operations are primarily concentrated in unconventional reservoirs in Colorado, with particular emphasis on the Niobrara and Codell formations. Through strategic asset acquisitions, Prairie Operating has secured oil and gas leasehold interests. However, the company currently reports no production or revenue. The firm is in the process of obtaining necessary drilling permits and has yet to commence actual drilling and completion operations. In a diversification move, Prairie Operating has also ventured into the cryptocurrency mining sector. This expansion into digital assets represents a notable departure from its core oil and gas business. As the company progresses through its pre-production phase, investors and industry observers will be closely monitoring Prairie Operating's ability to transition from asset acquisition to active exploration and production. The success of this transition, coupled with its cryptocurrency mining endeavors, will likely play a crucial role in shaping the company's future financial performance and market position.

Prairie Operating Co.(PROP.US) experienced a significant stock price surge following the announcement of a major acquisition. The company has entered into an agreement to acquire Bayswater Exploration's assets in the Denver-Julesburg Basin for approximately $603 million. This strategic move is expected to boost Prairie's average daily production by about 27,500 barrels of oil equivalent and expand its operations in the DJ Basin. In light of this acquisition, Prairie has revised its 2025 production and financial guidance upward. The company now projects average daily production to reach 29,000-31,000 barrels of oil equivalent per day, with adjusted EBITDA estimated between $350-$370 million. These positive developments propelled PROP's stock price, resulting in a 17.6% gain on the day and a year-to-date increase of 27.3%.

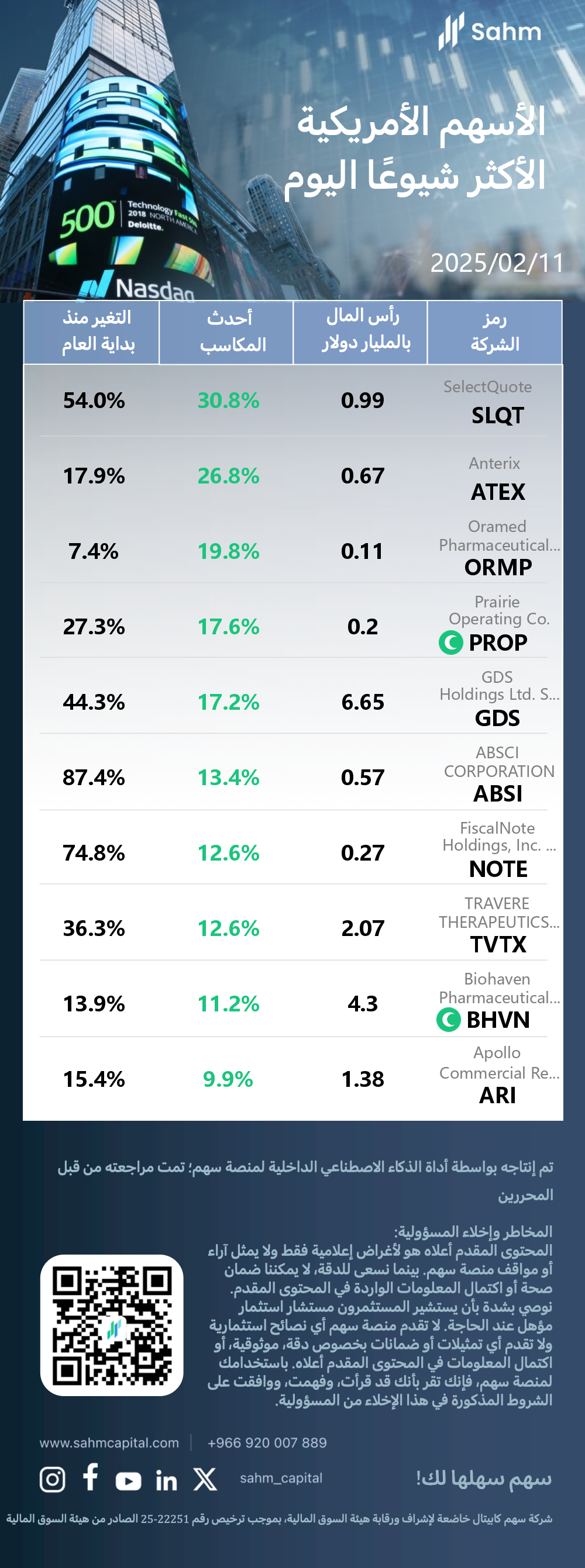

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

| SelectQuote(SLQT.US) | 0.99 | 30.8% | 54.0% |

| Anterix(ATEX.US) | 0.67 | 26.8% | 17.9% |

| Oramed Pharmaceuticals Inc.(ORMP.US) | 0.11 | 19.8% | 7.4% |

| Prairie Operating Co.(PROP.US) | 0.2 | 17.6% | 27.3% |

| GDS Holdings Ltd. Sponsored ADR Class A(GDS.US) | 6.65 | 17.2% | 44.3% |

| ABSCI CORPORATION(ABSI.US) | 0.57 | 13.4% | 87.4% |

| FiscalNote Holdings, Inc. Class A common stock(NOTE.US) | 0.27 | 12.6% | 74.8% |

| TRAVERE THERAPEUTICS INC(TVTX.US) | 2.07 | 12.6% | 36.3% |

| Biohaven Pharmaceutical Holding Company Ltd.(BHVN.US) | 4.3 | 11.2% | 13.9% |

| Apollo Commercial Real Estate Finance, Inc.(ARI.US) | 1.38 | 9.9% | 15.4% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.