Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | SRM Entertainment, Inc.: Overnight Gain 53.3%, Strategic Pivot to Crypto Sector Sparks Investor Interest, Driving Significant Stock Rally

SRM Entertainment SRM | 10.30 10.30 | 0.00% 0.00% Pre |

OpenDoor Technologies OPEN | 6.73 6.79 | +4.02% +0.90% Pre |

Upexi, Inc. - Common Stock UPXI | 2.05 2.04 | +0.49% -0.45% Pre |

Rigetti Computing RGTI | 23.96 24.24 | +1.83% +1.17% Pre |

SharpLink Gaming SBET | 9.71 9.68 | +2.10% -0.31% Pre |

Editor's Note: the "Trending USA Stocks" column tracks the day's top bullish stocks in the USA market, aiding investors in promptly identifying opportunities for potential gains.

16/07/2025 Eastern Time in USA The Dow Jones Industrial Average rose by 0.53%, closing at 44254.78 points; the Nasdaq Composite rose by 0.25%, closing at 20730.49 points; the S&P 500 Index rose by 0.32%, closing at 6263.7 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

SRM Entertainment, Inc.: Overnight gain 53.3%, Strategic pivot to crypto sector sparks investor interest, driving significant stock rally

SRM Entertainment, Inc., incorporated in Nevada in April 2022, is a specialized design and development firm focusing on toys and memorabilia. The company has established itself as a key supplier of merchandise to major theme parks and entertainment venues worldwide. Capitalizing on the burgeoning fan economy driven by evolving pop culture trends, SRM Entertainment has strategically positioned itself in the market. Their diverse product portfolio encompasses action figures, plush toys, accessories, apparel, and home goods, all characterized by distinctive designs and aesthetic appeal. The company's business model is centered on catering to consumers' emotional connections with various cultural elements, including movies, television shows, celebrities, and dining experiences. By creating innovative and engaging products, SRM Entertainment aims to provide fans with tangible ways to express their affinity for their favorite cultural phenomena. With a commitment to creativity and playfulness, SRM Entertainment continues to develop products that resonate with enthusiasts across multiple fandoms, solidifying its position in the competitive memorabilia and themed merchandise market.

SRM Entertainment, Inc. (SRM) has announced a significant strategic pivot, driving its stock price to surge 53.3% in a single day and 1537.5% year-to-date. The company plans to rebrand as Tron Inc. and change its ticker symbol to "TRON," marking a shift from a toy and souvenir designer to a TRON (TRX) treasury strategy firm. This transformation has captivated investor interest in the cryptocurrency sector, enhancing the company's visibility among investors, particularly those familiar with the TRON ecosystem. The rebranding initiative reflects SRM's commitment to aligning its corporate identity with its new strategic direction in the blockchain and cryptocurrency space, potentially opening up new growth opportunities and market positioning.

OpenDoor Technologies, Inc.: Overnight gain 43.3%, Innovative real estate platform attracts investors; market reassesses company value amid housing recovery expectations.

Opendoor Technologies Inc. (NASDAQ: OPEN), a pioneering force in the residential real estate sector, has established itself as a leading e-commerce platform for home transactions since its inception in 2013. The company completed its public debut in December 2020 through a merger with a special purpose acquisition company (SPAC), marking a significant milestone in its corporate evolution. Leveraging cutting-edge technology, including proprietary software, advanced data science, and innovative product design, Opendoor is at the forefront of revolutionizing the residential real estate market. The company's disruptive business model aims to create a more efficient and streamlined marketplace for property transactions, offering both buyers and sellers an experience that surpasses traditional real estate dealings. By spearheading the digital transformation of the real estate industry, Opendoor is poised to capitalize on the growing demand for tech-enabled solutions in property transactions. The company's innovative approach not only enhances the overall customer experience but also has the potential to reshape the landscape of the multi-trillion-dollar U.S. residential real estate market. As Opendoor continues to expand its operations and refine its technology-driven platform, investors and industry observers alike are closely monitoring its progress in disrupting the traditional real estate sector.

OpenDoor Technologies, Inc. (OPEN), the leading e-commerce platform for residential real estate transactions, has experienced a significant stock price surge. The company's innovative business model and technology-driven approach have garnered investor attention, contributing to the stock's impressive 43.3% overnight gain. This substantial increase, despite a 6.9% year-to-date decline, signals a marked improvement in market sentiment. The rally reflects investors' optimism about the broader real estate market recovery and recognition of the company's technological advantages. Furthermore, the previous decline had led to an undervaluation of the stock, prompting the market to reassess the company's value. This multifaceted surge underscores the complex factors influencing OPEN's stock performance and highlights the potential for continued growth in the real estate technology sector.

Upexi, Inc. - Common Stock: Overnight gain 39.6%, Private equity offering and crypto strategy boost investor confidence, driving stock surge.

