Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | Sezzle Inc. Ordinary Shares: Overnight gain 75.7%, Surge Linked to Strong Q1 Performance and Positive Market Outlook

Sezzle Inc. Ordinary Shares SEZL | 70.35 | -4.74% |

Embrace Systems Corp. EMBC | 11.80 | -1.26% |

Seres Therapeutics Inc MCRB | 16.94 | -1.28% |

Chromatics Color Sciences International Inc. CCSI | 23.96 | +0.84% |

BRC Inc. Class A BRCC | 1.23 | -2.38% |

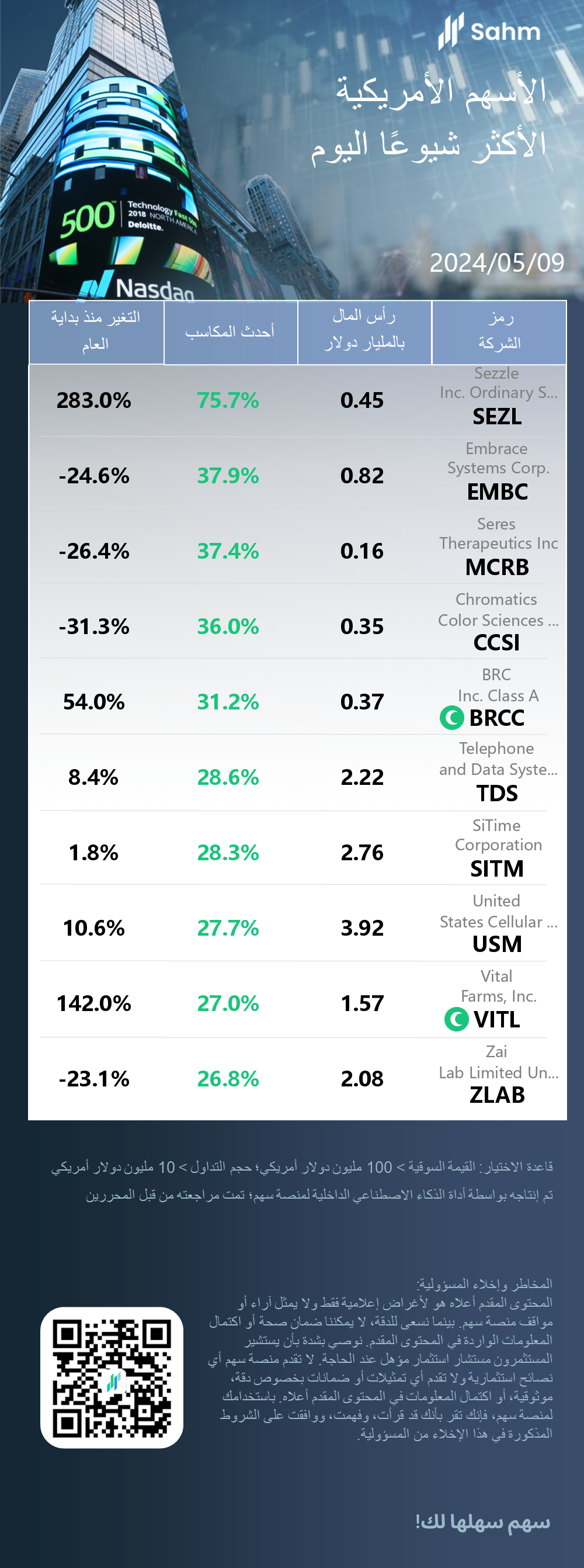

09/05/2024 Eastern Time in USA The Dow Jones Industrial Average rose by 0.85%, closing at 39387.76 points; the Nasdaq Composite rose by 0.27%, closing at 16346.26 points; the S&P 500 Index rose by 0.51%, closing at 5214.08 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

1、Sezzle Inc. Ordinary Shares: Overnight gain 75.7%, Surge Linked to Strong Q1 Performance and Positive Market Outlook

Sezzle Inc., established on January 4, 2016 in Delaware, has been dedicated to positioning itself as a purpose-driven payment solutions provider. The company is committed to fostering financial empowerment for the next generation and in 2017, launched its digital payment platform. This platform offers merchants a flexible payment alternative, designed to stand as a substitute for traditional credit options. As of the end of 2022, the Sezzle platform has bolstered the business growth of over 42,000 active merchants and has serviced nearly 2.9 million active users.

Sezzle Inc. Ordinary Shares (SEZL) experienced a notable surge in stock price, potentially driven by a robust fiscal performance in the first quarter and the market's optimistic outlook on the company's future growth prospects. Specifically, Sezzle recorded significant increases in underlying merchant sales and total revenue, coupled with a more than threefold jump in earnings per share, indicating a marked improvement in profitability and operational efficiency. Additionally, as the company progressively cements its market position in the payment sector, the market's recognition of its payment platform's business model has bolstered investor confidence. This, too, may have been a key factor propelling the stock's upward trajectory. Collectively, these points reasonably suggest that the market has positively appraised Sezzle's financial performance and growth potential, thereby sparking keen investor interest in acquiring its shares.