Upexi, Inc. (NASDAQ: UPXI), a diversified brand-holding company incorporated on September 5, 2018, and headquartered in Nevada, has established a strong presence in several high-growth markets, including health, wellness, pet care, and beauty. The company's portfolio includes well-recognized brands across these sectors. A key subsidiary of Upexi is Enterprise LLC, which operates through two wholly-owned entities: Cygnet and E-Core. Cygnet specializes in the distribution of health-related products primarily through the Amazon platform, leveraging the e-commerce giant's extensive reach and logistics network. Meanwhile, E-Core focuses on product liquidation services in the consumer electronics and luxury goods segments, providing a strategic avenue for inventory management and revenue generation. This diversified business model allows Upexi to capitalize on multiple growth opportunities while mitigating risks associated with market fluctuations in individual sectors. The company's strategic positioning in these consumer-centric industries underscores its potential for sustained growth and market expansion in the coming years.

Upexi, Inc. - Common Stock (UPXI) has experienced a significant surge in its stock price, driven by multiple factors. The company successfully completed a $50 million private equity offering, issuing approximately 12.5 million shares at $4 per share, demonstrating strong investor confidence. Upexi plans to allocate a portion of the raised funds to increase its Solana cryptocurrency holdings, drawing comparisons to MicroStrategy's Bitcoin strategy and earning the moniker "SOL version of MSTR." The stock's performance has also been bolstered by Bitcoin's all-time high and the U.S. House of Representatives' announcement of Cryptocurrency Week. Upexi's business diversification and management participation in the private placement have further enhanced investor sentiment. Year-to-date, UPXI has surged an impressive 106.8%, showcasing robust upward momentum in the market.

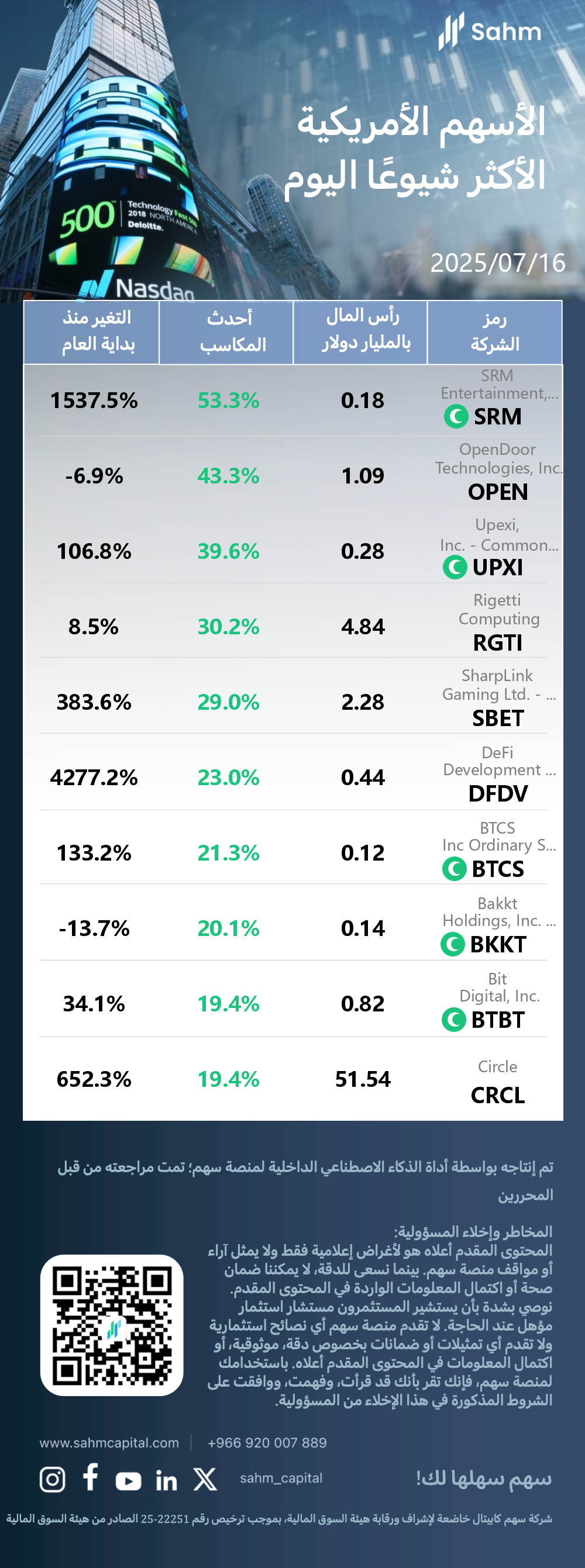

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

| SRM Entertainment, Inc.(SRM.US) | 0.18 | 53.3% | 1537.5% |

| OpenDoor Technologies, Inc.(OPEN.US) | 1.09 | 43.3% | -6.9% |

| Upexi, Inc. - Common Stock(UPXI.US) | 0.28 | 39.6% | 106.8% |

| Rigetti Computing(RGTI.US) | 4.84 | 30.2% | 8.5% |

| SharpLink Gaming Ltd. - Ordinary Shares(SBET.US) | 2.28 | 29.0% | 383.6% |

| DeFi Development Corp. Ordinary Shares(DFDV.US) | 0.44 | 23.0% | 4277.2% |

| BTCS Inc Ordinary Shares(BTCS.US) | 0.12 | 21.3% | 133.2% |

| Bakkt Holdings, Inc. Class A Common Stock(BKKT.US) | 0.14 | 20.1% | -13.7% |

| Bit Digital, Inc.(BTBT.US) | 0.82 | 19.4% | 34.1% |

| Circle(CRCL.US) | 51.54 | 19.4% | 652.3% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team.