2、Embrace Systems Corp.: Overnight gain 37.9%, Stock Rises on Strong Q2 Performance and Upbeat FY2024 Outlook

Embrace Systems Corp., established on July 8, 2021, in Delaware, has ascended to a leading position within the global medical device sector, with a dedicated focus on developing therapeutic solutions for diabetes care aimed at enhancing patient health and well-being. Leveraging a robust legacy of 95 years of industry expertise, the company's offerings have garnered widespread recognition in the international diabetes management market. Estimates indicate that Embrace Systems Corp.'s product suite serves approximately 30 million users across over 100 countries worldwide. The company's product portfolio encompasses a diverse range of pen needles, syringes, and safety devices, complemented by specialized digital applications designed to facilitate effective diabetes management.

In financial market news, Embrace Systems Corp. (EMBC) has seen a notable uptick in its share price, which appears to be closely linked to its better-than-expected financial results for the second quarter and an optimistic outlook for the fiscal year 2024. The company outperformed analyst estimates for both earnings per share and revenue in Q2, signaling an enhancement in profitability and competitive edge. Additionally, Embrace Systems Corp. (EMBC) announced the maintenance of its steady quarterly dividend, underlining a robust financial position characterized by ample cash reserves, cash equivalents, and an untapped revolving credit facility. The firm's strong market presence in the diabetes management sector also underpins the rally in its stock price. Collectively, these elements have positively influenced investor sentiment, propelling EMBC shares upward.

3、Seres Therapeutics Inc: Overnight gain 37.4%, Stock Rises on Positive Revenue, R&D Prospects, and Sector Sentiment.

Seres Therapeutics, Inc. (hereinafter referred to as "the Company"), established in October 2010, is a commercial-stage biopharmaceutical enterprise incorporated under the laws of the State of Delaware. The Company is dedicated to the development and commercialization of a novel suite of microbiome therapeutics, with an aim to treat a variety of diseases by modulating the human microbiome. Additionally, the Company is advancing the development of optimized microbiome therapies designed to eradicate pathogens, modulate host functions, and thereby reduce the risk of infections and promote immune tolerance.

Seres Therapeutics Inc. (MCRB) witnessed an uptick in its stock price, which can be attributed to a confluence of positive factors. Despite reporting a GAAP loss per share that exceeded analyst estimates, the company's revenue performance significantly outperformed market expectations—a sign investors often interpret as a positive indicator of business growth. Moreover, the robust cash reserves of Seres Therapeutics, as of the end of the first quarter, indicate sufficient operational funding through the end of 2024, providing a stable financial foundation essential in the capital-intensive biotech industry. The company's focus on the development of microbiome therapies, particularly its SER-155 program, could trigger optimistic market expectations for its future potential should it achieve significant milestones.Market sentiment toward the biotech sector has been generally positive, and potential bullish trends identified through technical analysis could be drawing traders and investors to the stock, contributing to the price increase. Additionally, undisclosed positive developments such as new partnership deals, patent filings, or favorable regulatory approval prospects could also be exerting an upward influence on the share price.

4、Chromatics Color Sciences International Inc.: Overnight gain 36.0%, Stock Rises on Strong Financial Performance and Technological Investments

Consensus Cloud Solutions, Inc. (hereinafter referred to as "the Company"), a Delaware-registered corporation, has established itself as an industry-leading provider of secure information delivery services by building a scalable software-as-a-service platform. Serving over one million clients, the Company's reach extends to enterprises of various sizes as well as individual users, spanning more than 50 countries. Its operations encompass several vertical markets, including healthcare, education, legal, and financial services. The Company is dedicated to advancing the adoption of secure information exchange across diverse technologies and industries.

In the latest developments, Chromatics Color Sciences International Inc. (CCSI) has witnessed an uptick in its stock price, buoyed by the company's stellar financial performance. Notably, in its recent quarterly earnings report, CCSI exceeded market analysts’ expectations with both adjusted earnings per share and sales figures surpassing forecasts. Such outperformance is often a key driver in bolstering investor confidence in a company’s profitability, which in turn can be a significant catalyst for upward momentum in its stock price.Despite a slight year-over-year dip in sales, the company's ability to maintain robust sales performance in the current market environment may be interpreted by investors as an indication of strong market competitiveness and business resilience. Furthermore, CCSI's strategic focus on cutting-edge technologies such as cloud computing, big data, and artificial intelligence, along with its dedication to data security and privacy, could be pivotal factors in securing market trust and supporting sustainable stock appreciation.Additionally, the company's diversified business operations and extensive customer base provide a solid market foundation. These elements, collectively, create a favorable dynamic for the continued rise in CCSI's share value.

5、BRC Inc. Class A: Overnight gain 31.2%, Stock Rises on Strong Quarterly Performance and Analyst Optimism

BRC Inc., a Delaware-registered entity established on October 26, 2021, was founded by a team of seasoned professionals. The company's core business revolves around providing high-quality coffee, aiming to cater to consumers with discerning tastes for American-style coffee.

BRC Inc. Class A (NYSE: BRCC) witnessed a notable surge in its share price, a move that appears to be closely linked to the company's robust quarterly financial performance. Reporting earnings per share and revenue figures that exceeded analyst expectations for the first quarter of 2024, BRC Inc. not only demonstrated a significant growth compared to the same period last year but also reflected an enhancement in its profitability and competitive edge in the market.Furthermore, the positive outlook for BRC Inc. was reinforced by Sarang Vora, an analyst at Telsey Advisory Group, who maintained an 'Outperform' rating and a steady price target for the company. As a premium coffee provider catering to a distinct consumer segment, BRC Inc.'s unique market positioning and brand loyalty are instrumental in bolstering the company's long-term revenue foundation.These elements collectively provide a cogent explanation for the upward momentum observed in the share price of BRC Inc. Class A (BRCC).

6、Telephone and Data Systems, Inc.: Overnight gain 28.6%, Stock Rises Amid Diverse Market Influences and Strategic Growth Moves.

Telephone and Data Systems, Inc. (TDS), established in 1960 and formerly a state-owned enterprise, is now a member of the Vietnam Steel Corporation. The company specializes in the production, sales, export, and import of steel and its related products. Its primary offerings consist of steel billets, which account for approximately 60% of its production, and rolled steel, making up the remaining 40%. With a market share of around 13%, TDS is a leading industrial steel distributor within Vietnam. Leveraging the robust capital and market support from the Vietnam Steel Corporation, TDS has established a comprehensive national distribution network and possesses a production capacity of 200,000 tons per annum. Since October 6, 2011, TDS has been listed and trading on the UPCOM market.

In a noteworthy development, shares of Telephone and Data Systems, Inc. (TDS) have experienced a considerable appreciation, potentially attributable to a multifaceted array of factors. As a Vietnamese enterprise engaged in steel production and trading, TDS's operations are directly impacted by the global demand for steel. The recent uptick in steel requirements, spurred by a resurgence in infrastructure and real estate markets, may be a pivotal element driving the stock price ascent. Additionally, the firm's performance enhancements, such as increased production efficiency, improved cost management, and the introduction of new product lines, may have bolstered market expectations for TDS's profit outlook. Supportive policies or market conditions, such as export tax incentives and relaxed environmental standards, could also be exerting a positive influence on the share value. Announcements of strategic partnerships or acquisitions may be interpreted by the market as a sign of TDS's commitment to bolstering its core competitive edge. Moreover, the overall trend in capital markets and the optimistic sentiment towards emerging economies may have similarly contributed to the upward trajectory of TDS's stock price. Technical factors, such as a shortage of shares or speculative buying, might also be playing a role. However, to accurately discern the reasons behind the stock's rise, a comprehensive analysis incorporating detailed financial data from the company, the latest market news, macroeconomic conditions, and industry trends is required.

7、SiTime Corporation: Overnight gain 28.3%, Stock Surges on Earnings Beat and Analyst Upgrade Amid Growth Prospects

SiTime Corporation, established in Delaware since December 3, 2003, specializes in providing high-precision timing solutions to the global electronics industry. The company ensures the accurate operation of customer electronic systems through its product offerings, which are characterized by high performance, stability, reliability, as well as programmability, miniaturization, and low power consumption. SiTime's extensive product line, catering to over 300 applications, spans across various sectors including telecommunications, automotive, and industrial fields. The company's technology is grounded in expertise in Micro-Electro-Mechanical Systems (MEMS), analog mixed-signal design, and advanced system integration.

In a notable market development, SiTime Corporation (SITM) experienced a significant uptick in share price following the announcement of its first-quarter financial results for fiscal year 2024, which exceeded analysts' projections. Despite a year-over-year decline in sales revenue, the company's adjusted earnings per share and revenue surpassed market consensus estimates, underscoring a robust profitability and competitive market position. Moreover, Needham analyst N. Quinn Bolton recognized the visibility of the company's growth, prompting an upgrade of the stock to a 'buy' rating and setting an elevated target price.Management's optimistic outlook for 2025, along with order volumes that have exceeded expectations, highlight SiTime's strong growth potential, particularly within the communications enterprises' data center market and the field of artificial intelligence. These positive indicators collectively bolstered investor confidence in SiTime, contributing to the upward momentum of its stock price.

8、United States Cellular Corporation: Overnight gain 27.7%, Stock Rises on Strategic Review, Acquisition Speculation, and Strong Performance

United States Cellular Corporation (USCC), established in 1983 under the laws of Delaware, operates its wireless segment serving nearly 5 million customers across five geographic regions in 23 states within the United States, focusing on the provision of wireless telecommunications services. Expanding into broader regional markets through individual markets delineated by the Federal Communications Commission (FCC), U.S. Cellular is dedicated to extending its service coverage to cater to the evolving needs of its customer base.

In a noteworthy development, shares of United States Cellular Corporation (USM) have experienced a significant uptick, driven by a confluence of factors. At the forefront is the initiation of a strategic review, as USM's parent company Telephone and Data Systems, Inc. (TDS) alongside UScellular announced the exploration of strategic alternatives for UScellular. Such actions often ignite market speculation regarding potential restructurings, mergers, or acquisitions, which in turn can elevate a company's valuation.Further buoying investor sentiment is the positive outlook on potential acquisitions or strategic partnerships involving UScellular, which provides additional support to the share price. The year-to-date appreciation of USM's stock suggests that the company might boast robust operational performance, with solid financial results bolstering investor confidence.Positive developments within the industry, such as technological innovation, rising demand, and regulatory improvements, could also contribute to favorable conditions for USM. Additionally, the company's market coverage and network superiority within the telecommunications sector remain key attractions for investors.The overall upward trend in the stock market further assists in enhancing individual stock performances. Changes in investor sentiment and increased trading volumes are also likely contributing to the upward pressure on the stock price.In conclusion, the aforementioned factors are collectively influencing the upward trajectory of United States Cellular Corporation (USM)'s stock price.

9、Vital Farms, Inc.: Overnight gain 27.0%, Stock Rises on Strong Earnings Report and Upbeat Financial Outlook

Vital Farms, Inc., established on June 6, 2013, and headquartered in Delaware, is a company dedicated to the food industry. By developing a network of small family farms, Vital Farms supplies high-quality food products to national markets and has emerged as a leading brand in the United States for pasture-raised eggs and butter. In terms of retail sales, it is also the second-largest egg brand in the country.

Vital Farms, Inc. (VITL) witnessed a notable surge in its stock price, closely linked to the company's recent impressive earnings report and positive financial outlook. The ethically-driven food company not only exceeded market expectations with its first-quarter 2024 revenue and earnings per share but also raised its revenue forecast for the full 2024 fiscal year, demonstrating a strong confidence in its future growth trajectory. Moreover, Vital Farms anticipates a robust increase in its adjusted EBITDA, bolstering investor confidence in the company's profit-generating potential. The company's consistent capital expenditures and its flexible capital allocation strategy further solidify its position as a leading brand in the American pasture-raised eggs and butter market. Collectively, these factors provide solid support for the upward movement of Vital Farms' stock price.

10、Zai Lab Limited Unsponsored ADR: Overnight gain 26.8%, Stock Rises on Policy Support, Strong Financials, and Positive Industry Trends.

Since its inception on March 28, 2013, Zai Lab Limited has evolved into an innovative biopharmaceutical company integrating research and development with commercialization. The firm is dedicated to the discovery and advancement of novel therapeutic approaches, with the aim of addressing unmet medical needs in the areas of oncology, infectious diseases, and autoimmune disorders in China and globally. Leveraging in-licensing and proprietary research, Zai Lab has established a comprehensive platform to deliver cutting-edge treatments to patients worldwide. The company is recognized as one of the earliest biopharmaceutical firms in China to undertake significant expansion, strategically capitalizing on global innovation resources and commercial opportunities.

It is noteworthy that Zai Lab Limited Unsponsored ADR (ZLAB) has recently experienced a significant surge in its stock price, buoyed by a confluence of favorable factors. The convening of a drug pricing symposium by the National Healthcare Security Administration signals robust policy support for innovation in the pharmaceutical sector, generating positive expectations for the industry. Moreover, synthetic biology has been specifically recognized in the government's work report, heralding promising opportunities for future growth and further bolstering market confidence.Zai Lab's first-quarter financial results were particularly impressive, with a substantial increase in product revenue and a healthy cash and cash equivalents reserve, reflecting the company's solid financial health. Additionally, the growth in sales of the company's core and newly launched products, along with an acceleration in commercialization efforts and clear profit objectives, underscore Zai Lab's competitive market position and growth potential.In summary, government policy support, favorable industry trends, robust financial performance, and proactive commercial plans and future projections are the primary drivers behind the substantial rise in Zai Lab Limited Unsponsored ADR's (ZLAB) stock price.